7 Things To Do After Submitting Your 2024–25 FAFSA® Form

The financial aid process doesn’t end once you submit your Free Application for Federal Student Aid (FAFSA®) form. There are still seven things you should do after you complete your form:

- Check your FAFSA confirmation.

- Review your FAFSA Submission Summary.

- Make corrections, if needed.

- Complete your state’s aid application.

- Compare schools and out-of-pocket costs.

- Apply for scholarships.

- Watch for your financial aid offers.

Avoid issues with your federal student aid and increase your chances of getting additional aid for school by taking a few steps after you submit your FAFSA® form.

1

Check your FAFSA® confirmation for important information.

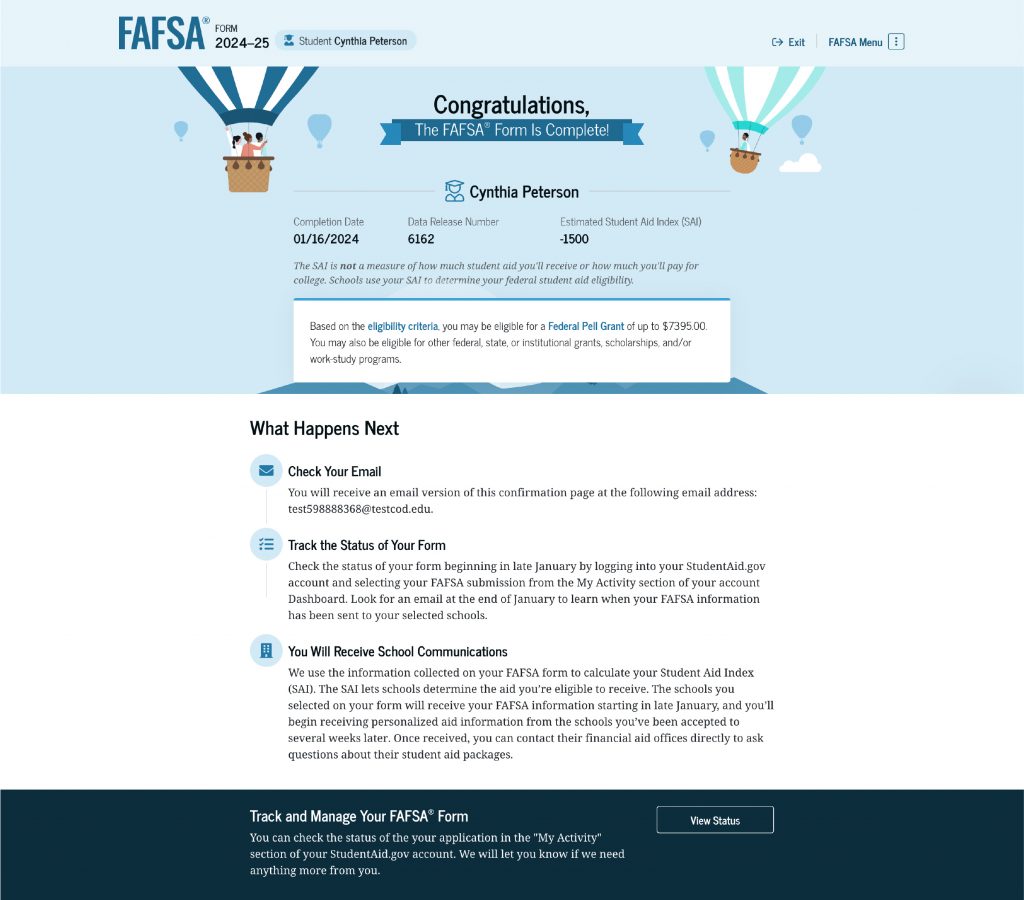

After you complete and submit the FAFSA form online, you’ll see a confirmation page like the one below. The full confirmation page will appear if all information, consent and approval, and signatures required on your form have been submitted.

If you have contributors who still need to complete their sections, you’ll see an abbreviated confirmation page after you submit your section of the form. New for the 2024–25 FAFSA, each contributor must enter and complete the form separately answering only the questions pertinent to them. There are a significant number of FAFSA applications that have been started but cannot be processed until the other contributors complete their work. Please ensure the FAFSA is completed, signed, and submitted by all contributors. The full confirmation page and information will be emailed to you once all required sections are complete.

