What You Need To Know About the FAFSA Submission Summary

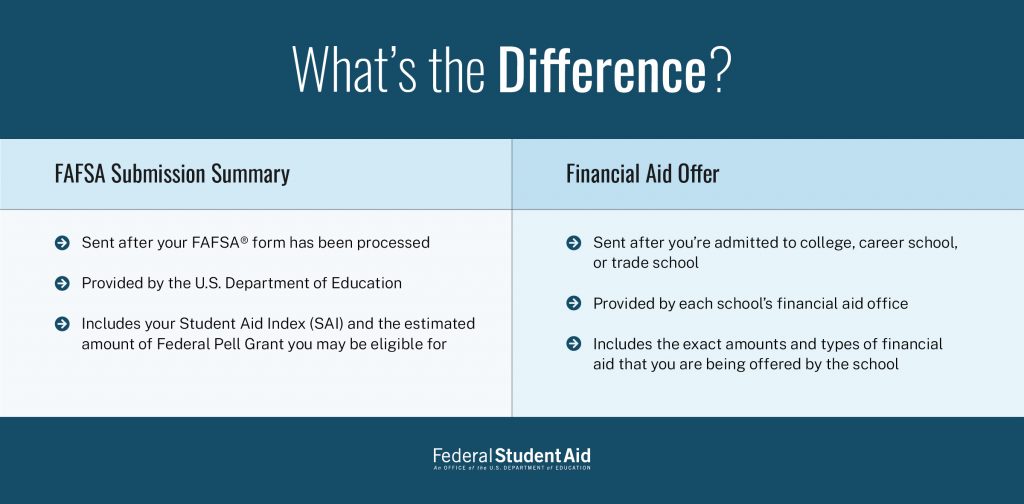

The FAFSA Submission Summary, formerly known as the Student Aid Report (SAR), can tell you about your financial aid eligibility, potential schools, making corrections or changes to your FAFSA form, and next steps as you prepare to receive aid offer letters.

We cover the following topics below:

- What’s in the FAFSA Submission Summary and When You’ll Get It

- Reviewing Eligibility Overview

- Checking FAFSA® Form Answers

- Finding School Information

- Taking Next Steps

- Making Corrections or Changes to Your FAFSA® Form

- Finding Resources To Help You Understand Aid

The FAFSA Submission Summary replaces the Student Aid Report beginning in the 2024–25 award year.

