Become a Public Service Loan Forgiveness (PSLF) Help Tool Ninja

This article will summarize how to use the PSLF Help Tool so that you’re in and out with minimal hassle. We’ll cover help tool basics, how to find your employer in our database, and more.

PSLF Help Tool Basics

The PSLF Help Tool helps those seeking PSLF to learn more about the program, whether their employment qualifies, and what they might need to do with their loans to set themselves up for success. You and your employer(s) can digitally sign the form, allowing for more efficient processing.

You can use the PSLF Help Tool to apply for both PSLF and Temporary Expanded Public Service Loan Forgiveness (TEPSLF). And you can use the tool no matter where you are in the PSLF process, whether you want to apply for forgiveness right now or certify employment to understand your progress toward that goal.

Employer Database

The first thing you need to do using the PSLF Help Tool is to search for and select the employer for which you want to certify employment. Our employer database is regularly updated with employer eligibility for PSLF. Our database has millions of employer records in it, and we are adding new records every day, though we won’t ever have every possible employer. Below is information about how the database works, as well as some tips on how to interact with it.

Want to do a quick check of your employer(s) but aren’t quite ready to submit the PSLF form? You can use our new PSLF employer search to verify your employer’s eligibility outside of the PSLF Help Tool—no login required.

The PSLF employer search provides easy-to-follow prompts and guides you through the process to determine if your employer qualifies for PSLF. The search results will provide next steps depending on whether your employer qualifies for PSLF, does not qualify for PSLF, or isn’t listed in the database.

