How to Manage your Public Service Loan Forgiveness (PSLF) Progress on StudentAid.gov

The Public Service Loan Forgiveness (PSLF) Program is fully managed by the U.S Department of Education on StudentAid.gov. Borrowers seeking PSLF can submit PSLF forms, track the status of their forms, view correspondence, and access payment counts through their StudentAid.gov account.

As a part of our efforts to improve the Public Service Loan Forgiveness (PSLF) process, you can now manage your participation in the PSLF Program on StudentAid.gov. Instead of navigating to a servicer’s website, StudentAid.gov is now your one-stop shop for all things PSLF.

In this article, we will cover how to do the following:

- Confirm your employer’s PSLF eligibility status.

- Submit a PSLF form with the PSLF Help Tool.

- Confirm your PSLF form signatures.

- Track your PSLF form status and history.

- View your eligible and qualified payments (new feature!).

- Request forgiveness on your remaining loan balance.

1

Confirm your employer’s PSLF eligibility status

Qualifying employment for PSLF is about your employer, not your job title.

Use our PSLF Employer Search to see if your employer is eligible before starting your PSLF form. No logging in required!

Learn about PSLF requirements and other tips for PSLF success.

If you’ve already confirmed that your employer meets PSLF requirements, you can skip this step.

2

Submit your PSLF form with the PSLF Help Tool

Submitting a PSLF form every year is the best way to validate your progress and stay on track for PSLF. The PSLF form confirms your employer’s eligibility in order to update your qualifying payment count.

Using the PSLF Help Tool will auto-generate a PSLF form based on the information you provide to certify your employment. Our Become a Public Service Loan Forgiveness (PSLF) Help Tool Ninja article has detailed information about using the PSLF Help Tool and some useful tips.

The tool includes digital signature and submission functionality that lets both you and your employer(s) digitally sign your PSLF form.

You’ll need to log in with your StudentAid.gov account username and password to use this tool.

For faster processing, we highly recommend you digitally complete, sign, and submit your PSLF form.

3

Confirm your PSLF form signatures

You must make a total of 120 qualifying monthly payments to qualify for PSLF.

To process your PSLF form and get credit for qualifying payments, we’ll need to receive all required signatures from you and your employer.

