How To Complete the FAFSA® Form When You Have Multiple Children

If you have more than one child in college, career school, or trade school, you’ll need to follow five steps when filling out the Free Application for Federal Student Aid (FAFSA®) form:

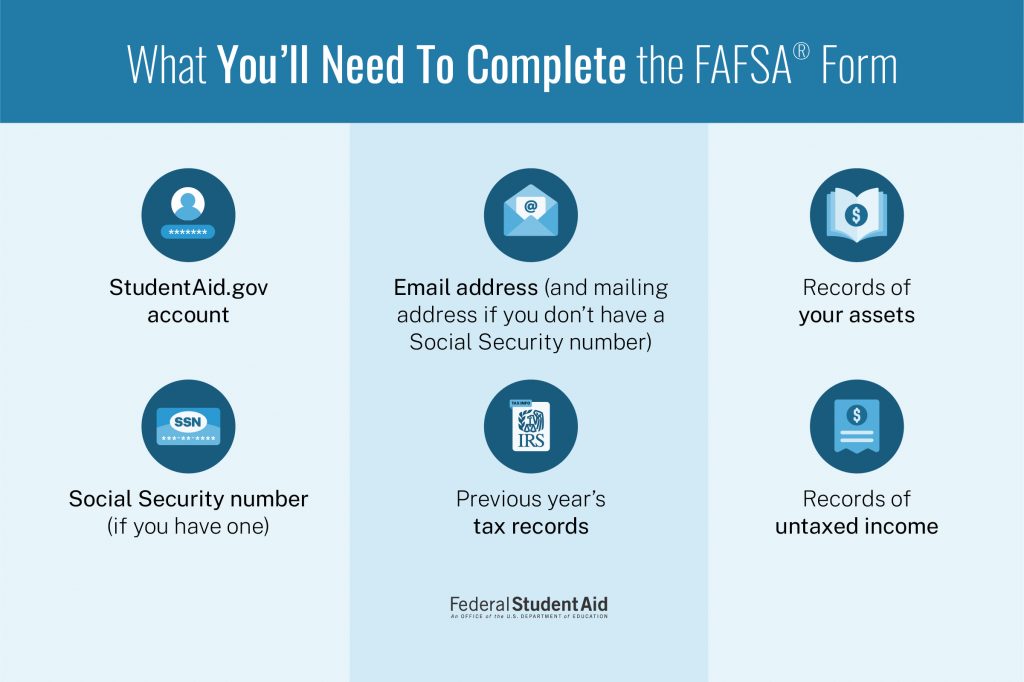

- You and each of your children will need your own StudentAid.gov account.

- Each child must start their own FAFSA form and complete their required sections.

- Each child will need to invite you to complete their FAFSA form.

- You will receive separate invitation emails to complete the FAFSA form for each child.

- You must complete all required parent sections for each child’s FAFSA form.

Read on for more details.

1

You and each of your children will need your own StudentAid.gov account.

If any of your children are considered dependent students, you will be required to participate on their FAFSA form. To do so, you’ll need a StudentAid.gov account to access their form.

Your StudentAid.gov account is associated with your Social Security number and is unique to you. It serves as your legal electronic signature throughout the financial aid process. You can’t share an account with any of your children. You and each of your children will each need your own account.

If you don’t have a Social Security number, you can still create a StudentAid.gov account to complete and sign your required sections of the FAFSA form online.

Learn more about creating and accessing a StudentAid.gov account:

2

Each child must start their own FAFSA® form and complete their required sections.

The FAFSA form is your child’s application for federal student aid. Each child should start their own FAFSA form and complete the required student sections, provide consent and approval, and sign the form. To prevent errors and save time, we recommend that they complete all of these steps before you fill out the parent sections of their FAFSA form.

If each child doesn’t start the FAFSA form first, or if you and your child are both completing their FAFSA form at the same time, you may have more difficulty completing your required sections or may even spend time providing information that’s not required.

Your children can watch our “Completing the FAFSA Form” video playlist to learn more about starting and completing their sections.