Get Your Employer’s EIN—We Aren’t Kidding

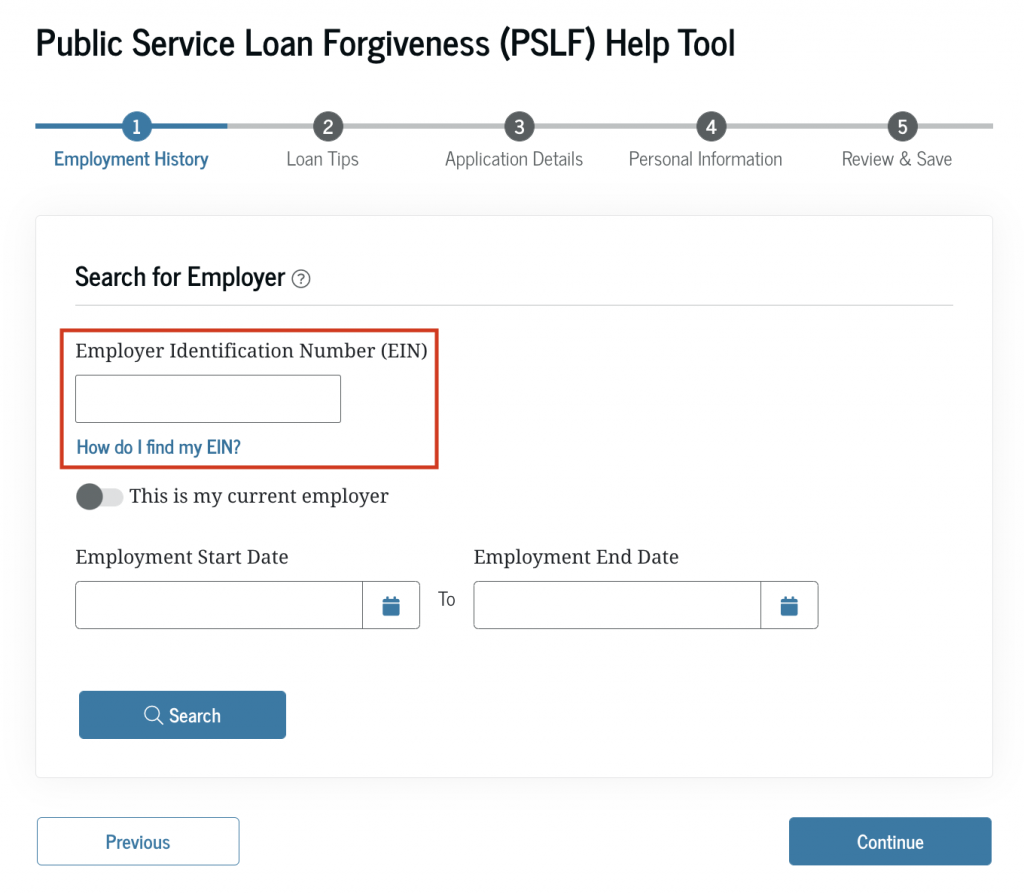

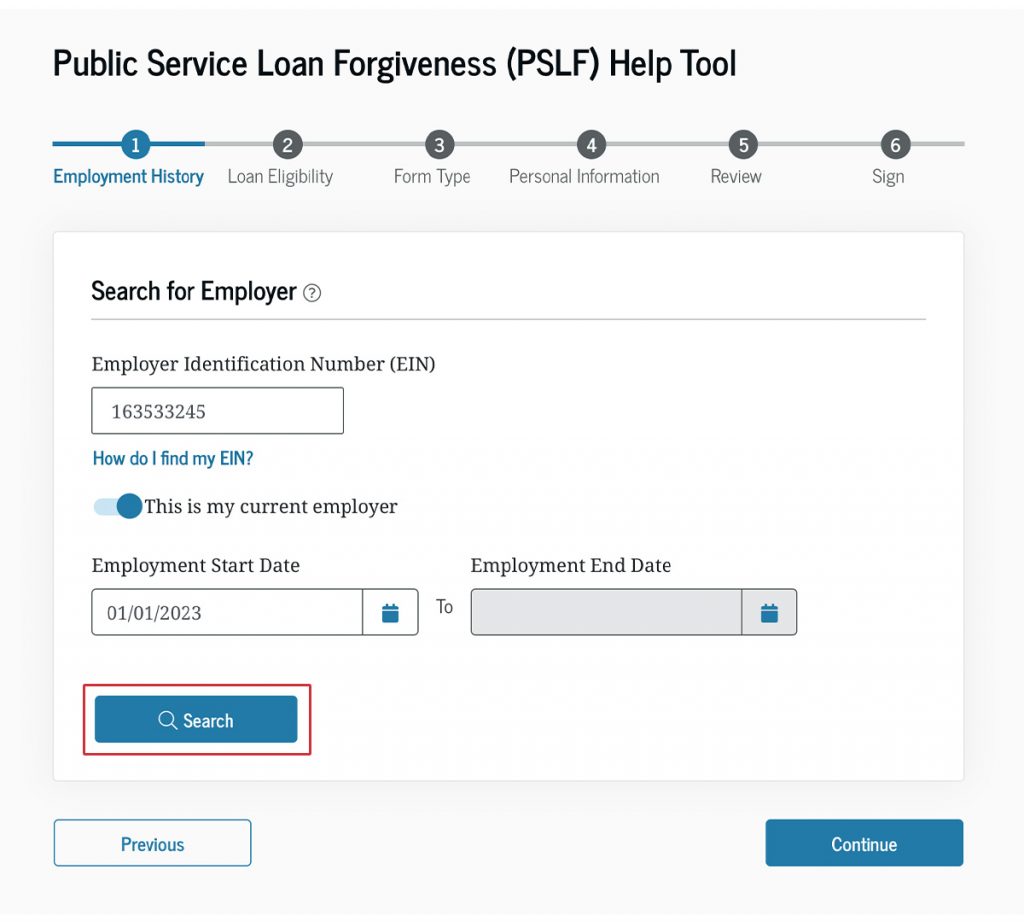

We can’t stress this enough: To interact with this database, you need your employer’s Federal Employer Identification Number (FEIN/EIN). You can find your EIN in box b of your W-2, or you can get it directly from your employer by asking them what EIN they will report on your W-2.

Get the right number from a document your employer gave to you; don’t hunt around for this number on the internet. Employers frequently use one EIN for employment and another for other financial purposes. Entering the wrong number can really slow up the process. Have the EIN in hand when you are ready to use the help tool. Note: The Federal Employer Identification Number is different from the state ID number that also appears on your W-2. As PSLF is a federal program, we want the federal number, not the state number.

You might think it is easier to ignore the prompt to search by EIN and instead manually enter information about your employer. But one of the first things that you’ll be required to enter about your employer is the EIN.

So, you really do need this number, and there are no exceptions. Entering numbers like 12-3456789 or 99-999999, while allowed in our systems (for now), will ultimately result in our requesting you to use the tool properly later, and only after you have waited for us to look at your submission and determine that 12-3456789 and 99-999999 aren’t valid entries. (And, yes, if you are curious, we have seen this more often than you might think.)

Your submission is virtually guaranteed to take longer if you are manually entering information about your employer instead of using our database, even if you are entering a valid EIN for your employer. We cannot recommend this enough:

