Compare Student Loan Repayment Plans With Our Student Loan Calculator

Figuring out which student loan repayment plan is right for you is a little easier with Loan Simulator, our student loan repayment calculator. The tool helps you review different student loan repayment plans and compare estimated monthly payments, total paid over time, and more. Under some income-driven repayment (IDR) plans, your monthly payment could be as low as $0.

Note: The Loan Simulator can’t calculate exactly how much in student loans you’re eligible for. For that, you need to complete the Free Application for Federal Student Aid (FAFSA®) form. You can also use the Federal Student Estimator to estimate your potential student aid.

Loan Simulator can help you check which student loan repayment plans you’re eligible for, whether you want to

- compare repayment results (like a lower monthly payment),

- enroll in a new plan based on your end goal,

- see if you qualify for loan forgiveness, and under which plans, or

- simulate what it looks like if you pay more per month or suspend payments.

Keep in mind, this tool can’t predict your future payments with 100% accuracy. In order to make these predictions, Loan Simulator makes several assumptions as it calculates monthly repayment amounts.

Check out the following highlights of how to use Loan Simulator.

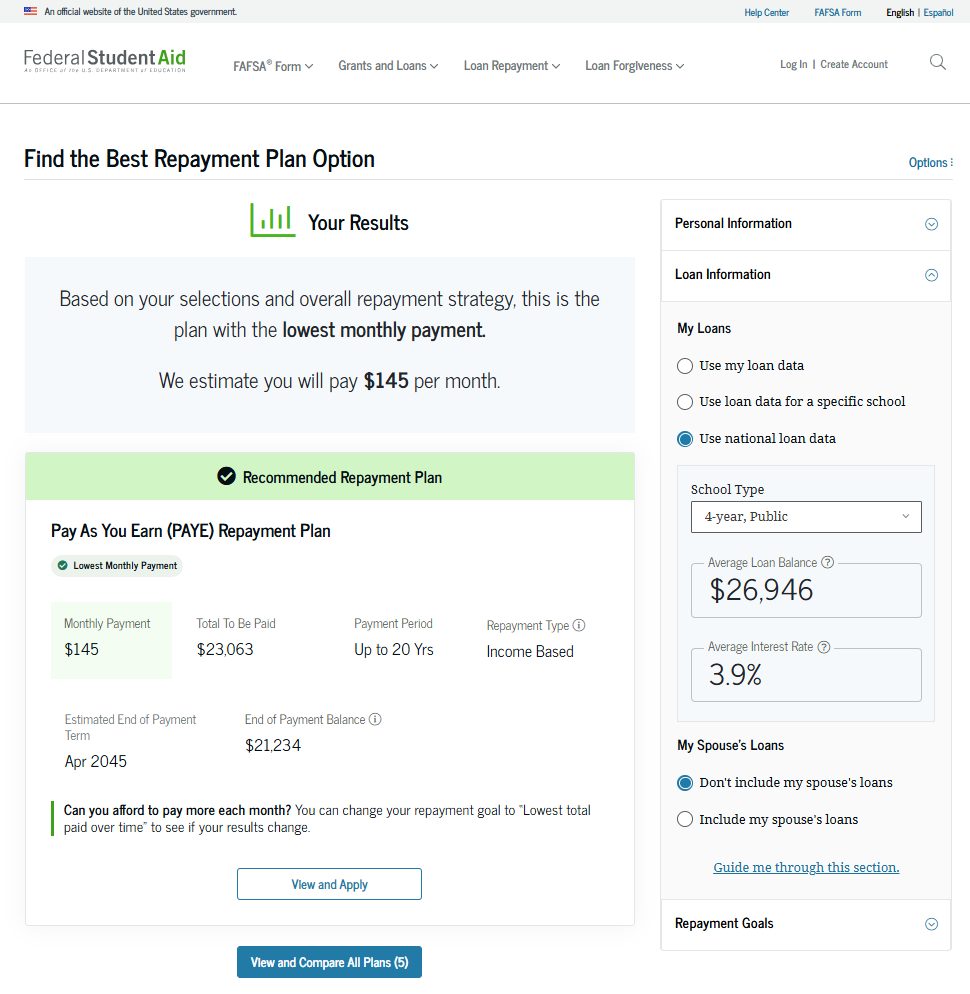

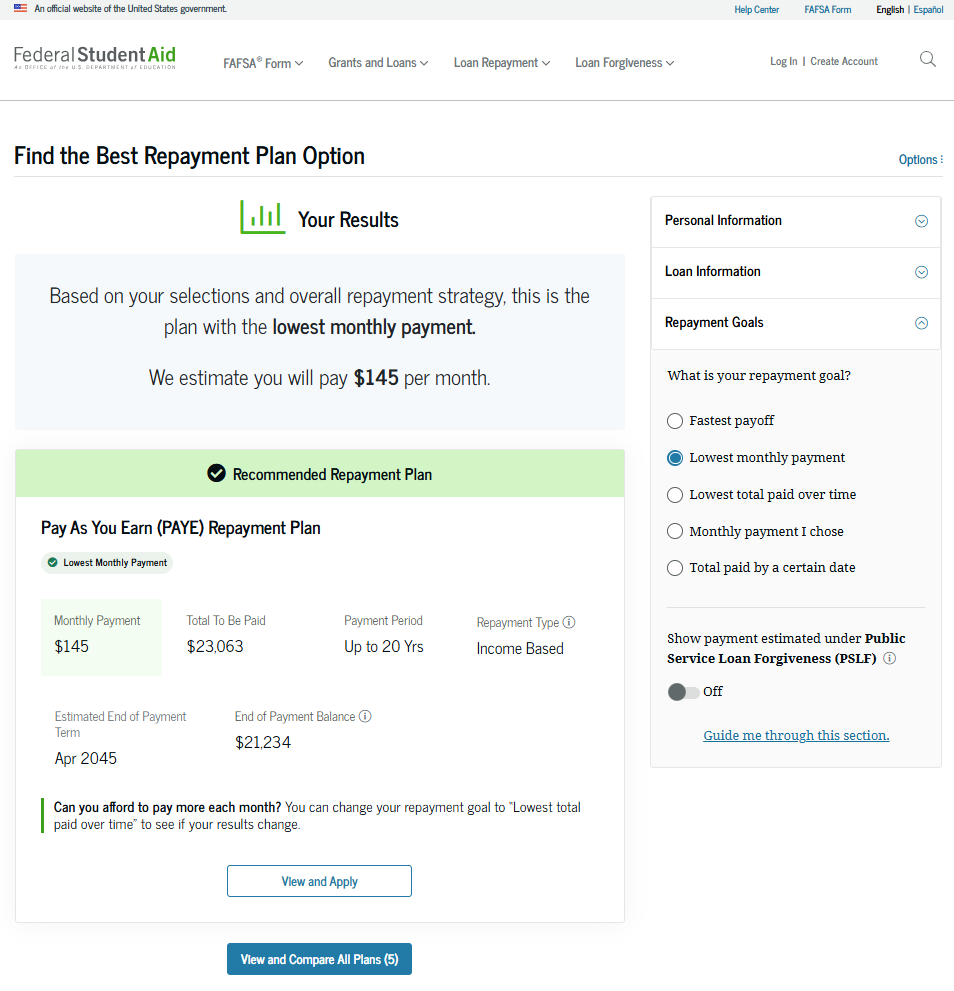

Compare Repayment Results for Different Plans

Is your goal to pay off your loans as quickly as possible or to keep your monthly payment as low as possible? Is it to lower your total amount paid over time or to pay off your loans by a certain date? Don’t have a goal yet? That’s okay! We can still recommend a plan for you.

To get loan recommendations for your situation, we’ll ask you a few questions that will help us provide you with more accurate results. After you confirm your existing loan information, we’ll show you a recommended repayment plan.

In addition to information about your loans, you must include your income for any IDR plans to appear in your Loan Simulator results.