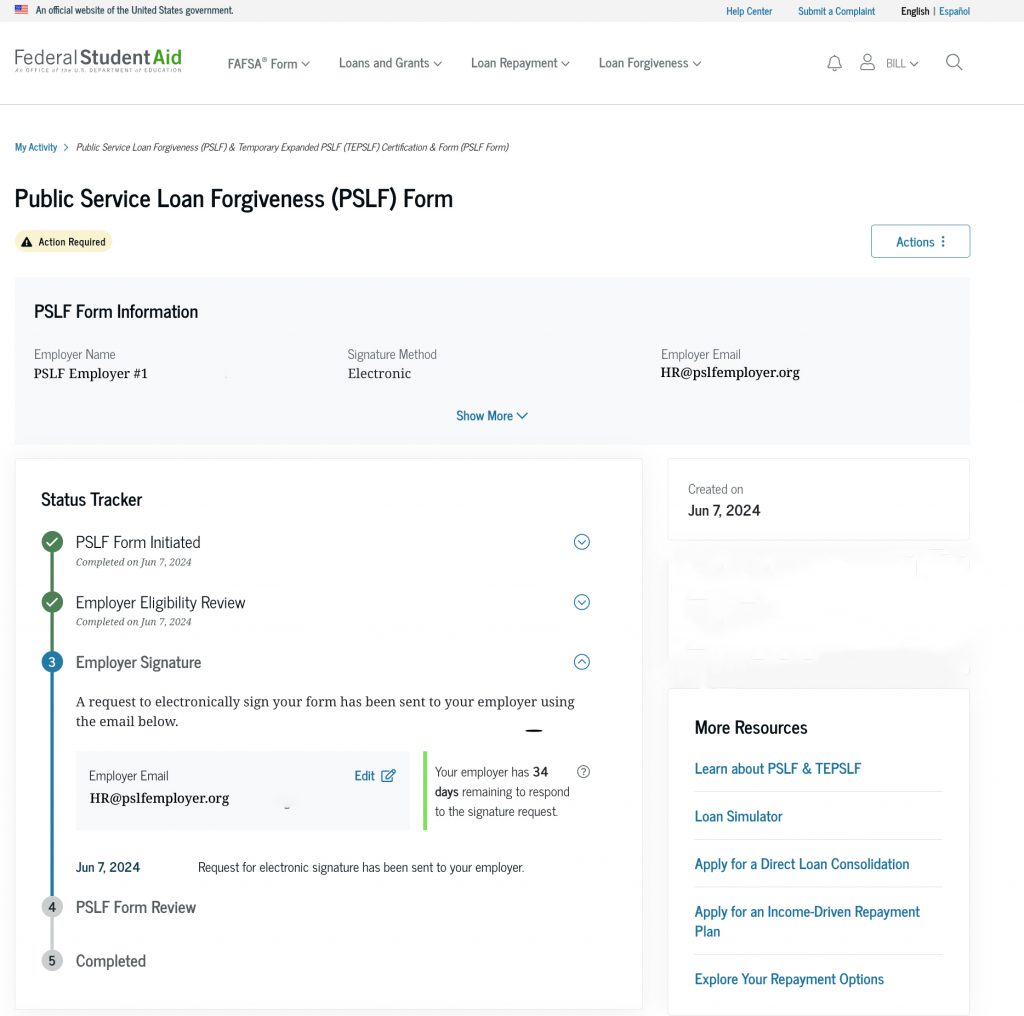

To confirm your signatures, follow the steps below:

- Log in to StudentAid.gov using your account username and password.

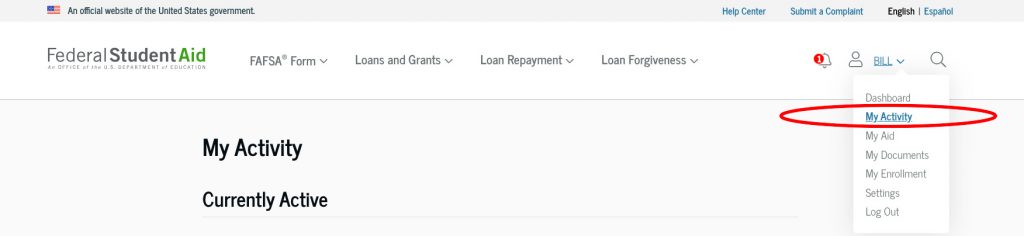

- Find “My Activity” in the dropdown menu under your name in the upper right-hand corner.

- Select the relevant PSLF form.

- Confirm that you and your employer have successfully signed your PSLF form within the Status Tracker.

In this section, you’ll be able to edit the email address associated with your employer and even send them another a reminder email to sign your form.

Once your employer signs your form, you will receive an email confirmation.

If your employer is unable to digitally sign the form, you can also manually upload a signed PDF in this section (please note this will increase your processing time).

To make sure you meet your deadline for signatures, we recommend that you reach out to your employer directly to ensure the correct person (the authorizing official) has received your form to sign. This is usually someone in your employer’s human resources department. You can tell the authorizing official to expect an email from the U.S. Department of Education’s office of Federal Student Aid via DocuSign (dse_NA4@docusign.net) on your behalf.