- Search the database.

- And use what’s there.

What Happens When You Search

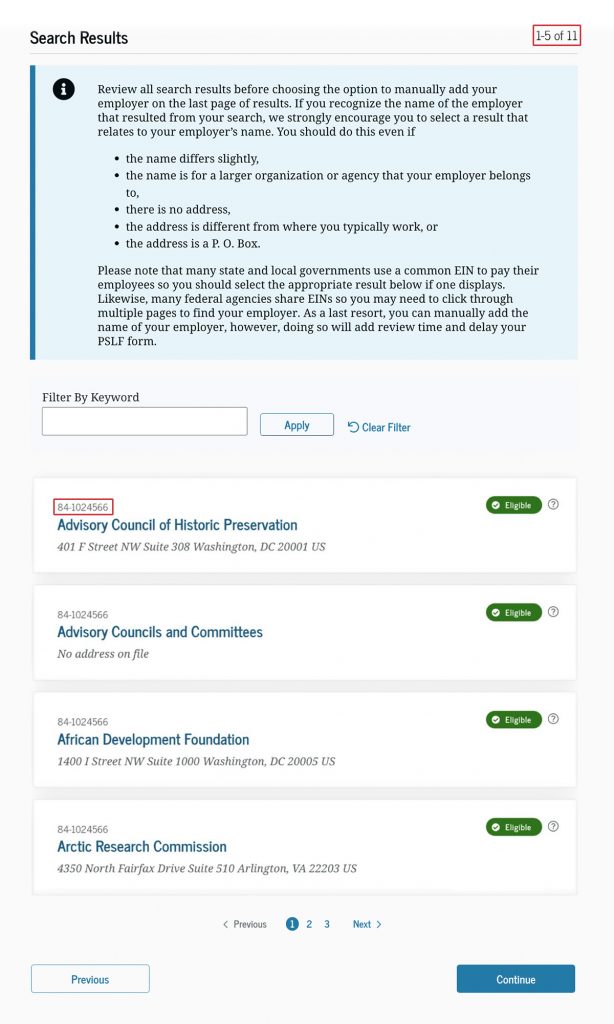

When you search for your employer by EIN, employers that are in the database already will have the following eligibility statuses:

- Eligible—everything is good to go here, and we have determined the employer qualifies for PSLF.

- Undetermined—we need to perform a review on your employer’s eligibility for PSLF based on the employment dates you entered in your search.

- Ineligible—we have evaluated this employer and determined that it doesn’t qualify, for example, because it is a for-profit organization.

- Split—your employer’s eligibility is “split” because they were only eligible for PSLF for part of your employment. An example of a split status might include organizations that switched between a for-profit and not-for-profit non-profit status. It can also include organizations that formed, merged, or closed after the PSLF Program began in 2007.

Again, in all cases, if your employer shows up when you search by EIN, populate your submission with what’s in the database. Here’s why:

- If your employer is marked as eligible, nobody will need to manually review anything, and your PSLF form will automatically be generated for signature and submission when you complete the help tool.

- If your employer is marked as ineligible, likely ineligible, or undetermined, we will still manually review things, but our review will be faster than if you disagreed with what you saw and decided to enter something manually instead. (By the way, if your employer is marked as ineligible, trying to enter things manually won’t circumvent our manual review; it will just prolong it.)