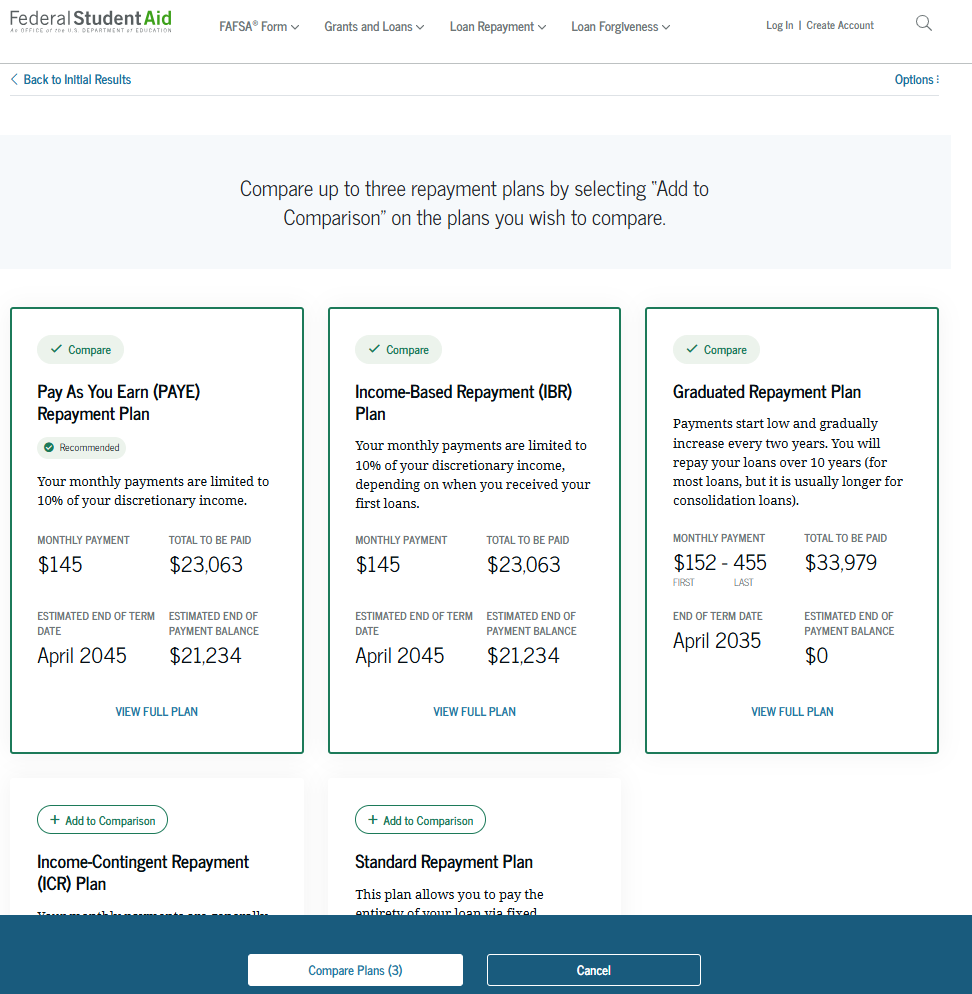

Then, you’ll get the chance to compare up to three repayment plans to view side-by-side estimates for your

- monthly payment,

- interest amount,

- total to be paid,

- payoff date, and

- forgiveness amount, if applicable.