1

What’s in the FAFSA Submission Summary and When You’ll Get It

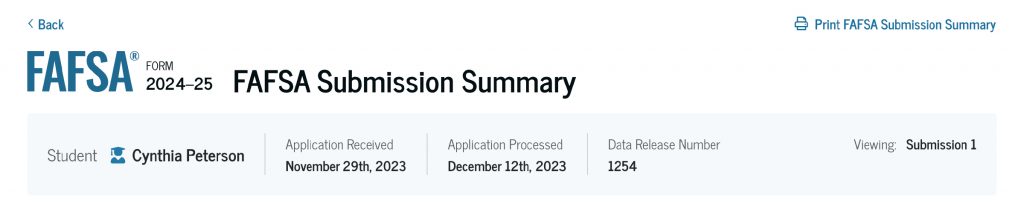

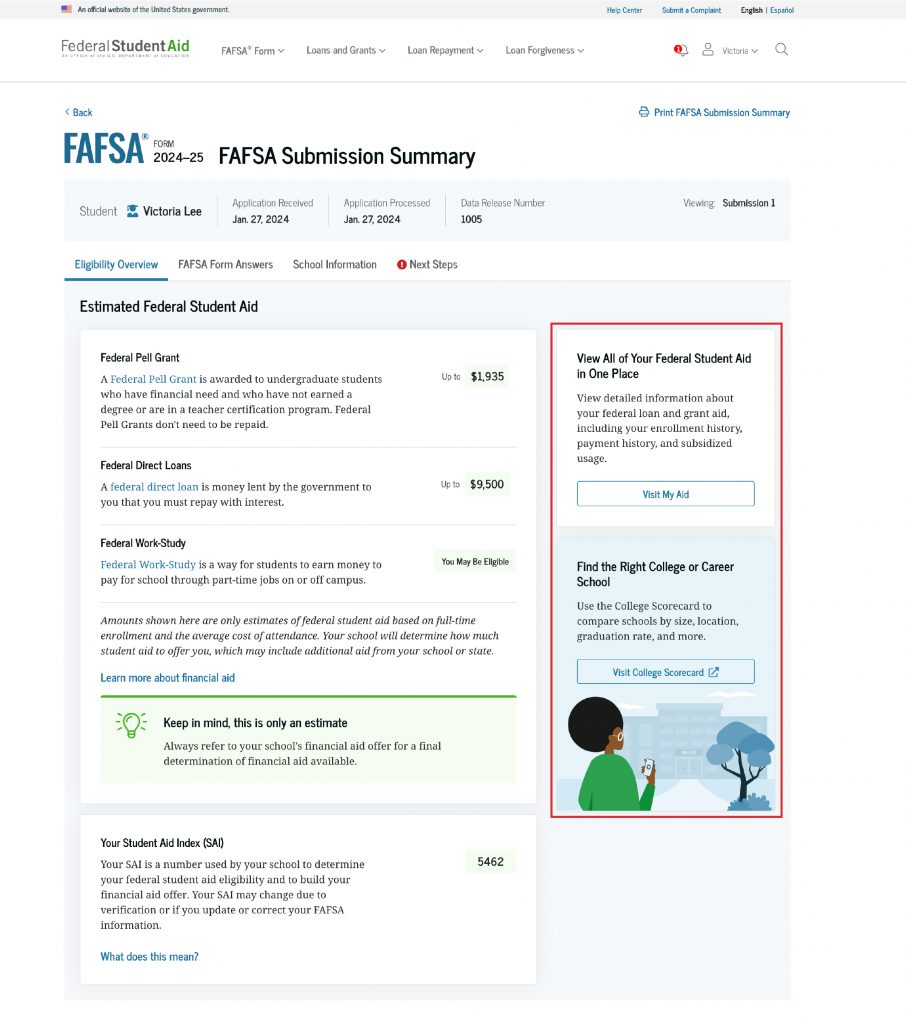

The FAFSA Submission Summary can offer a big picture outlook of your financial aid: your eligibility for the coming award year, information about the schools you are considering, and what you need to do next to prepare to pay for school. You’ll be able to access the FAFSA Submission Summary once your FAFSA form is processed, which usually takes one to three business days. Only you, the student, can access the FAFSA Submission Summary—not your form contributors.

After your FAFSA form is submitted and processed, you can find the FAFSA Submission Summary on the Dashboard of your StudentAid.gov account. You’ll also see the date your application was received and processed.