Let’s look at a few other things to note about our database and what we care about when it comes to certifying employment.

Employer Names

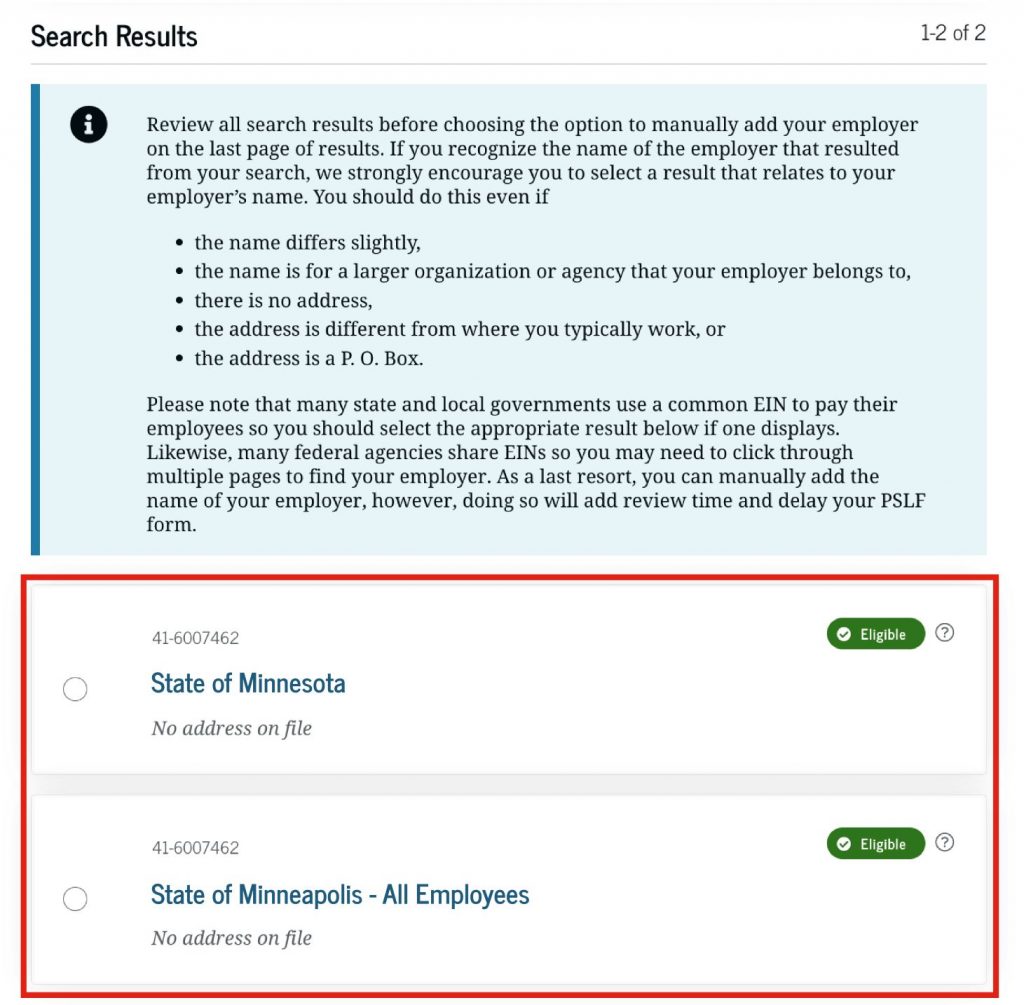

If you’ve searched by EIN, do you recognize the name that you see in the search results? If so, use that entry even if the name isn’t exactly what you’d call your employer.

Do you work for Public School 123, but the name in our database shows up as School District 2 or City of X? Use the results of the database anyway. For our purposes, you are almost always considered to be an employee of the district or city, not the individual school where you happen to teach.

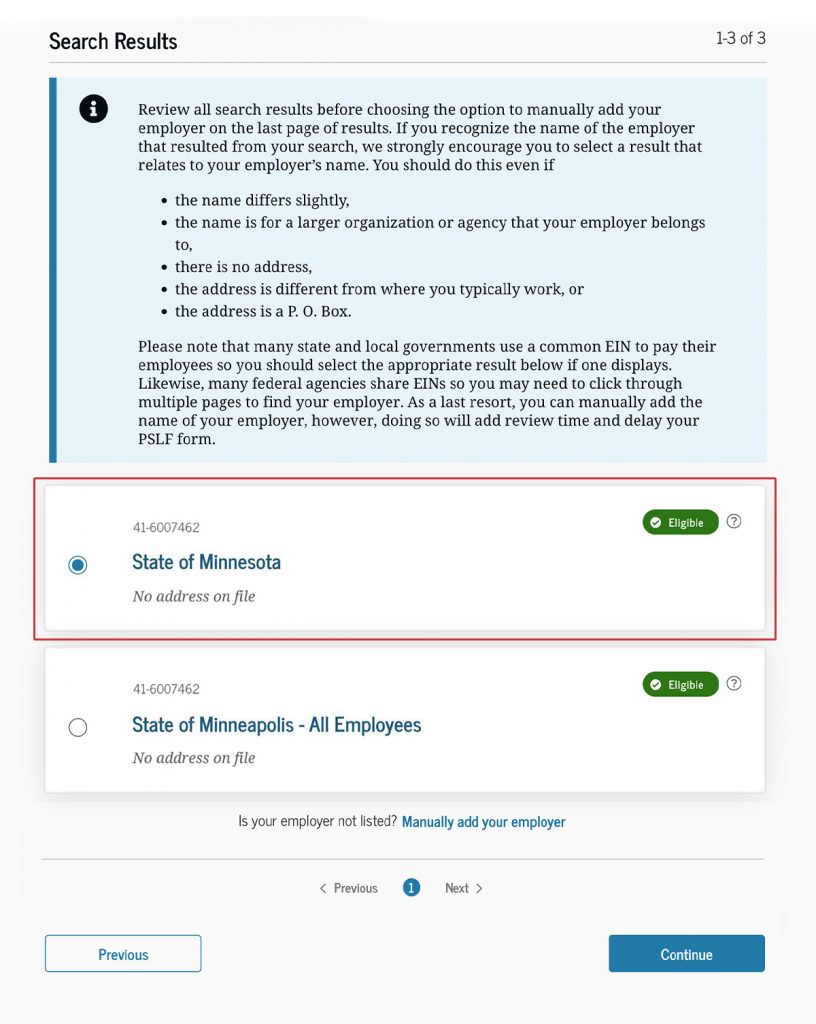

Similarly, do you work for a state agency like the Department of Natural Resources in Minnesota, but the database shows your EIN as being tied to the State of Minnesota? Many states use a common EIN for all state employees. We have included these in our database with the employer name: “[Name of State] – All employees.” This is the result you should use. For our purposes, you are a state employee.