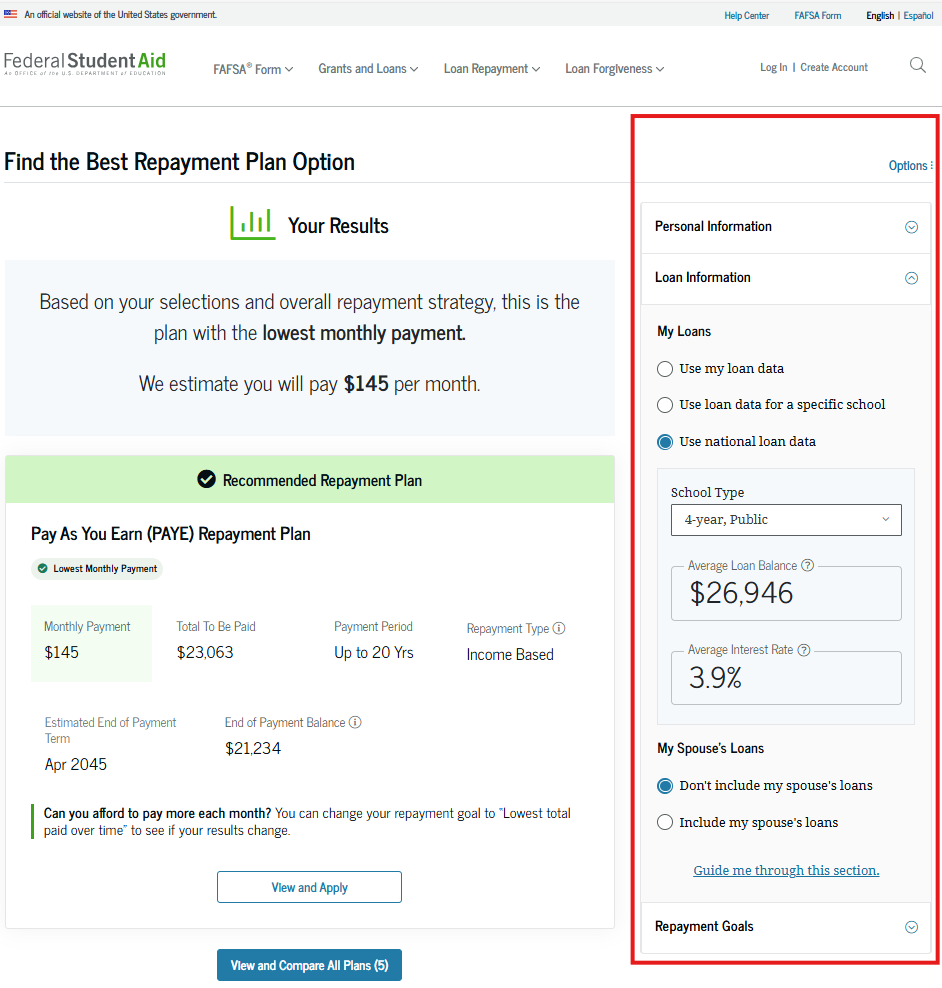

You can skip guided questions and use the sidebar to enter information quickly and to experiment with changing your repayment goals and other options.