4

Track Your PSLF form status and history

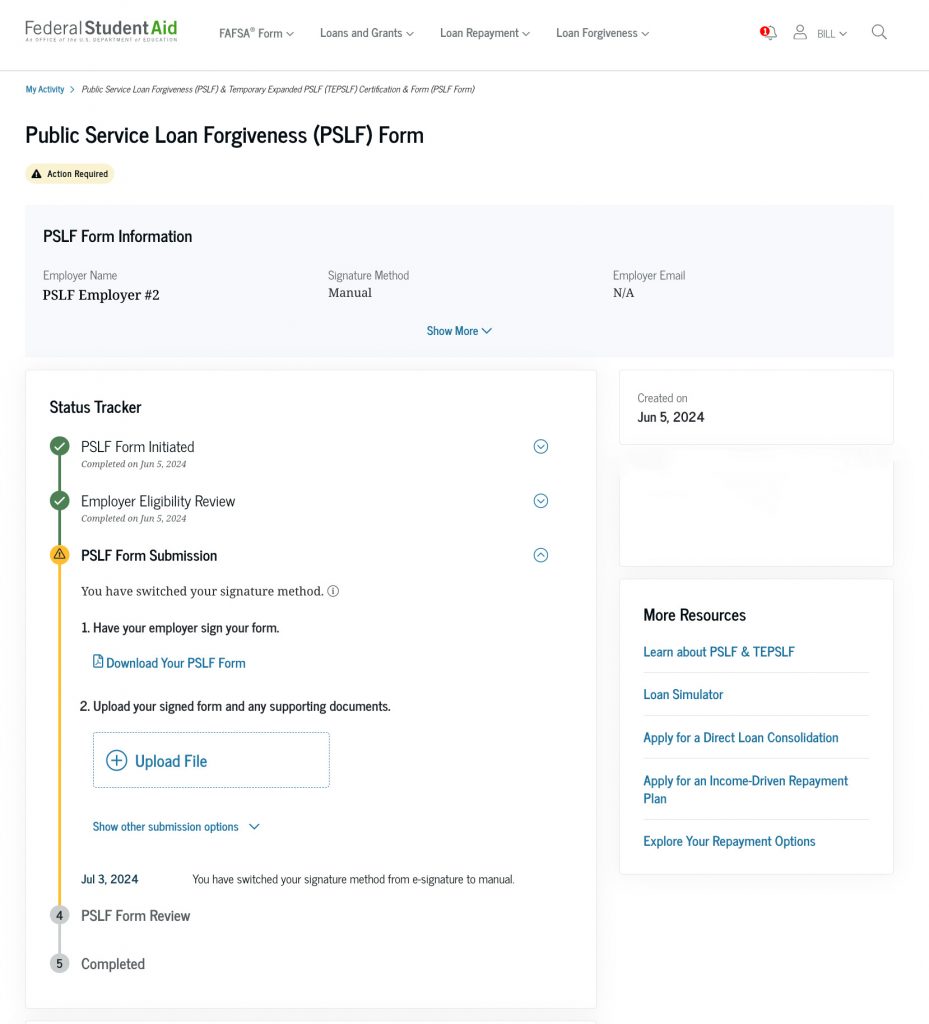

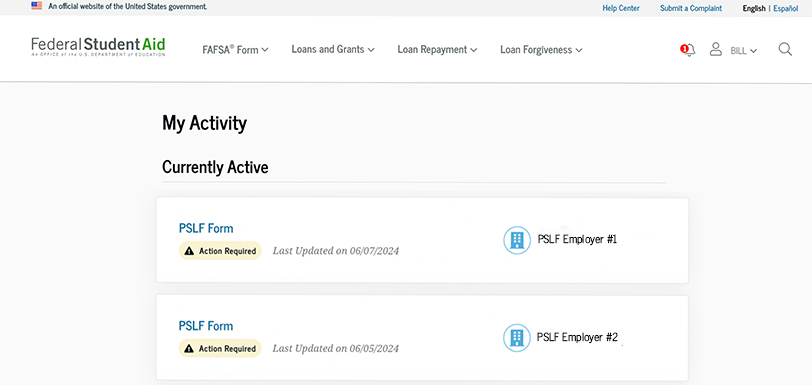

Once you’ve submitted a PSLF form, you can track its progress by logging in to StudentAid.gov using your account username and password and selecting “My Activity” in the dropdown menu under your name in the upper right-hand corner.

Once you’ve navigated to the “My Activity” section of your account, select a specific form in order to view

- the status of your PSLF form,

- the date your PSLF form was submitted,

- the status and date of your employer’s eligibility status, and

- whether your employer(s) signed your PSLF form and, if so, the date they signed it.