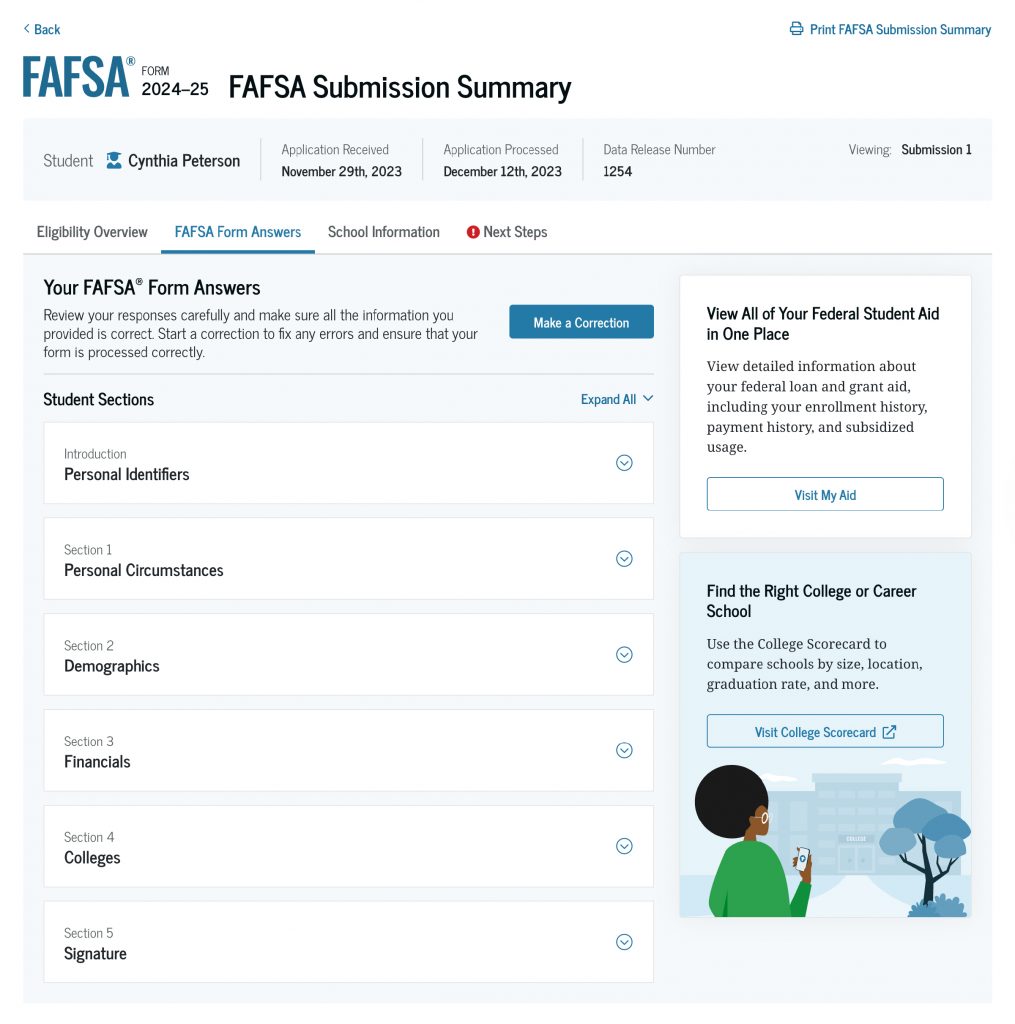

The FAFSA Submission Summary consists of four main parts organized into tabs on the page: Eligibility Overview, FAFSA Form Answers, School Information, and Next Steps. It not only gives you information that can help you prepare to pay for school but also allows you to make corrections and find other resources you may need as you plan.

2

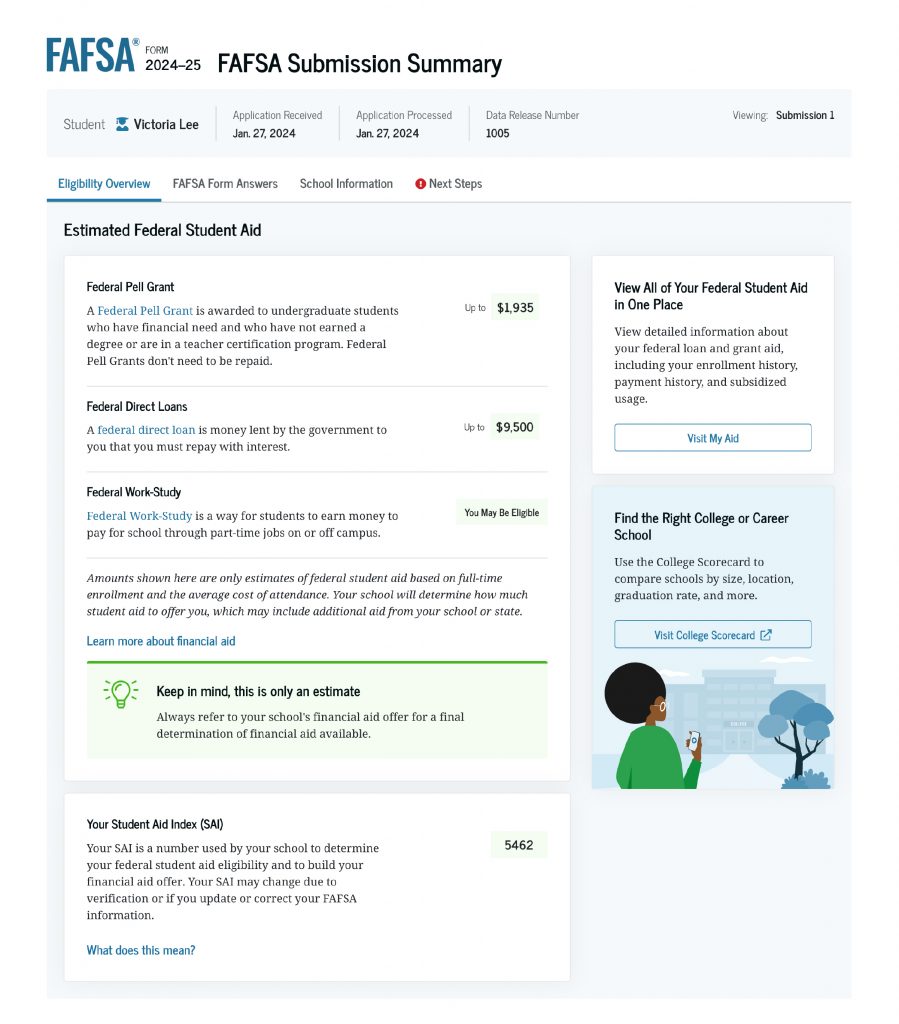

Reviewing Eligibility Overview

The Eligibility Overview tab on the FAFSA Submission Summary is an important tool for understanding the aid you may receive from your school. This includes money you don’t have to repay (such as a Federal Pell Grant), money you can earn from working at your school (Federal Work-Study), and federal student loans.