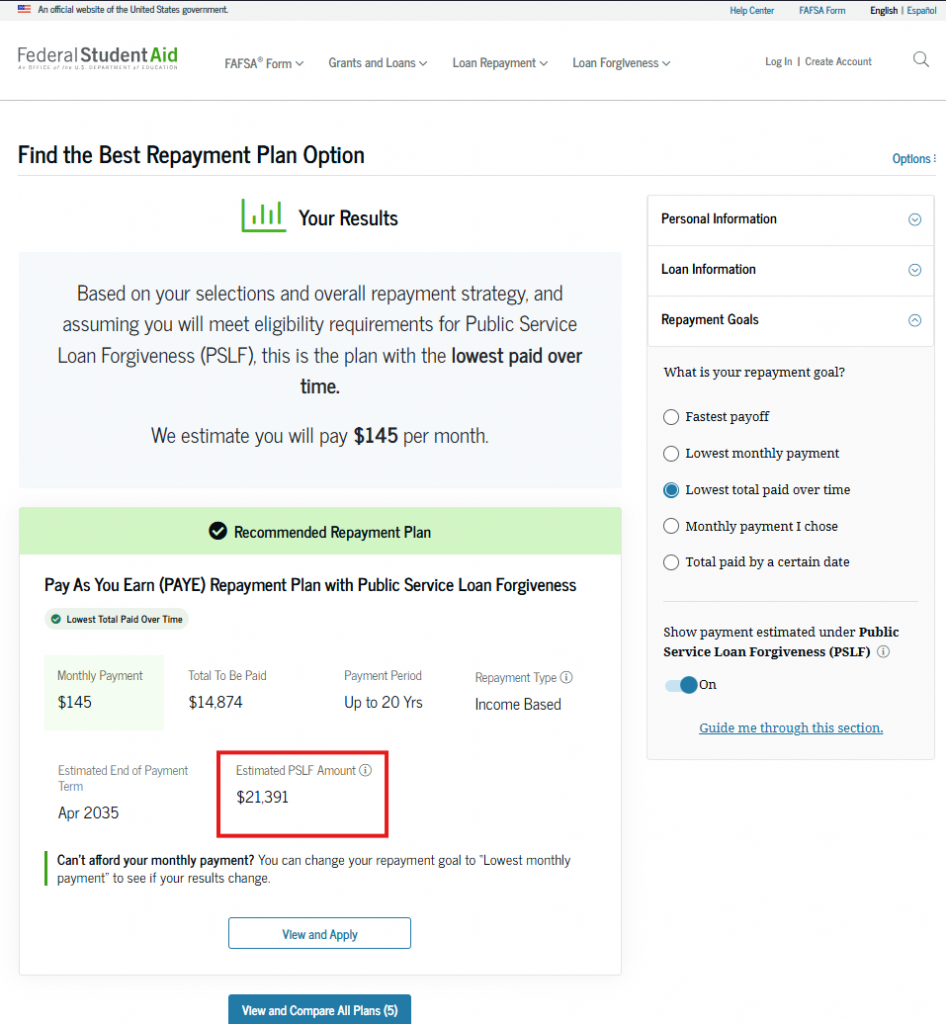

Just keep in mind that the date you’d pay off your loans and your estimated loan forgiveness amount may vary based on whether you’re enrolled in Public Service Loan Forgiveness (PSLF) or are already in repayment with other programs.

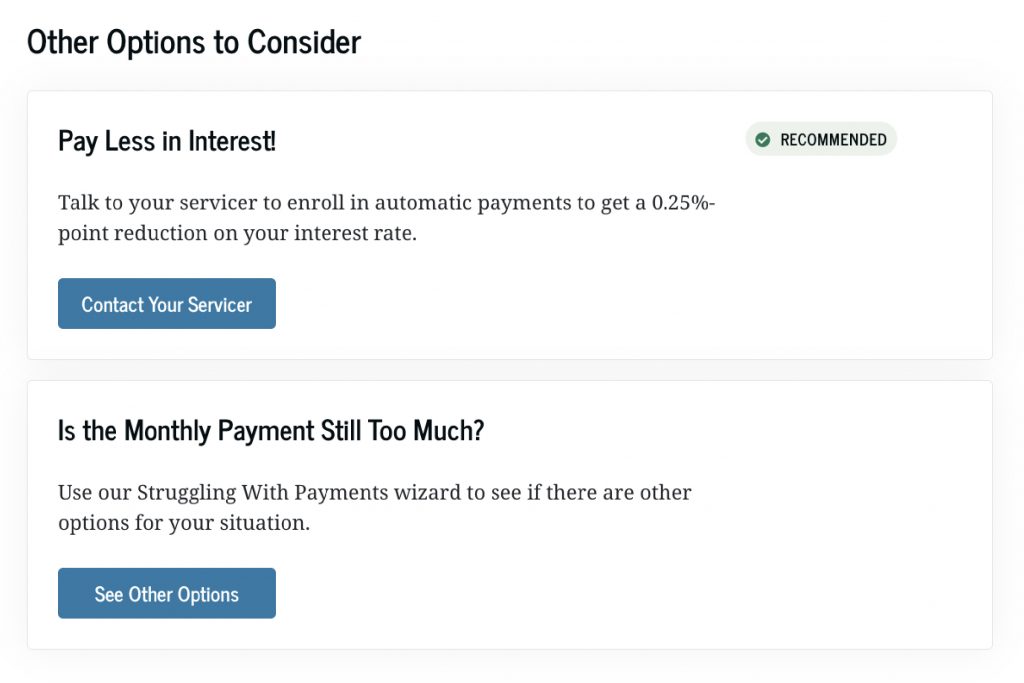

And if you aren’t enrolled in a program like PSLF already, don’t worry—we offer “Other Options to Consider” along the way so you don’t miss out on opportunities you may benefit from. This includes how you can pay less interest and what to do if your monthly payment is still unaffordable on the recommended plan.