Your confirmation page will include next steps you may need to take for your FAFSA form once it is processed. This may include immediate actions, such as providing consent and approval or a signature from a contributor. Remember, you and any identified contributors must provide the required information, consent and approval, and signature for your FAFSA form to be complete and for you to be eligible for federal student aid.

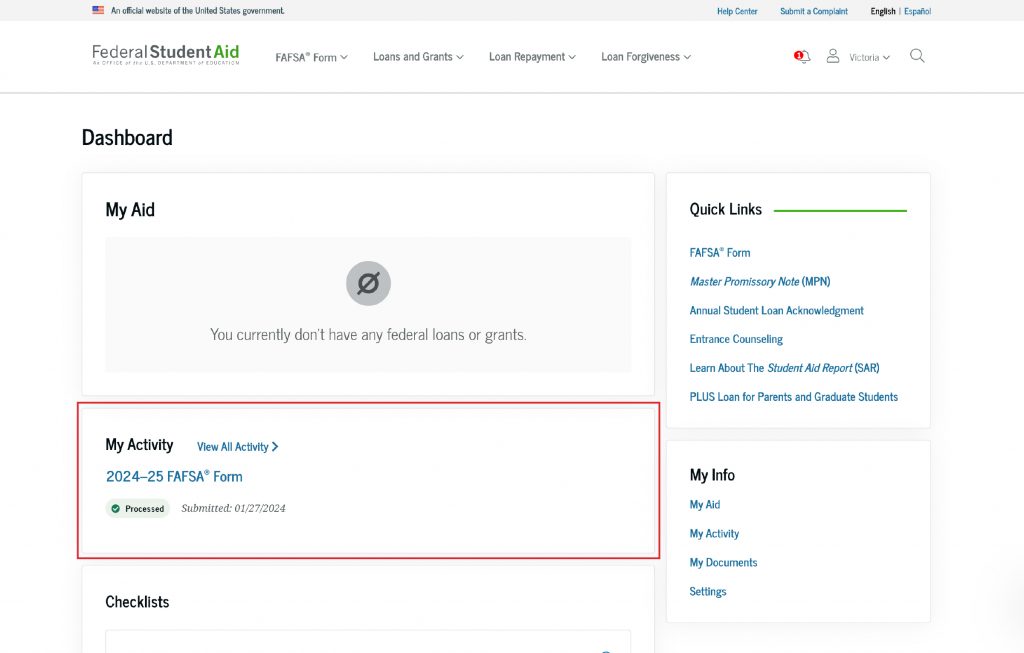

To confirm your FAFSA form has been submitted and to check the status of your form, follow these steps:

- Log in to StudentAid.gov using your account username and password.

- Navigate to your account Dashboard. Select “2024–25 FAFSA Form” from the “My Activity” page.

In this section, you may see the following:

- Draft—you’ve started your FAFSA form but haven’t completed your required sections.

- In Progress—you’ve completed your required sections of the FAFSA form but haven’t submitted the form.

- Action Required—you’ve completed your required sections but there was an error, and a correction is needed. This may include missing consent and approval and/or a signature.

- In Review—your form was submitted but hasn’t been processed yet.

- Processed—your FAFSA form was processed successfully with no errors.

- Closed—your FAFSA form was started but wasn’t submitted before the deadline.

The “Details” page in your Dashboard can also provide more information on your application.