You’ll see your confirmed Student Aid Index (SAI), which is an index number used by your school to determine your financial aid eligibility and to build your financial aid offer. A negative SAI indicates the student has a higher financial need.

If you’re selected for verification of your eligibility, there will be an asterisk next to your SAI along with a comment notifying you that you have been selected.

In that case, your school(s) will contact you to indicate what documentation you must submit and by what date. Make sure you provide all documentation as soon as possible, because the school won’t be able to process your financial aid until it receives everything it asked for.

The aid amounts listed on this tab are estimated based on the information you provided on your FAFSA form and are not guaranteed to be offered by your school. Your school makes the final decision about the aid it offers you.

3

Checking FAFSA® Form Answers

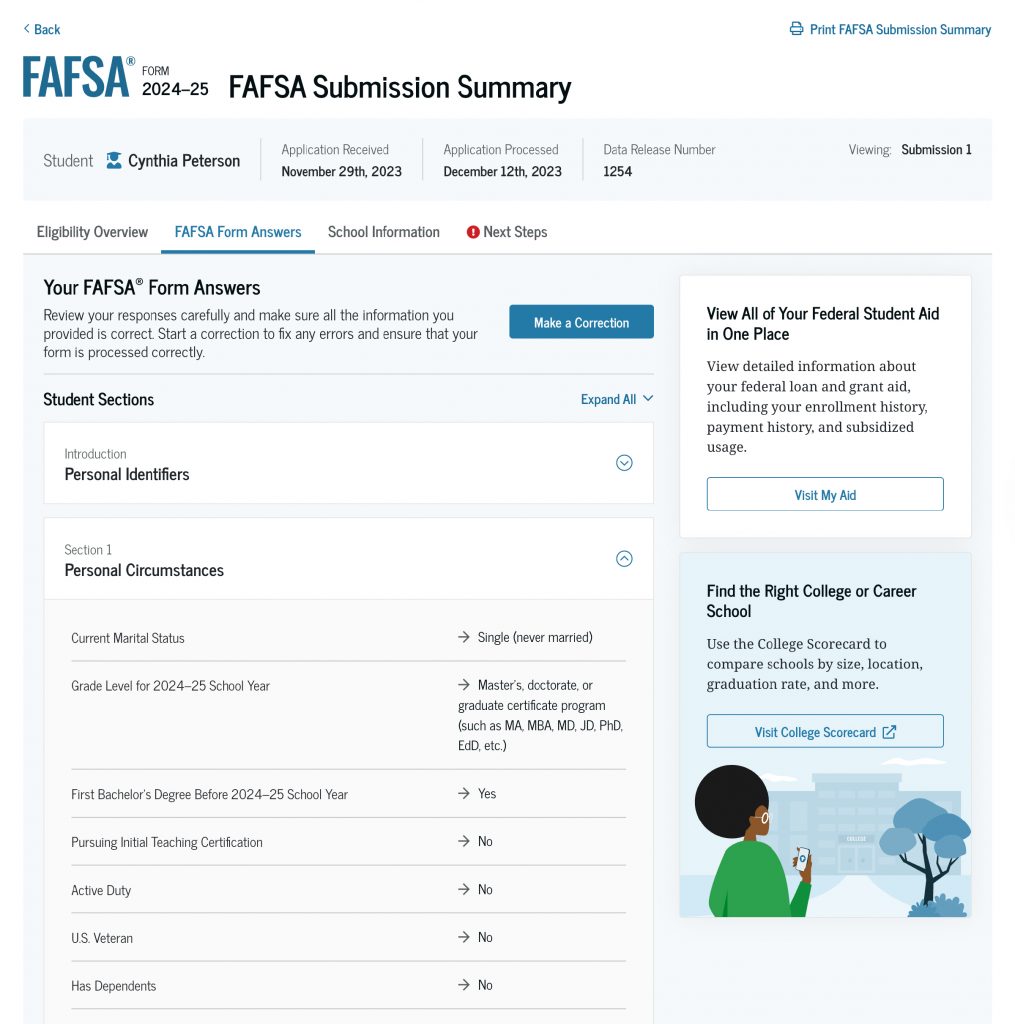

On this tab of your FAFSA Submission Summary, you’ll see the answers you and your contributor(s) provided on your FAFSA form. Select the down arrow to expand each section and review the answers for accuracy.