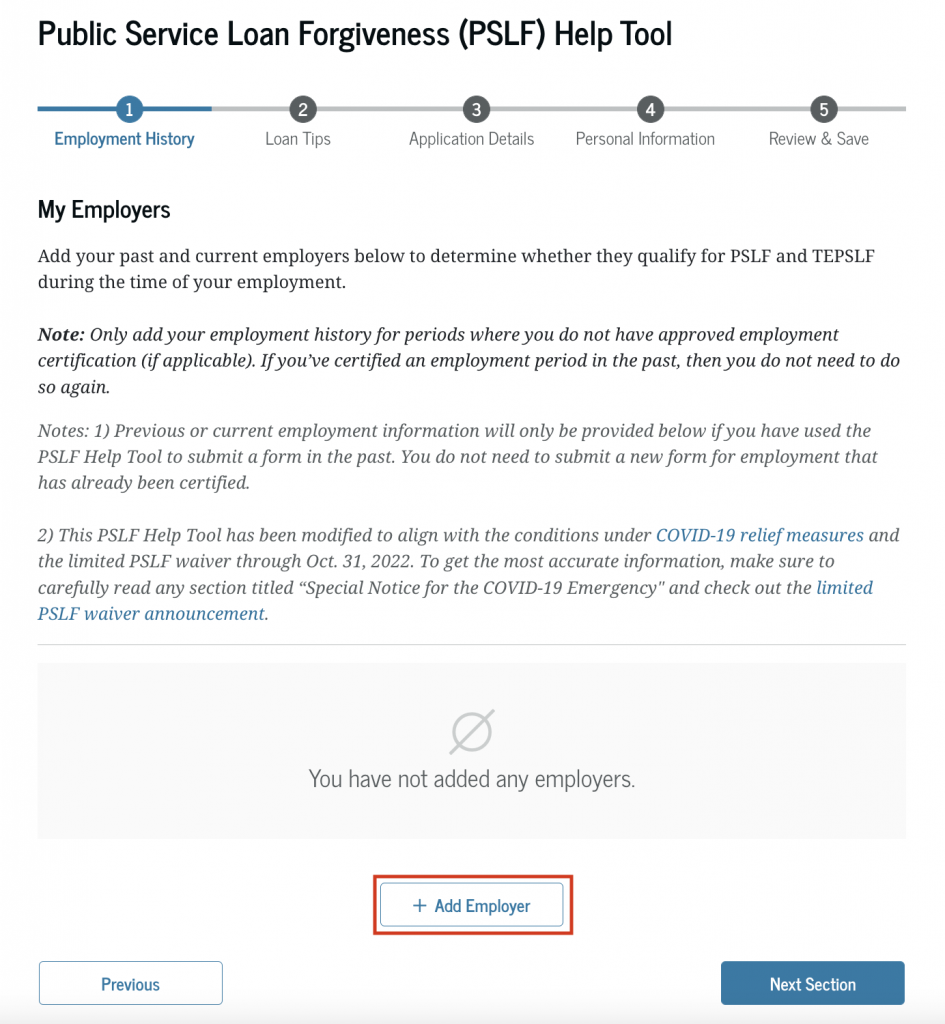

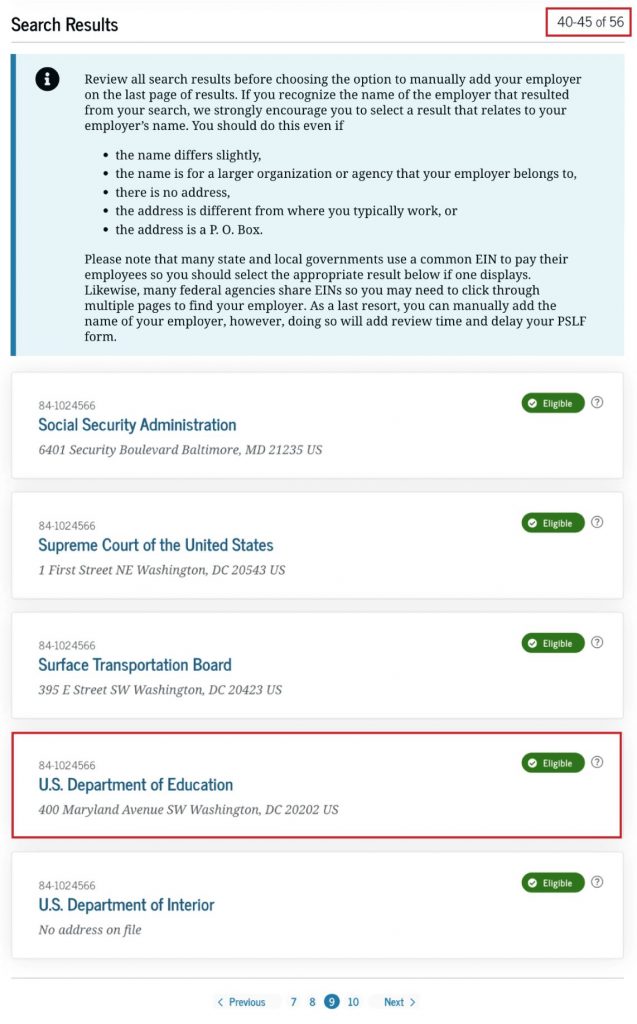

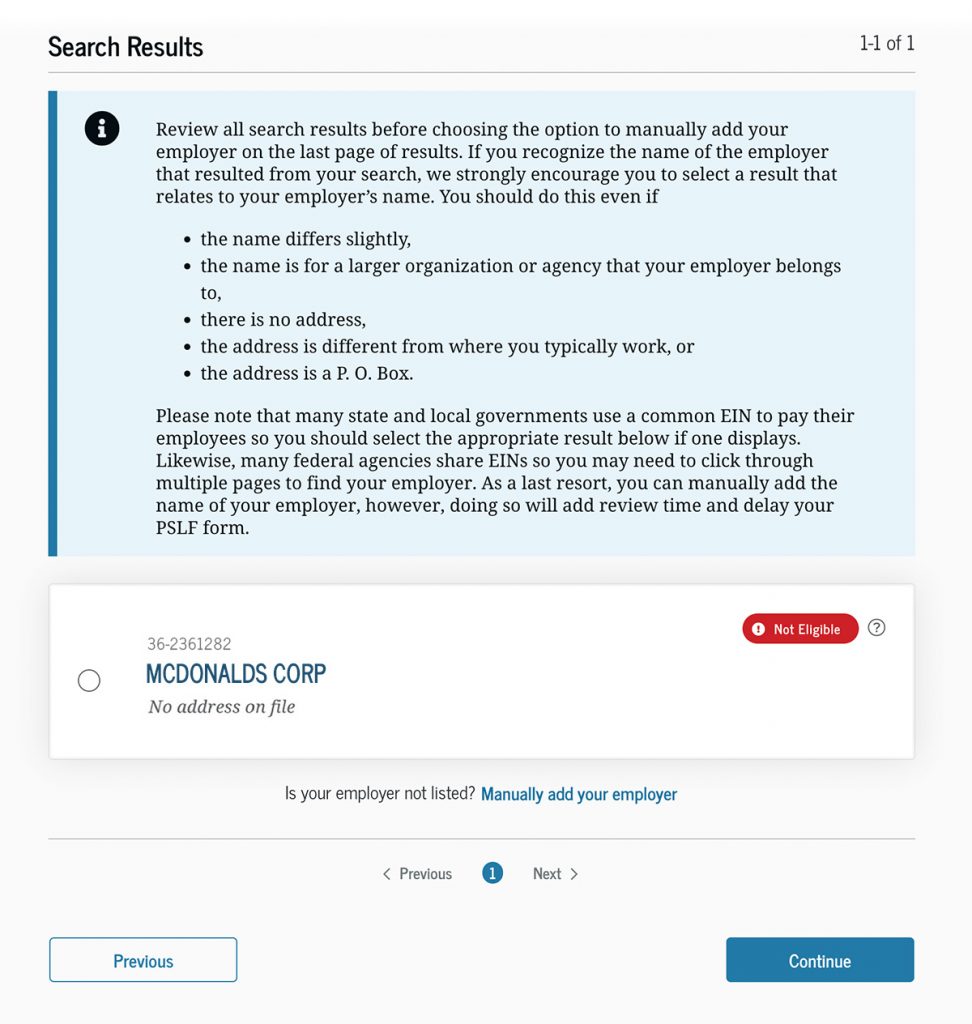

Below are some photos of navigating the employer search portion of the PSLF Help Tool.

Many of our entries for state governments show two entries—one for the state, and one for the state with “all employees” appended to the name to help users understand that we would like for them to use these results even if they work for a state agency that isn’t listed.

Lastly, do you work for the federal government? If so, many federal departments share a few common EINs. When you search for an EIN, you might need to click through several pages of results to find your department (the U.S. Department of Education is on page 9 of our search results). But you should do so. Again, we know that all federal agencies are qualifying employers for PSLF, but if you don’t use our database, manual review will be required.

Note: It’s also important to know that, for PSLF purposes, it doesn’t matter which agency or office of a department you work for, which command you are a part of in the military, or which VA medical center you work in. Certify at the department level, using the results of what you see when you search by EIN.

Employer Addresses

Our employer address data is sourced from several difference places, but most of them are associated with main headquarters addresses or the address to which financial or other legal documents should be sent. That address might not reflect where you typically work. And, for our purposes, that’s okay.

The address is a data point to help you potentially identify the entry we have for your employer in the database. While our address data will improve over time, don’t disregard our database entries just because the address seems different to you from where you normally work, because it’s a P.O. Box address, or because there is no address at all.