3

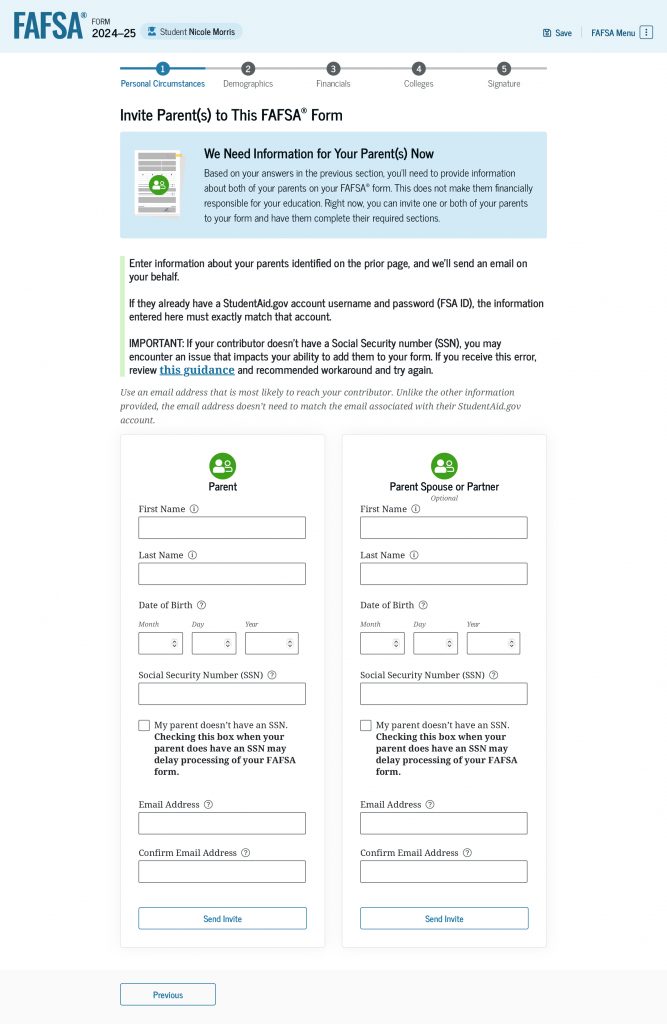

Each child will need to invite you to complete their FAFSA® form.

When completing the “Student Personal Circumstances” section of their FAFSA form, dependent students are required to invite their parent(s) to contribute to their form. This means that each of your children will invite you to participate on their form. If your children indicate that their parents are married on their form, they’ll be asked to invite both you and your spouse.

To invite you (and your spouse, if required), each child will enter your personal information, including your name, date of birth, Social Security number (if you have one), and email address. Make sure your children have the exact information that appears on your Social Security card or legal identification card to avoid issues or delays when they’re completing the FAFSA form. If you have a suffix in your name (e.g., John Paul Jr., or John Paul III), your children should leave that out.

IMPORTANT: We recommend printing a copy—or taking a screenshot—of the information on the “Personal Information” page when you create your StudentAid.gov account. Your child will need to provide this same information exactly as you have entered it when they invite you to complete your section of the form. Differences as small as using “Road” in the invitation to the contributor, versus the contributor using the abbreviation “Rd” when creating a StudentAid.gov account address, can potentially lead to errors that will prevent you from entering the FAFSA form.

4

You will receive separate invitation emails to complete the FAFSA® form for each child.

After each child completes the student sections and provides your information, you’ll receive emails from Federal Student Aid inviting you to each of their FAFSA forms. Each email will include the subject line, “Help Complete [your child’s name]’s Form.”

If both you and your spouse were invited to your children’s FAFSA forms and you filed taxes jointly, the parent who accepts the invitation first will be the only required contributor on that form.

After you select the link in the invitation email, you’ll log in to your StudentAid.gov account and be taken to your “My Activity” page. There, you’ll see a list of all of the FAFSA forms you’ve been invited to. Select “Get Started” under the first FAFSA form to enter the form.

5

You must complete all the required parent sections for each child’s FAFSA® form.

Once you enter the first FAFSA form, you’ll need to complete the parent sections, provide consent and approval for the transfer of federal tax information from the IRS into the form, and sign the form. For more details about what you can expect in the parent sections, read our “8 Steps for Parents Completing the 2024–25 FAFSA® Form” article.

Providing consent and approval is required for your children to be eligible for federal student aid. When you provide consent and approval, you agree to allow the U.S. Department of Education to reuse your federal tax information on the other FAFSA forms you’re invited to, so you will only need to provide your consent and approval once.