You can also double-check the schools you said you wanted to send your FAFSA information to and whether you digitally signed your form. You can review your answers to personal circumstances, demographics, personal information, and student financials questions, too.

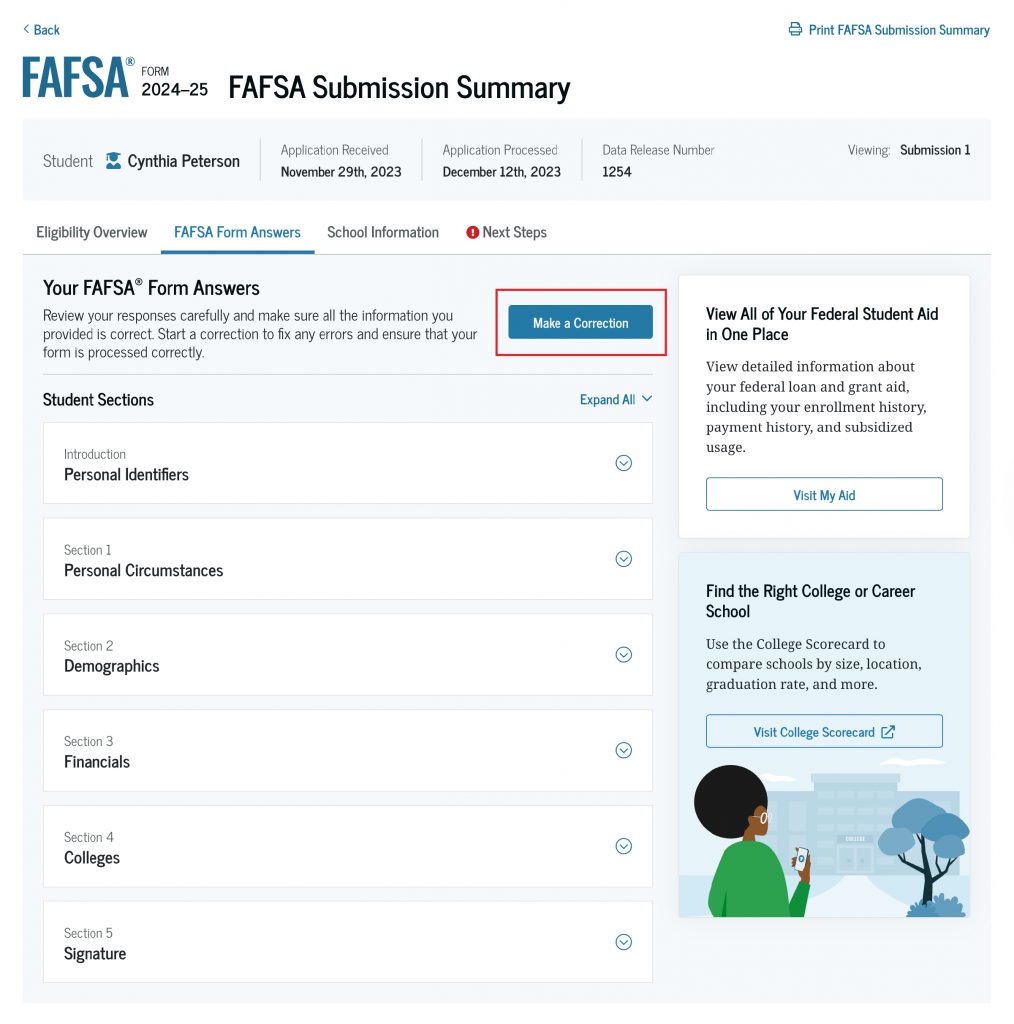

If you identify an error, you can start a correction by selecting the “Make a Correction” button at the top of the tab.