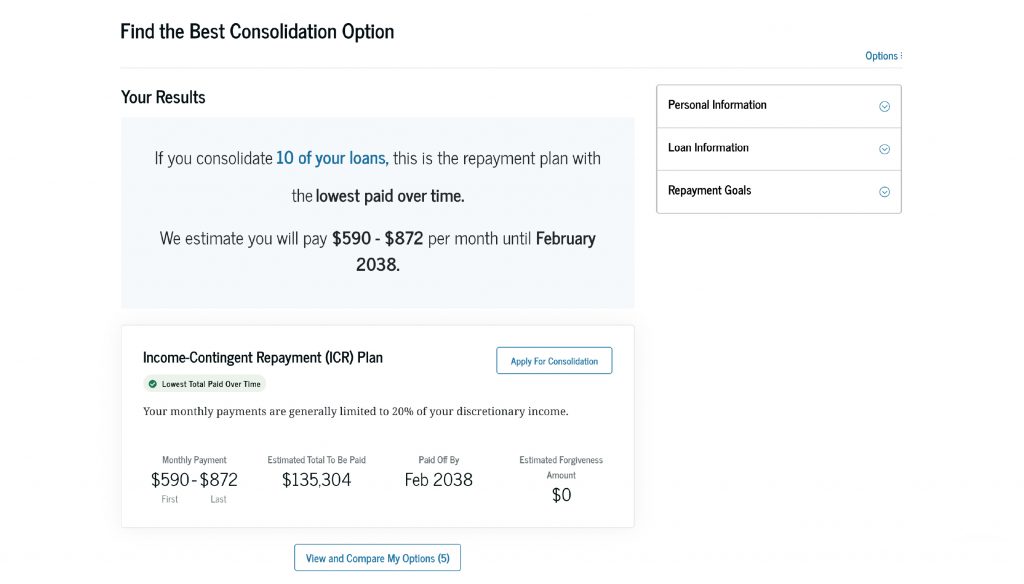

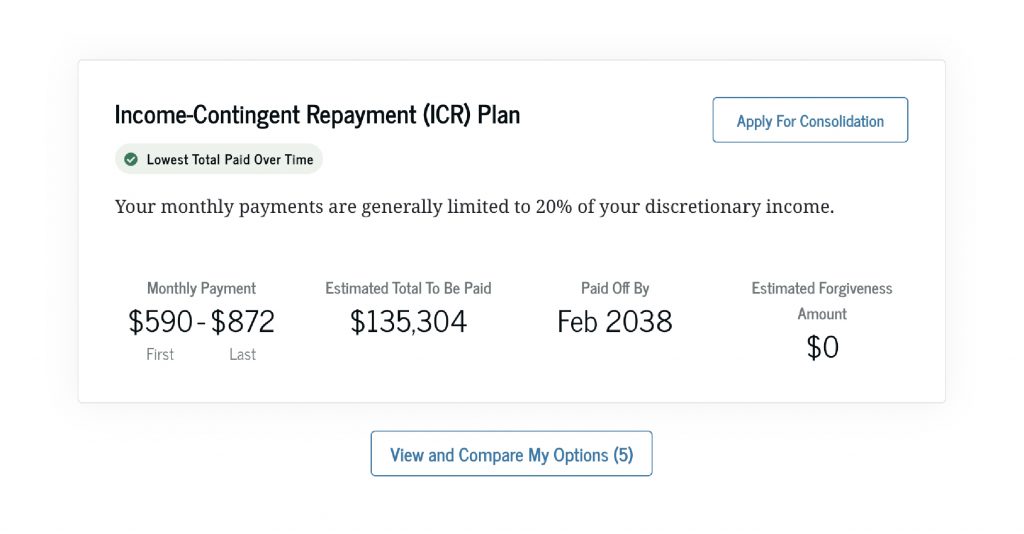

Use Your Results To Take Action

The repayment plans that meet your goals will be tagged with indicators (such as “Lowest Total Payment Over Time”). You’ll also see your total amount paid, payoff date, the first and last monthly payment (for some plans, such as an IDR plan, which will change over time), and more.

Then, you can learn how to apply for the suggested plans on the results page or, in some cases, apply right from the page.

Consider Loan Forgiveness or Loan Consolidation

Loan Simulator can not only estimate loan forgiveness amounts based on your repayment plan and personal circumstances but also let you know if loan forgiveness isn’t available under certain plans or loan types and why.