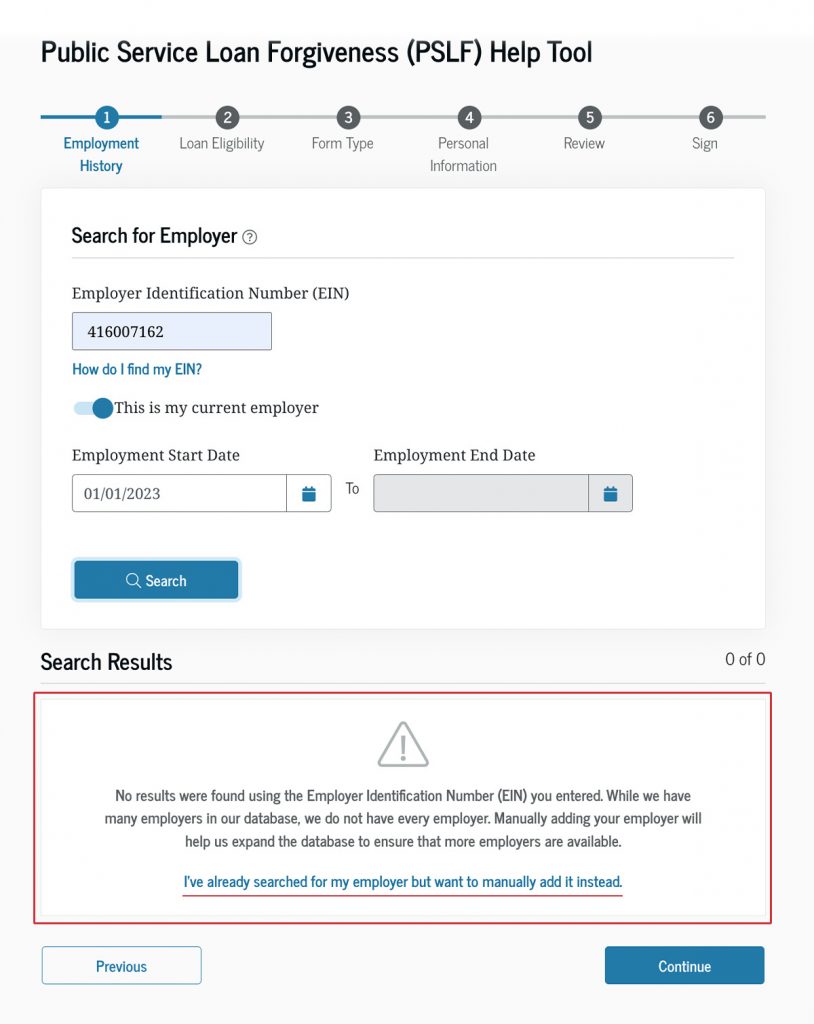

If Your Employer Isn’t in the Database

If you searched for your employer by EIN and your employer isn’t there, first check that you searched for the federal EIN. States also assign employer ID numbers, and we’ve seen plenty of cases where the state number was used instead of the federal number.

You may enter the right number and find nothing there—if so, don’t panic! While we have more than 2.7 million employers in our database, coverage isn’t and won’t ever be at 100%. Employers are created every day, and we’re still just starting out.

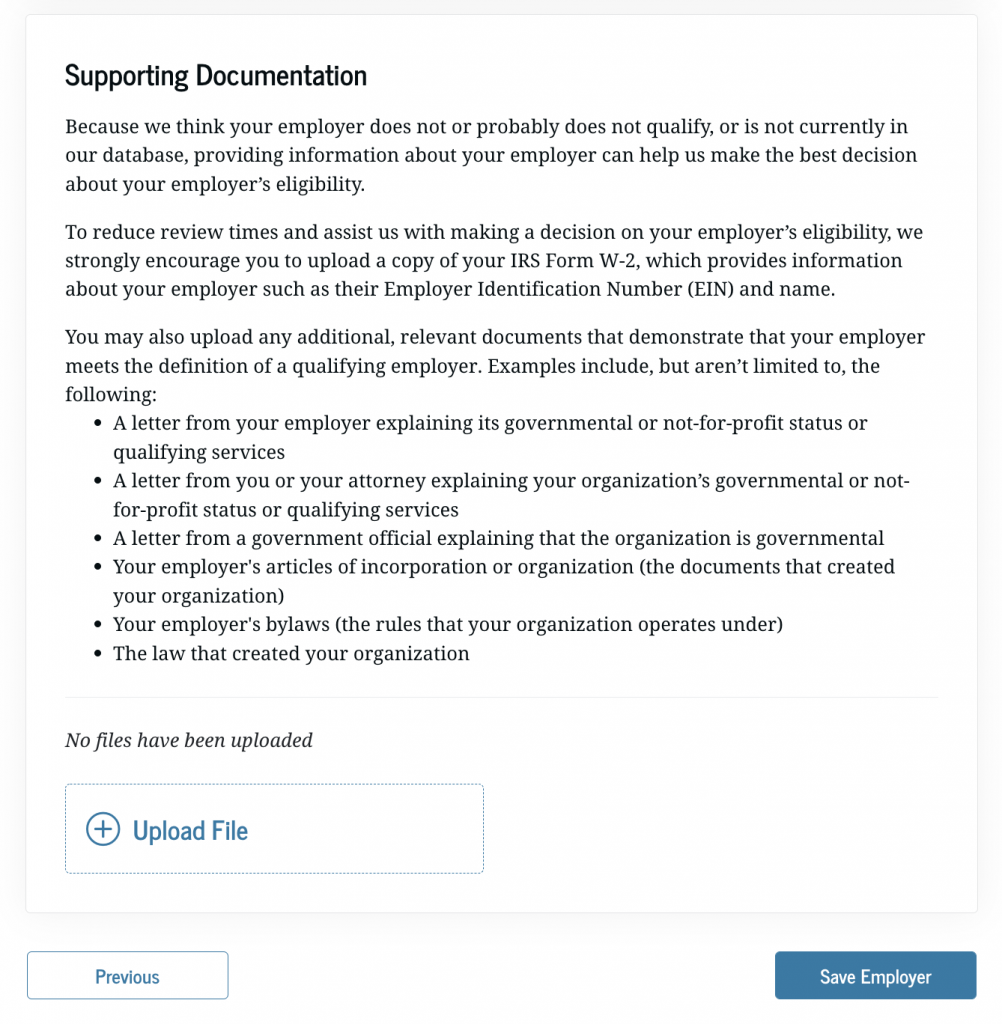

In the end, if this happens to you, don’t fret. We will review your submission and use your submission to add your employer to our database when our review is complete. We recommend two things when doing your manual entry:

- Enter your employer name exactly as it appears on your W-2.

- Upload a copy of your W-2 when prompted to upload documentation (this will save us—and you—a lot of time in our review).

Don’t panic if, when entering your employer manually, you see that we are flagging your employer as undetermined. We’ve found that many smaller, local governmental organizations in particular, and some state governmental organizations, aren’t in our database yet. And organizations that aren’t in our database currently show as undetermined in the PSLF Help Tool.

Rest assured—if you are an employee of a local or state government, your employment will qualify. But uploading a W-2 will still help our research and review, and we will use your submission to add your employer to our database for future use.

If Your Employer Is in the Database as Ineligible

There are a few reasons that your employer could be in the database as ineligible. These reasons include that we determined that it’s a for-profit organization or that it is a not-for-profit that isn’t a 501(c)(3) organization and that does not provide a qualifying service.