4

Finding School Information

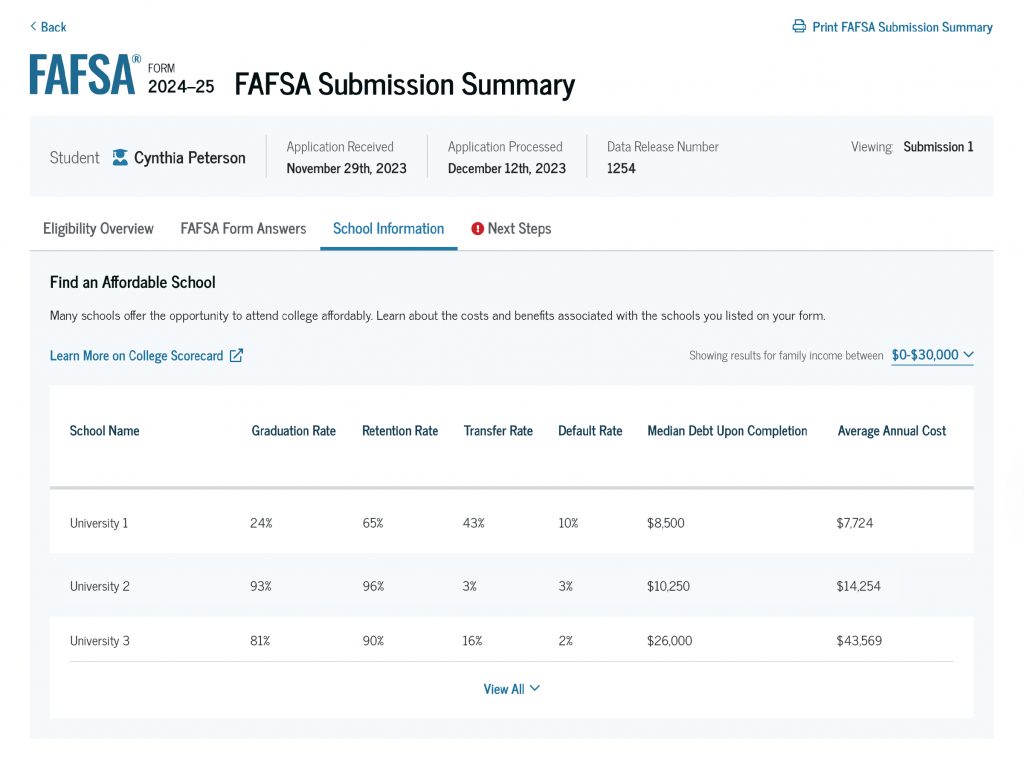

The School Information tab includes information about the school(s) you selected to send your FAFSA information to.

This information includes each school’s graduation, retention, transfer, and default rates; median student loan debt upon completion; and average annual cost of attendance.

You should use this information to compare the schools and help inform your decision of which one to attend. This can give you a good idea of what it will cost to attend each school and what student loan debt you could take on when you finish, if any.