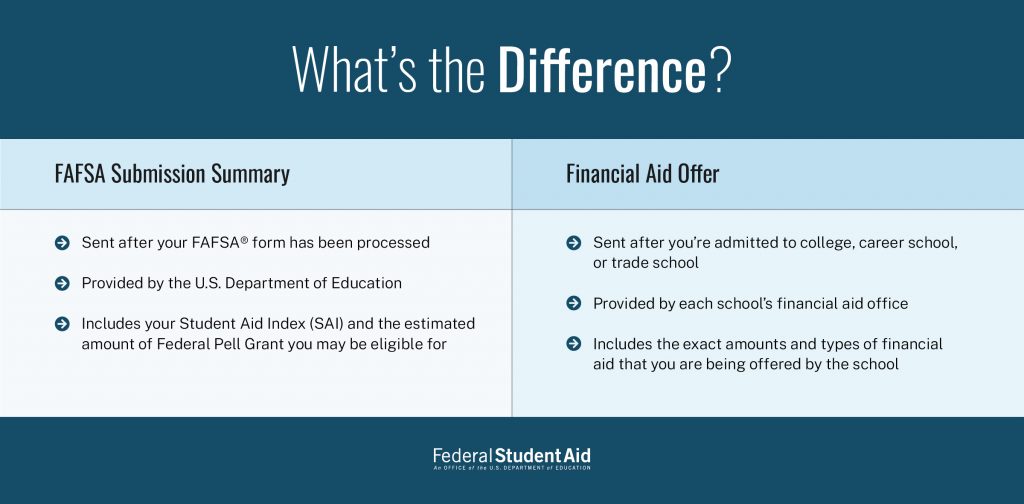

When reviewing your confirmation information, remember: This is not your financial aid offer. You’ll get that separately from the school(s) you apply to and are accepted for admission to.

However, the confirmation page includes estimates for the Federal Pell Grant amount you may receive from your school and your estimated Student Aid Index (SAI). A lower or negative SAI indicates a student has a higher financial need.

Schools will use your SAI to calculate the amount of aid you’re eligible for. Learn what the SAI is and how it’s calculated.