How is your financial information used?

The federal tax information that’s transferred into each child’s FAFSA form—along with the additional financial information that you and each child provide in the form—will be used to calculate their Student Aid Index (SAI). The SAI is an eligibility index number that each child’s school will use to calculate financial aid. Schools no longer consider the number of children who will be in college, career school, or trade school. However, the amount of your income that is used to calculate each child’s SAI is lower than the previously used Expected Family Contribution (EFC) calculation.

When you complete the “Parent Financials” section of your children’s FAFSA forms, you’ll report the value of your child’s education savings accounts. You must report the amount for each child, so make sure the information you provide is for the child’s name listed at the top of the form to avoid errors.

What happens next?

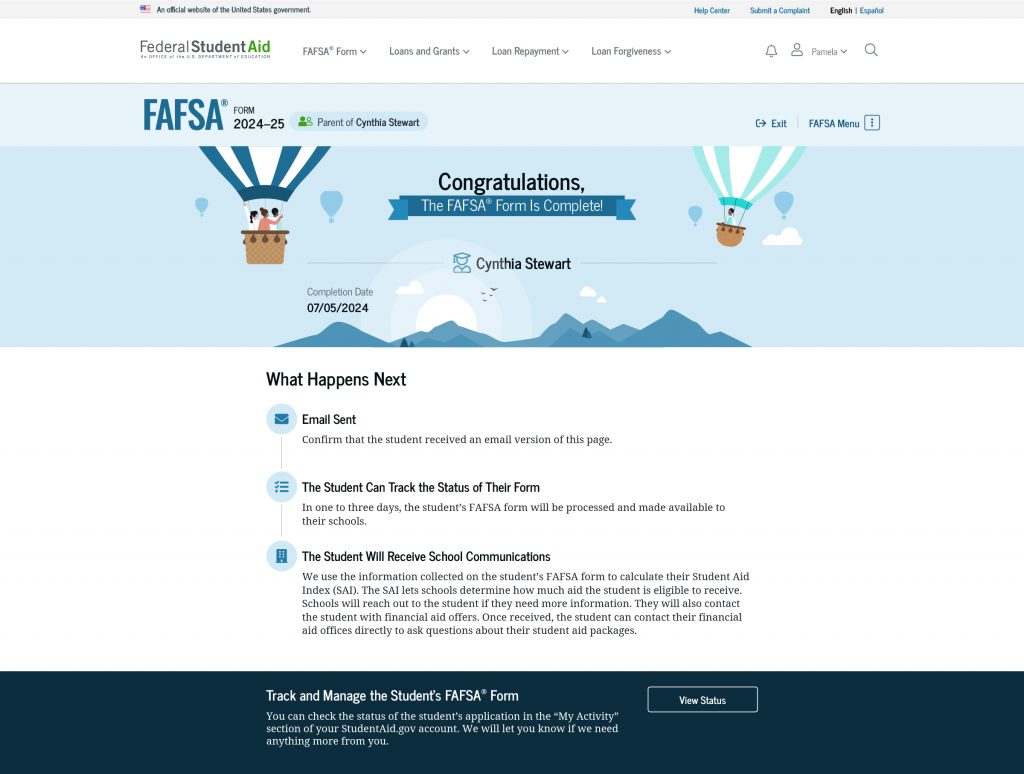

After you complete the parent section, you’ll sign the FAFSA form. You must sign each child’s FAFSA form for it to be complete. After your information, consent and approval, and signature are provided—and if your child has completed the required student sections—you’ll see a confirmation page informing you that your child’s FAFSA form is complete. You can then return to the “My Activity” page of your StudentAid.gov account to enter the next FAFSA form.

If you do not see a form within your “My Activity” page, check that information on the “Personal Information” page matches the information that your child used to invite you to fill out the form. Differences as small as using “Road” in the invitation to the contributor, versus the contributor using the abbreviation “Rd” when creating their StudentAid.gov account address, can potentially lead to errors.

After each child’s FAFSA form is submitted, the colleges, career schools, or trade schools they listed on their forms will send financial aid offers if they’re accepted for admission. Review each aid offer with your children and understand what options are available if your child didn’t receive enough aid to cover the cost of school.