5

Taking Next Steps

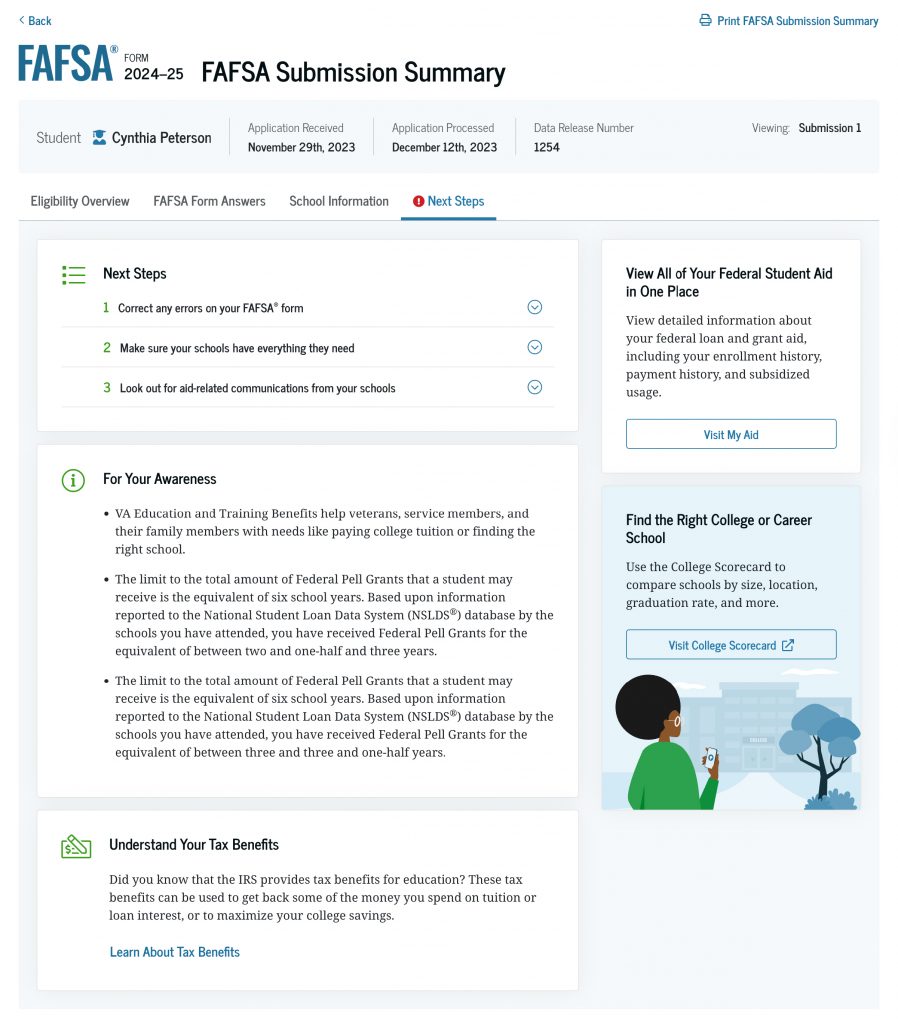

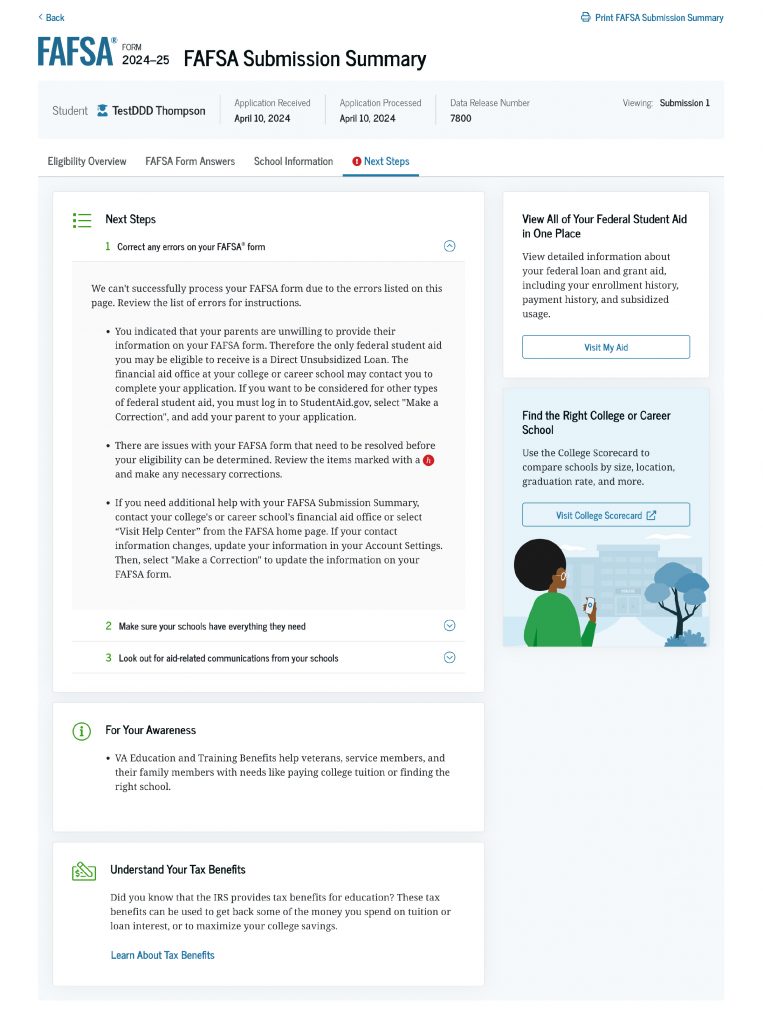

On the final tab of the FAFSA Submission Summary, we make some comments based on the information in your form, including next steps you should take.

This might include asking you to take important actions, such as making a correction or sending additional documentation to your school. Failing to take these actions might affect your eligibility for federal student aid, so don’t wait.

We might also offer some information for your awareness. Select the down arrow to expand the section and view more details about each item.