2

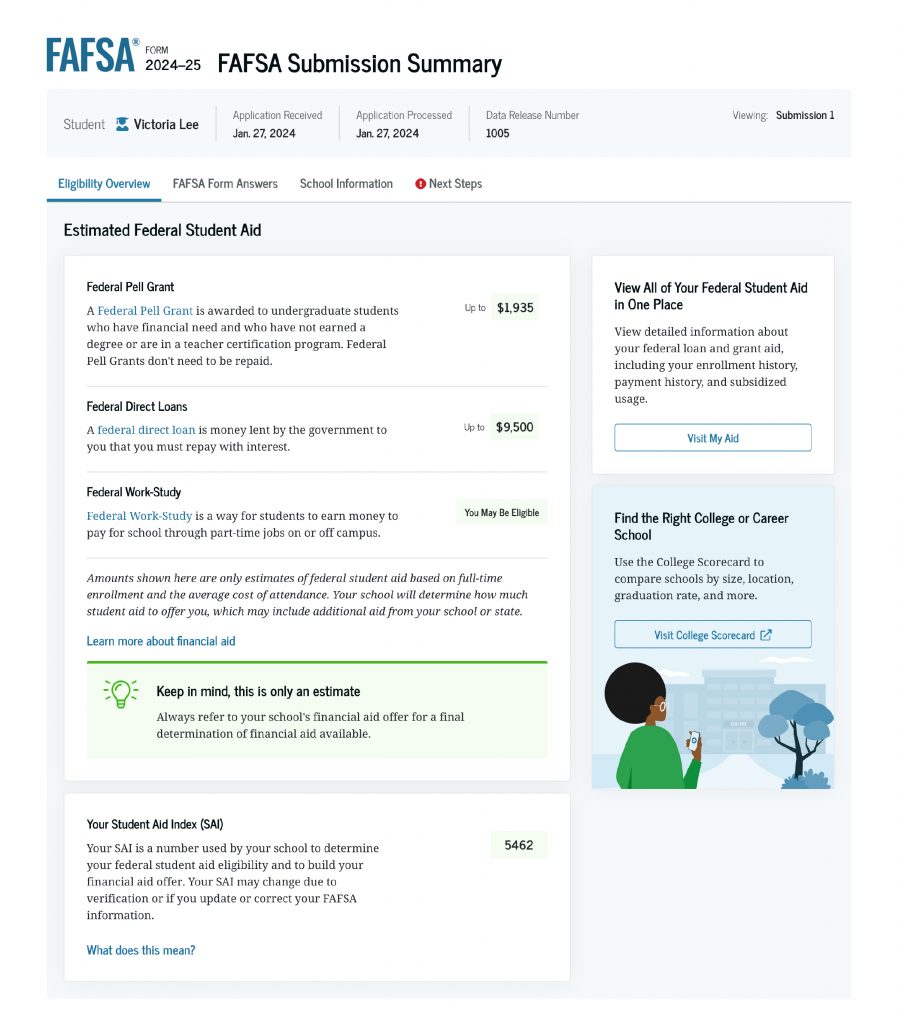

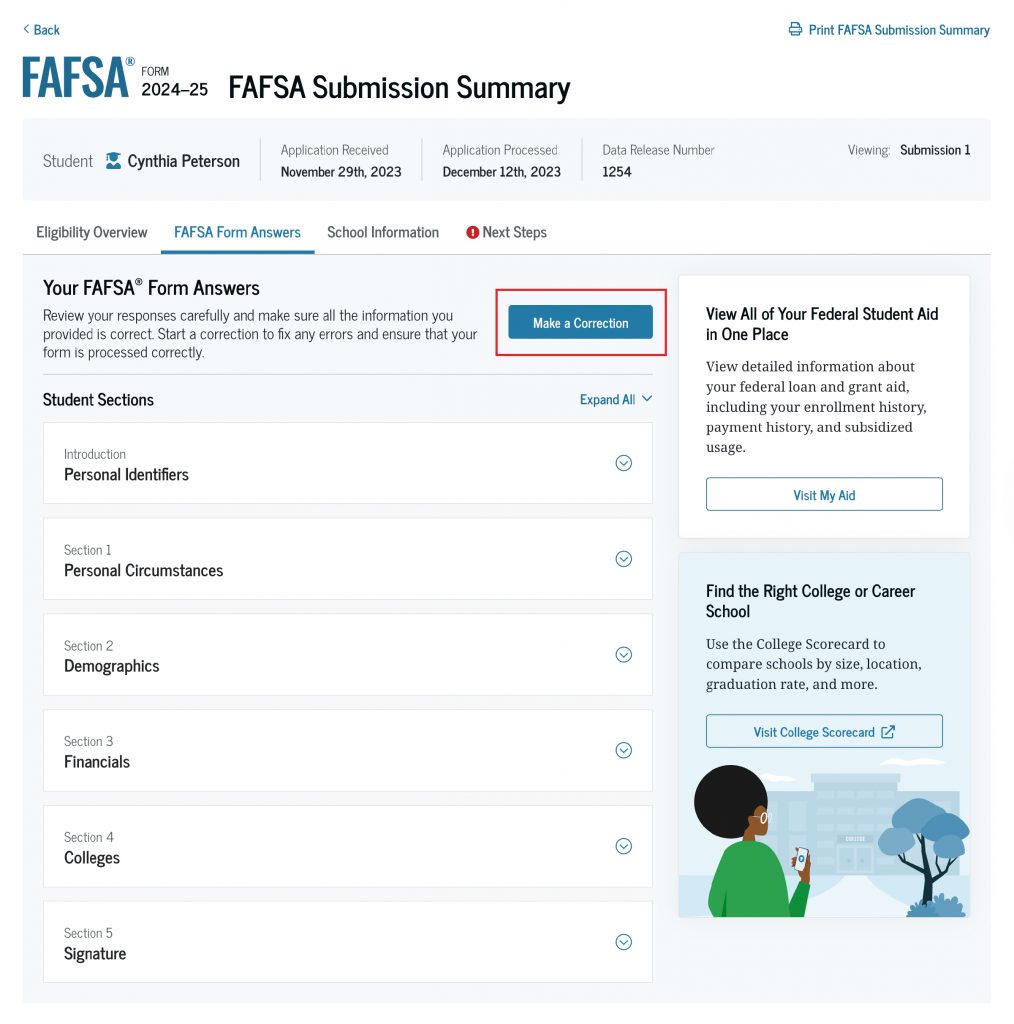

Review your FAFSA Submission Summary.