You might see discrepancies in Loan Simulator if you

- recently filled out an IDR application through your loan servicer,

- have been working toward PSLF, or

- receive the 0.25% interest rate reduction for using auto pay.

Loan Simulator does not account for your past payments, so keep that in mind when viewing estimated loan terms under repayment plans.

In order to qualify for some repayment plans and/or for PSLF, you may need to first consolidate your loans into a Direct Consolidation Loan. If that’s the case, Loan Simulator will let you know. A Direct Consolidation Loan replaces one or more existing federal student loans with a single new loan with one monthly payment.

If we recommend consolidating, you’ll get the option to go straight to the Direct Consolidation Loan Application directly from Loan Simulator.

Loan Simulator also allows you to see if consolidating your loans would be beneficial for you based on your goals. That means we may recommend that you consider not consolidating based on the information you told us, too.

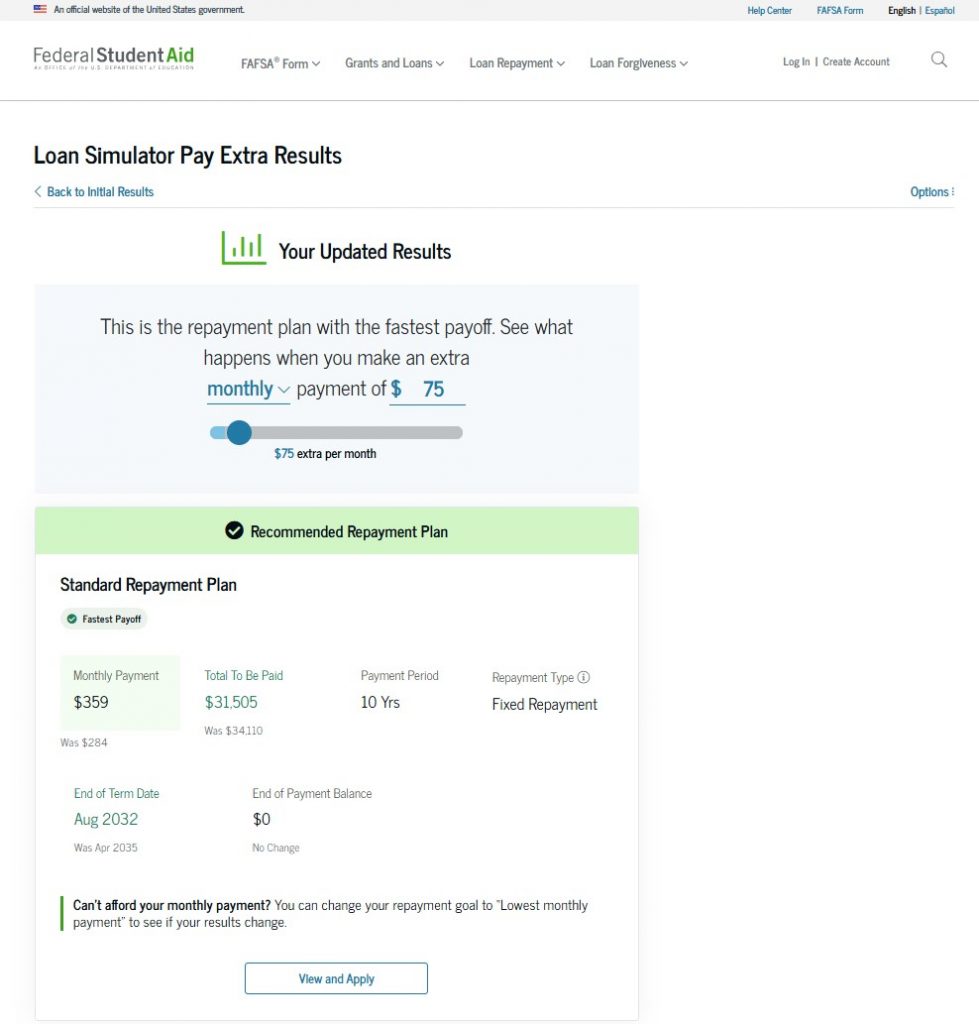

Simulate Paying More or Pausing Payments

If your circumstances change, you can see what impact making additional payments would have on your principal and interest paid over the life of your student loans.