6

Making Corrections or Changes to Your FAFSA® Form

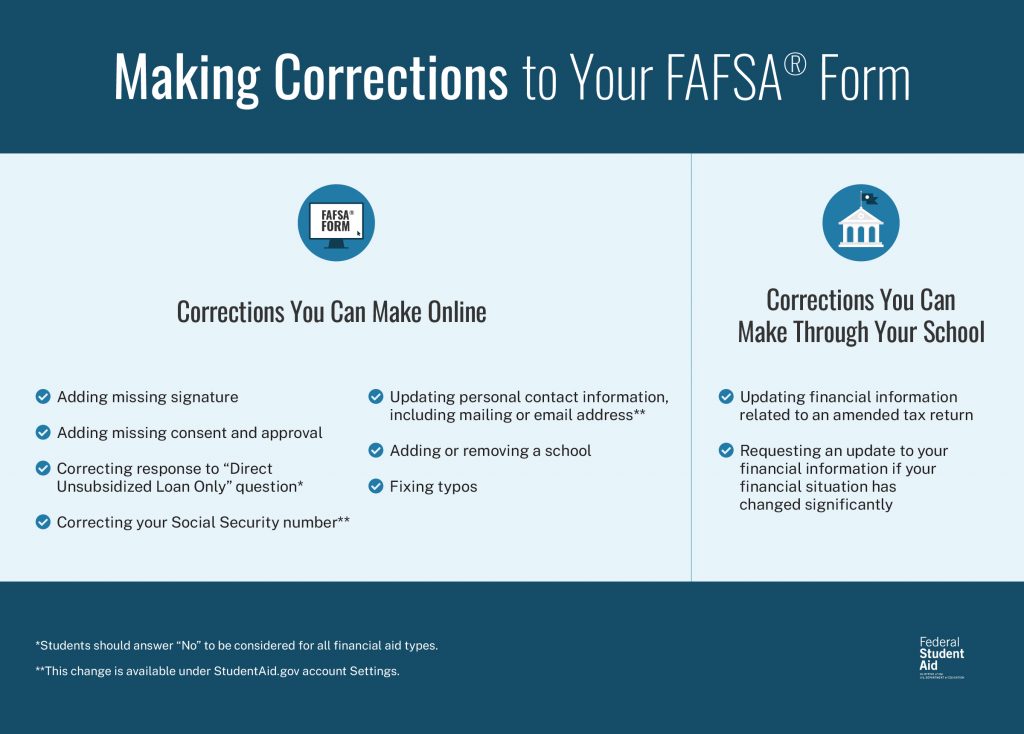

The FAFSA Submission Summary is an important resource for identifying if you or your contributor(s) need to make a correction to your FAFSA form.

If you find a mistake in your FAFSA form (such as a typo, or if the Next Steps section directs you to make a correction), you can fix it by selecting the “Make a Correction” button on the FAFSA Form Answers tab.

You can also make a correction from the “Details” page of your processed FAFSA form submission, found in your StudentAid.gov account.

Contributors can also start a correction from their StudentAid.gov accounts, however, they can only make a correction to their own sections of the form, and not yours (the student).

If you’ve experienced an event in your life that affects your ability to pay for school and is not accurately reflected on your FAFSA form, you’ll need to contact the financial aid office at your school to make sure they know about it. This could be something like you or a contributor lost a job, or your marital status changed. At this time, schools are unable to update your Submission Summary to reflect these types of circumstances. However, your school can work with you to estimate how these types of changes will impact your aid offer.

7

Finding Resources To Help You Understand Aid

On the right side of your FAFSA Submission Summary page, you can find additional resources to help you see “the big picture” of your school choice and potential financial aid package.

In the “View All of Your Federal Student Aid in One Place” box, you can select “Visit My Aid” to see detailed information about your existing federal loan and grant aid (if you have any), including your enrollment history, payment history, and subsidized loan usage. Keep in mind there are limits to the amount of subsidized loans you can receive in your lifetime, so you can see how much you’ve already received. You can receive Federal Pell Grants for up to 12 full-time terms or about six years, and you can see how much of those you’ve already received here.

Like our comparison information on the School Information tab, you can continue to research schools that fit your interests and your budget based on the aid we estimate you’ll receive and how much you’re expected to pay for yourself. Under “Find the Right College or Career School,” we link you to College Scorecard to compare just about any school. You can see how much students earn in their jobs and how much student debt they have after graduation, among other facts. We take you through this feature at the 31-minute mark in our Spaces recording.

If you’d like to change the schools you send your FAFSA information to, you can do this by making a correction to your form.

Want more information about the FAFSA process? Check out our video playlist on the next steps after you submit your FAFSA form.