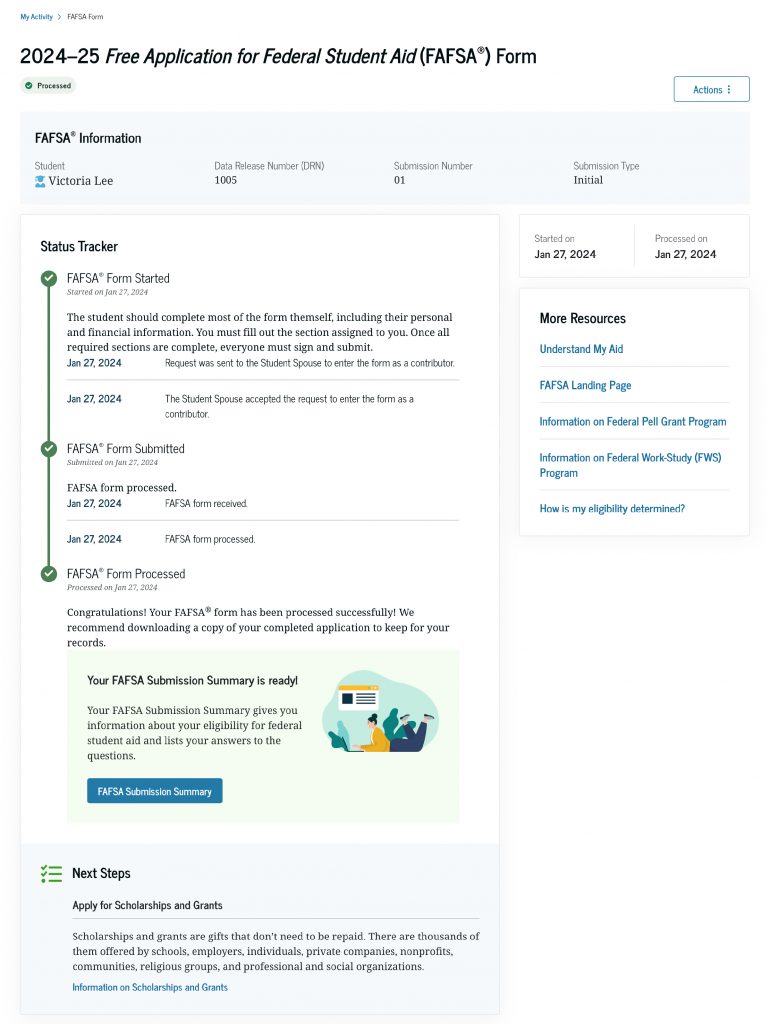

After your FAFSA form is submitted and processing begins, it will be processed in one to three days for online forms. Once your FAFSA form is processed, you can log in to your StudentAid.gov account to view your FAFSA Submission Summary or check the processing status for your FAFSA form.

Your FAFSA Submission Summary is not your financial aid offer, but it will include important information across four tabs. Review each tab carefully to make sure the information is correct and take any actions listed on the final tab. Each tab covers a specific topic:

- Eligibility Overview includes estimates of your federal student aid and your confirmed SAI.

- FAFSA Form Answers includes the responses you provided on your FAFSA form and the ability to start a correction if you notice any errors.

- School Information includes details about the schools you listed on your FAFSA form for you to compare.

- Next Steps includes information for your awareness and actions you may need to take for your FAFSA form.

One of the next steps you may see listed on your FAFSA Submission Summary is making sure your schools have everything they need. Some schools may require additional financial aid applications, and if you indicated that you have unusual circumstances or were identified as a provisionally independent student on your FAFSA form, you will need to provide supporting documentation. Find out what your school may require and submit any required documentation by the appropriate deadlines to avoid issues with your financial aid.

To learn more about the FAFSA Submission Summary, read our “Understanding the FAFSA Submission Summary” article.