Our decision that an employer isn’t eligible is based on the best information that we have at the time. We can and do change our minds when presented with evidence that we didn’t have a complete picture about an employer when we made our last decision about it. So, if you see that we’ve said that your employer is ineligible, and you disagree, you have the option to submit documentation explaining why you (and preferably your employer) believe that your employer qualifies. And we encourage you to do so.

While we will review all submissions, even those for ineligible employers, sending us photos of your cat as documentation, while charming, won’t change our minds about your employer. Sending us a text document that says nothing more than “intentionally left blank” is less charming but also won’t change our minds about your employer. Submitting no documentation at all will likely result in our not changing our minds about your employer either.

But—and we cannot stress this enough—it really is important to understand that for-profit employers are not qualifying employers for the purposes of PSLF, even if you have been designated as an “essential worker” during the pandemic. In our short history after enhancing the PSLF Help Tool, we have seen multiple borrower submissions for the following types of organizations:

- Most fast-food chains

- Many large department stores

- Several grocery stores

- Large corporate pharmacies and pharmaceutical companies

- For-profit charter school management corporations

- For-profit medical providers

- Banks (and credit unions, which are technically not-for-profits but also don’t qualify)

- Financial services companies

- Investment firms

- Large technology companies

- Ride-sharing service and “gig economy” companies

- A cookie company

- An energy drink distribution company

- Management consulting firms

- Large government contractors (see note below about contracted employees)

- Shipping companies

These types of organizations play vital roles in the American economy, and for those of you who are essential workers, we thank you. But when it comes to PSLF, for-profits just don’t qualify. We will always review these submissions as they come in, but before you submit, carefully consider whether you work at a for-profit organization. If you aren’t sure whether your employer is organized as a not-for-profit, ask them—they will know.

A Special Note About Professional Employer Organizations

A professional employer organization (or PEO) is an organization that might employ you on paper for things like tax reporting or benefits. These organizations are almost always for-profit organizations, and therefore they don’t qualify in their own right. They sometimes issue your W-2 under your true employer’s name but with their own EIN. Some examples of PEOs are ADP, Insperity, and TriNet (just to name a few).

In this case, you shouldn’t use your W-2 to guide your submission on the PSLF Help Tool. We’ve done a fairly good job at tracking down the EINs that PEOs use to issue W-2s through. So, if you search for an EIN that comes back as ineligible but is associated with a company that you don’t work for, it’s entirely possible that the name you’re seeing is the PEO’s name. Or, if you see a name on your W-2 that isn’t the employer you work for your employer may be using a PEO provider.

If this happens to you, we recommend asking your employer about the name of the company. Specifically, ask whether they are partnered with this PEO to handle some of the human resources work that goes into employing you. If the answer is yes, ask your employer for their EIN, not the one on your W-2, and enter that into the PSLF Help Tool instead. If you make your submission using the EIN of the PEO provider, then when we review your submission, we will ask you to use the PSLF Help Tool again using the EIN of your actual employer instead of the PEO provider.

A Special Note About Certain Contracted Employees

Some states prevent otherwise qualifying employers from directly hiring employees to fill certain positions or perform specific services. This most commonly occurs in the healthcare industry. Since these laws prevent these facilities from directly hiring employees, they instead contract with outside organizations to provide these services under a contract.

Generally, if you are a contract employee you would search for your employer based on the EIN you see on your W-2, but if state laws prevent the employer where you physically work from hiring you directly, the EIN on your W-2 will be that of the contracted organization, which is often an ineligible for-profit employer. In this case, you shouldn’t use your W-2 to guide your submission on the PSLF Help Tool.

If this situation applies to you, we recommend asking the employer where you physically perform your work if you are hired as a contract employee because of state law. If so, you would need to request the EIN of the employer where you physically work to search the PSLF Help Tool and have someone from that organization certify your employment as if you were a direct employee of their organization.

Submitting Your PSLF Form

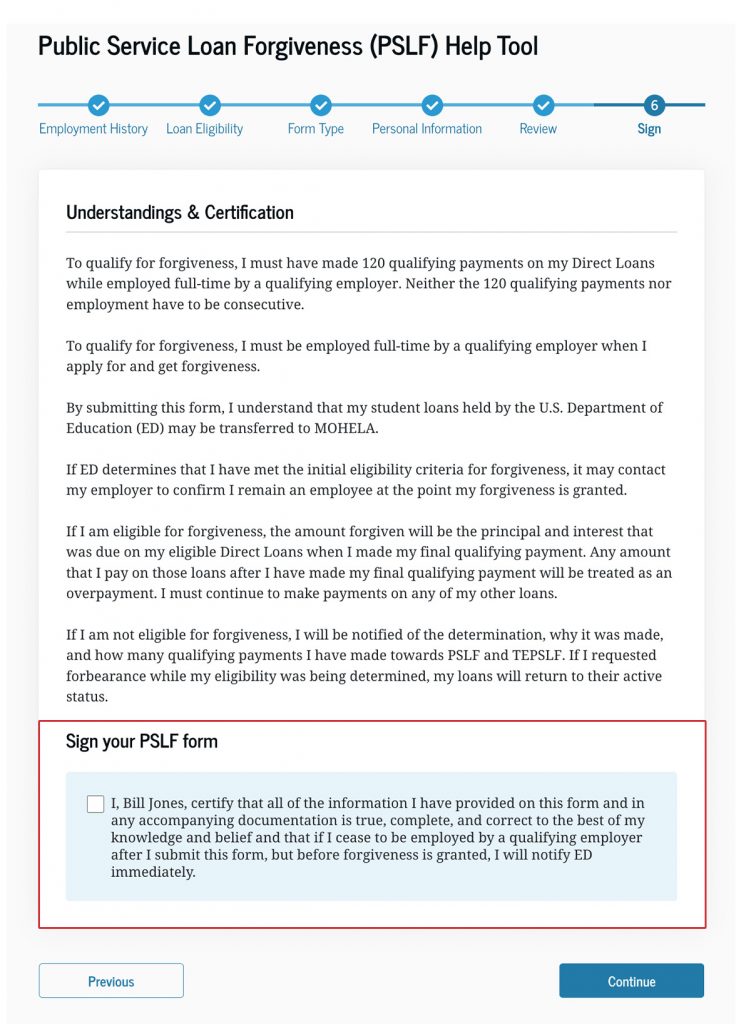

After you complete your PSLF form using the PSLF Help Tool, you can sign and submit it either digitally or manually.