If you ever struggle to make payments, Loan Simulator can help you estimate the impact of pausing payments under a forbearance or deferment. Choose specific periods of time and see how a payment pause could affect your principal paid, interest paid, and monthly payment.

Loan Simulator can also help you find out if you’d be eligible for $0 monthly payments on an IDR plan.

The best thing to do if you’re struggling with payments is to go back to the Loan Simulator home page and select “I’m Struggling With My Student Loan Payments.”

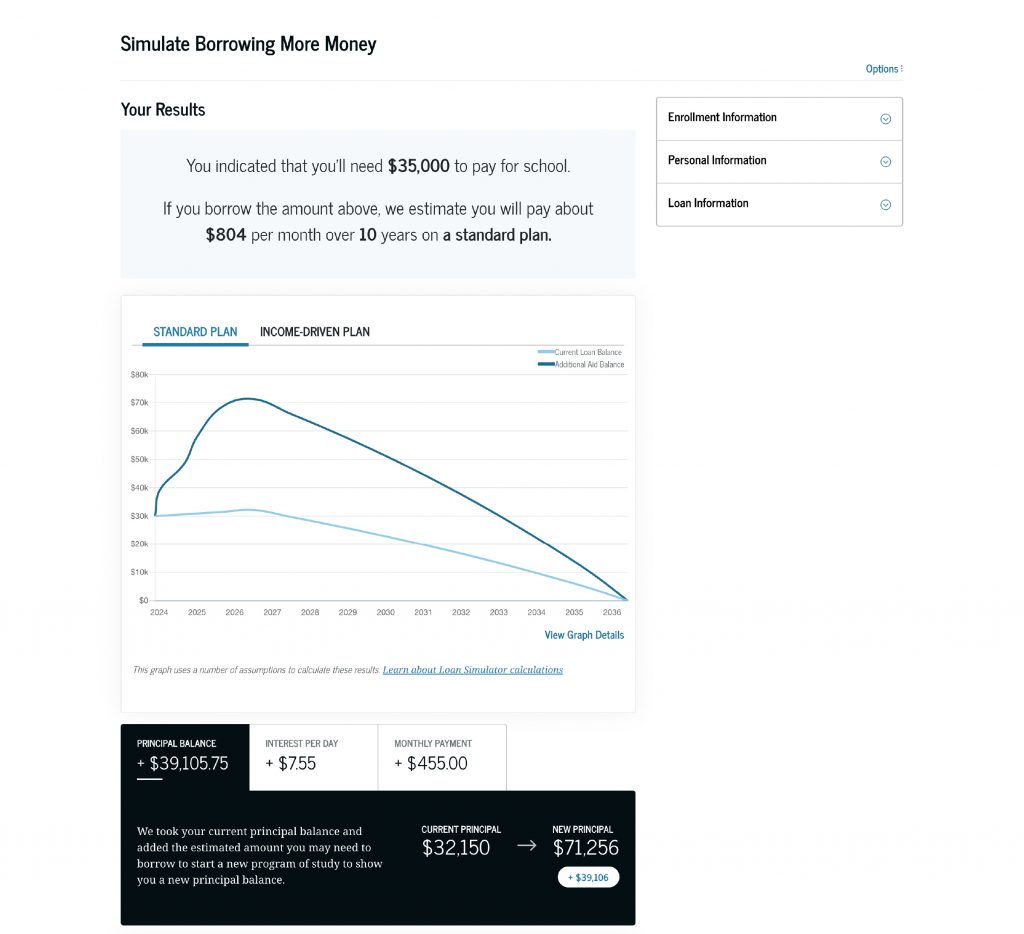

If you’re considering going back to school or are currently in school, you can use Loan Simulator to simulate borrowing more money by selecting “I Want to Simulate Borrowing More.” You’ll be able to see how much more aid you may be eligible for based on federal loan limits and how close you are to reaching that limit.

Want more information on Loan Simulator? Watch this walkthrough of Loan Simulator for a screen-by-screen play of how to get the most out of this federal student loan calculator.