3

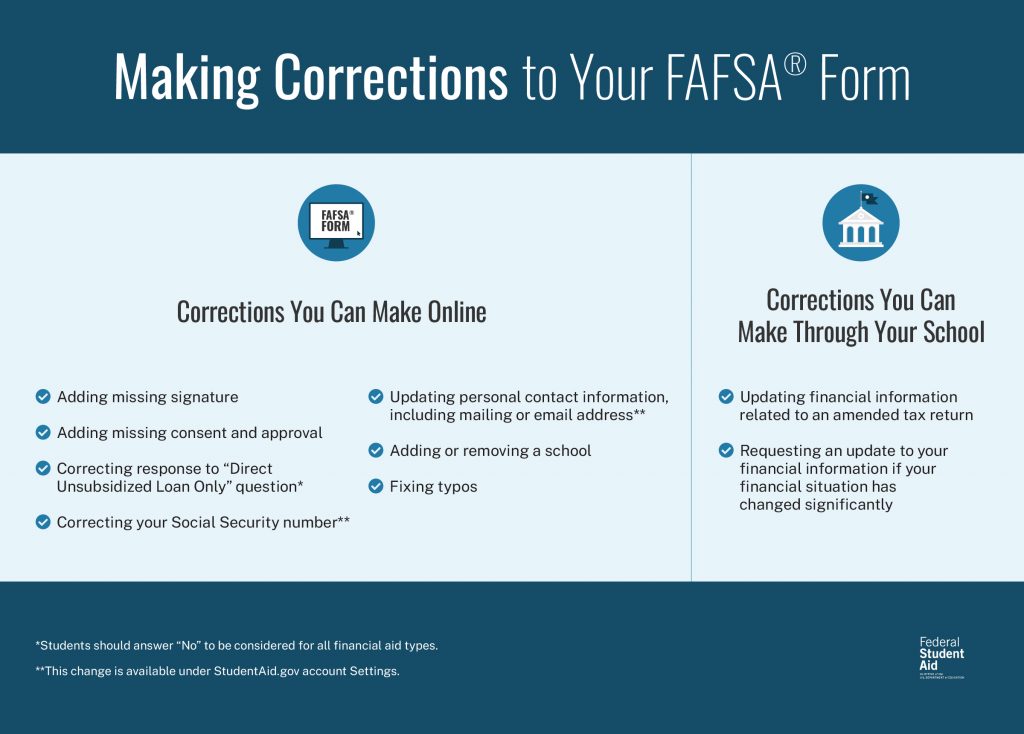

Make FAFSA® corrections, if needed.

After your FAFSA form has been processed, you can go back and submit a correction for certain fields. This includes updates as instructed by your school, correcting a typo, and/or adding another school to receive your FAFSA information. You can add up to 20 schools to your online FAFSA form at a time.

If you want to report significant changes in your family or financial situation, contact the financial aid office at the college, career school, or trade school you plan to attend.

For errors on your FAFSA® form, you can submit a correction. For changes to your family or financial information, contact your school’s financial aid office.

To begin a correction, go to your FAFSA Submission Summary and then select “Make Corrections” at the top of the FAFSA Form Answers tab. You can also log in to your StudentAid.gov account and make a correction from the “Details” page of your processed FAFSA form submission.

Note: Contributors (including a parent, stepparent, or spouse) can begin a correction, but they can submit corrections only for their own sections of the FAFSA form. Students can begin and submit a correction for any section of their FAFSA form.

4

Complete your state’s aid application.

Student aid doesn’t come only from your school and the federal government. Student aid is also available from your state. Some states only require that you complete your FAFSA form to be eligible, but other states may require you to complete a separate application.

Many states have limited funds, so understand your state’s requirements and apply early to be eligible for as much aid as possible. You can find more information about state aid, including types of aid available, eligibility requirements, applications (if required), and deadlines, by visiting your state’s higher education agency website. You should contact your state’s higher education agency if you have any questions.

5

Compare schools and out-of-pocket costs.

Even before you receive your financial aid offers, you can begin researching and comparing the schools you included on your FAFSA form. Each school will have a different cost of attendance and may include different items in their calculation. Along with tuition and fees, the cost of housing and food and the cost of equipment, books, and supplies may be included for some schools.

Schools will use your cost of attendance and subtract the amount of grants and scholarships you’ve been awarded to calculate the net cost for you to attend. The net cost, or net price, is the amount you will have to pay out of pocket. You can use College Scorecard to estimate your personal net cost at a school and to compare school costs to help you determine which school is most affordable for you.

6

Apply for scholarships.

Since many schools won’t be able to meet your full financial need, you’ll need a way to pay the difference between the financial aid your school offers and what the school costs. Scholarships are a great way to fill the gap.

Don’t wait until you receive your financial aid offers to start applying for scholarships. There are thousands out there, but many have early deadlines. Set a goal for yourself; maybe you aim to apply to one scholarship per week. Make scholarship applications your focus while you wait for your financial aid offers.

The applications may take some time, but the possible payout makes it all worth it.

Learn where to find scholarships.

7

Watch for your financial aid offers.

The colleges, career schools, and trade schools that you list on your FAFSA form (and that accept you for admission) will use your FAFSA information and your SAI to determine what financial aid you’re eligible to receive. The schools will prepare your financial aid package and send you a financial aid offer. Each school has their own schedule, but if you’re beginning school in the fall, many schools will send aid offers the spring before.

Your aid offers will include important information for you to review:

- the cost of attendance at the school

- the types and amounts of financial aid you are being offered

- the net cost (or amount you will have to pay out of pocket)

- the deadline you need to respond to your aid offer by

Learn more about understanding and reviewing your financial aid offers.