Under the “Currently Active” section, you might see the following notices:

“Action Required” due to one of the following:

- You need to provide an employer email address within the next 30 days to continue with the processing of your application with e-signatures.

If you don’t provide an email address within 30 days, your signature method will be switched to manual (which will slow down your processing time).

- The employer email address you provided is not a valid address. Please provide a new one in order to continue.

- Manual signatures are pending.

“In Review” may be due to one of the following:

- We are in the process of determining if your employer is eligible for PSLF.

- Your employer e-signature is pending.

Under ”Activity History,” you might see previous PSLF communications and PSLF forms with the following status.

“Cancelled”

- You’ve chosen to cancel your application. If you still wish to pursue PSLF, you’ll need to start a new application through the PSLF Help Tool.

“Closed”

Some common reasons include the following:

- Your employer made changes to your employment period. You need to use the PSLF Help Tool to adjust your employment period and resubmit your application.

- We reviewed your employer’s eligibility and have determined that they are ineligible for PSLF. Please review the qualifying employer requirements if you wish to learn more.

“Completed”

- Your application has been submitted and there are no additional actions you need to take at this time.

5

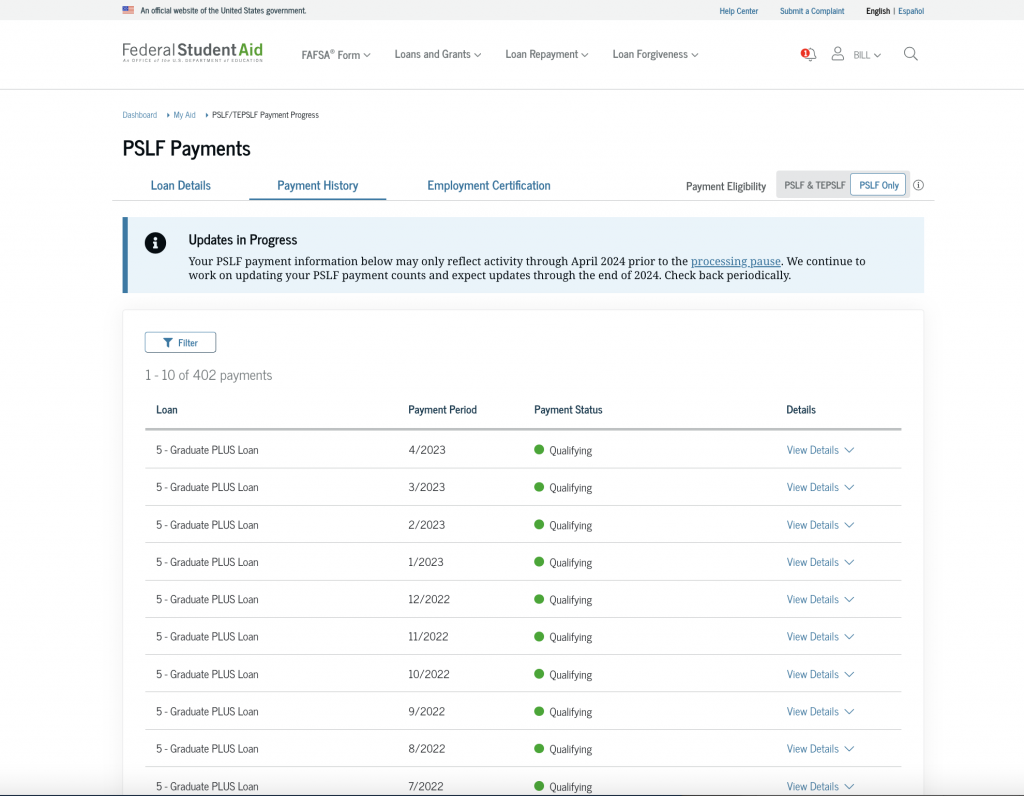

View your eligible and qualified payments

Your payment counts will be updated for the approved periods of employment after your PSLF form is processed. This update might not happen immediately, but you will receive a confirmation notification when your qualifying payments have been updated on StudentAid.gov. In the past, this information was available on a servicer’s website. These improvements now let you view all relevant PSLF information in one centralized location and also allow for faster processing times for PSLF forms.