Digitally Sign and Submit

You can use the PSLF Help Tool to

- digitally sign your PSLF form,

- send your form to your employers to digitally sign the form to certify your employment, and

- electronically submit for processing.

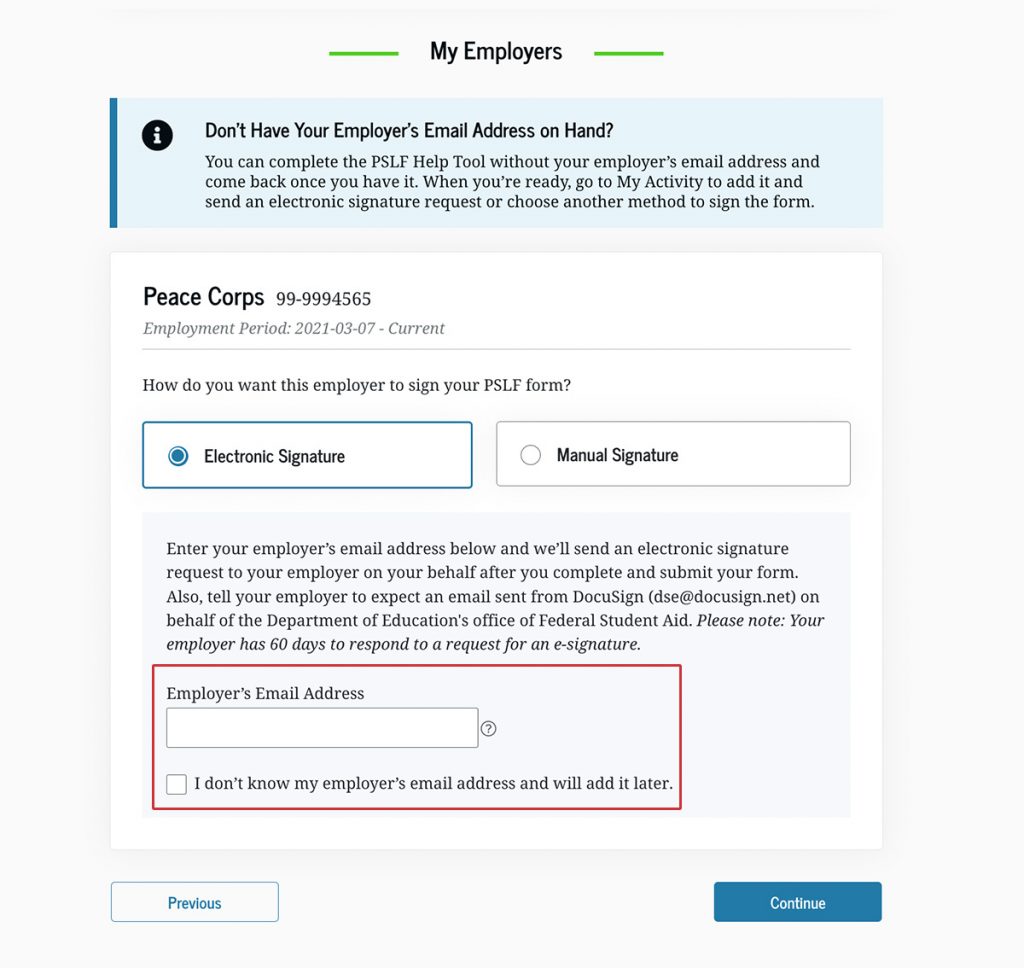

Once you’ve completed the tool’s steps, you’ll get the chance to sign your form digitally. Since you have to be signed in to use the PSLF Help Tool, all you have to do at this point is check the box and select “Continue.”

To get a digital signature from your employer, you will need the correct email address for an “authorizing official.” An authorizing official is someone who has access to your employment or service records and is approved by your employer to certify your employment or your service as an AmeriCorps or Peace Corps volunteer. This is usually someone in your human resources department, though in some cases your direct supervisor or another person may be authorized to certify your employment. Check with your organization to see who is allowed to certify your PSLF form.

Tell the authorizing official to expect an email from the U.S. Department of Education’s office of Federal Student Aid via DocuSign (dse_NA4@docusign.net) on your behalf. Once your authorizing official certifies your employment by signing digitally, your form will be electronically submitted for processing.

Print and Sign Manually

You may also submit a PSLF form by downloading the PDF and completing all the sections manually. You will still need to

- print out the form,

- sign, and

- have your employer(s) sign your form.

If you submit a manual PSLF form, digital signatures from you or your employer must be hand-drawn (from a signature pad, mouse, finger, or by taking a picture of a signature drawn on a piece of paper that you then scan and embed on the signature line of the PSLF form) to be accepted. Typed signatures, even if made to mimic a signature, or security certificate-based signatures are not accepted.

Then you will need to send the completed form with your and your employer’s signature to us. You may mail the form to this address:

U.S. Department of Education

P.O. Box 300010

Greenville, TX 75403

You may also fax your PSLF form to 540-212-2415.

You may upload by logging in to StudentAid.gov and visit My Activity.

After You Submit Your PSLF Form

After you submit a PSLF form and we confirm you have a qualifying employer and qualifying loans, we determine how many qualifying payments you made during the employment period on your form. Then, you’ll receive a letter telling you the number of qualifying payments you have made. Log in to StudentAid.gov and go to My Aid in your Dashboard to see your PSLF progress.

Tracking Your Forms

Once you’ve submitted your PSLF form for your employer’s signature, you can track it in My Activity. Here, you’ll be able to see whether your PSLF form is open (in progress), closed, or completed. You can select a form and learn

- if review of your employer’s eligibility has been completed,

- if your employer has electronically signed your form, and

- what next steps you might take.

Be sure to submit a PSLF form each year or whenever you change jobs. This will make applying for forgiveness much easier after you’ve made 120 qualifying payments.