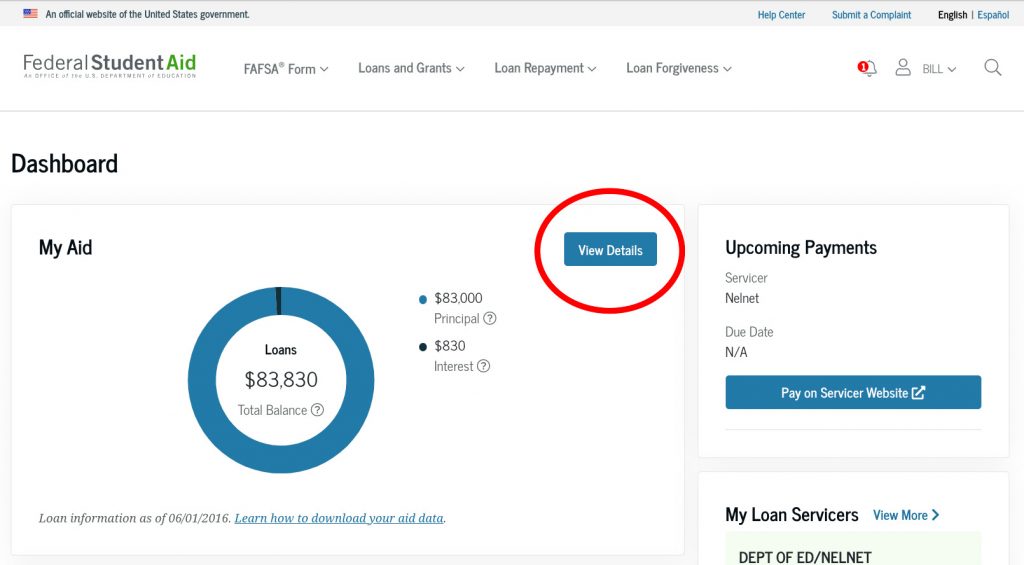

If you’re already logged in to StudentAid.gov, view your payment counts in the My Aid section of your account.

If you aren’t logged in, you can access the My Aid section of your StudentAid.gov Dashboard by following these steps:

- Log in with your account username and password.

- From your Dashboard, select the “View Details” button in the My Aid card.

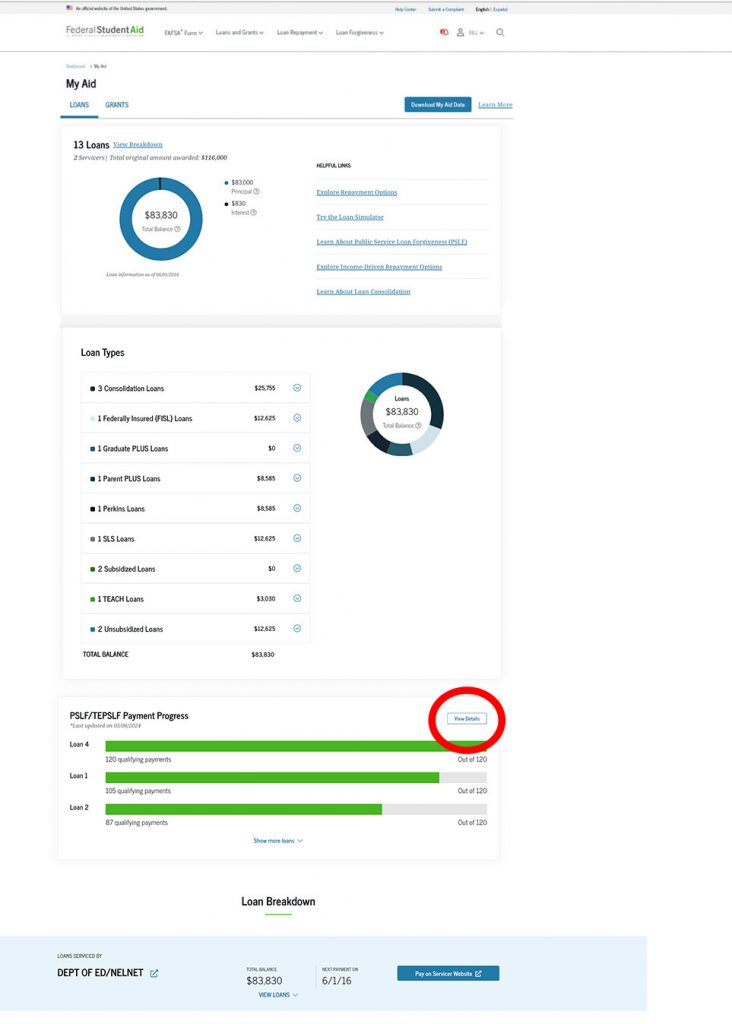

- Scroll down to the PSLF/TEPSLF Payment Progress section and select “View Details.”

- Select “Show Payment Summary” to see the payment counts for a specific loan.

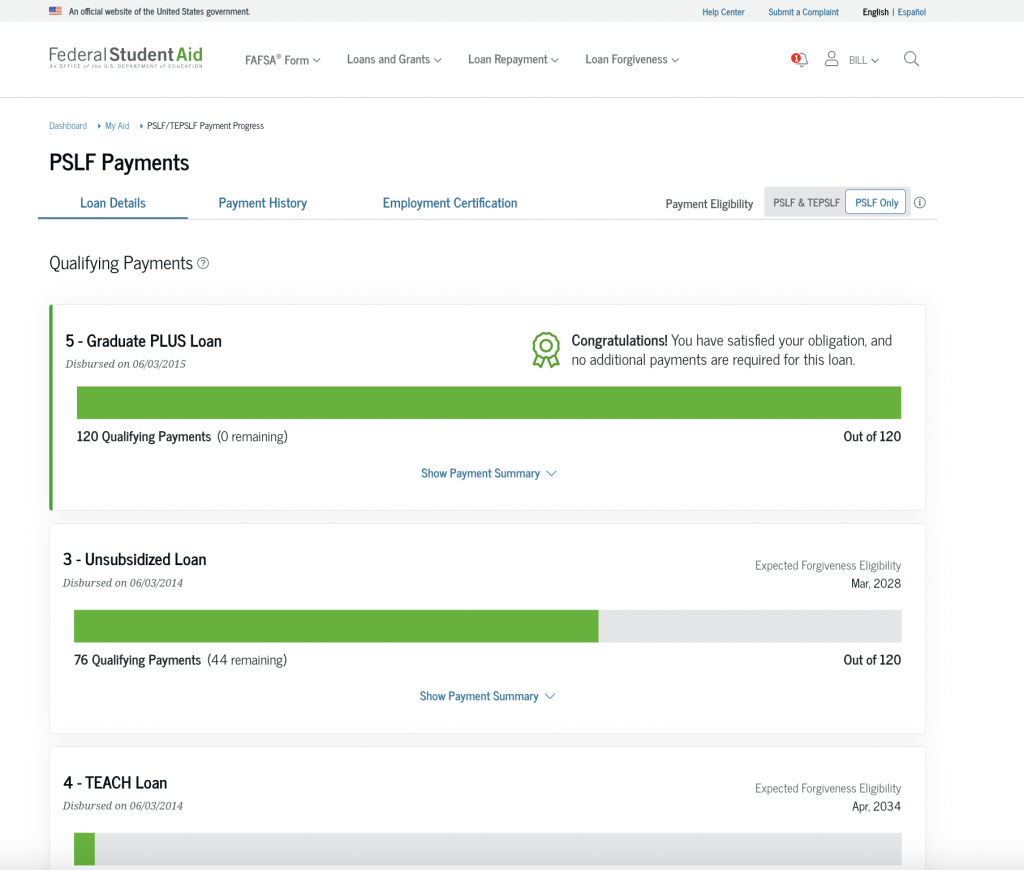

- Under the “Loan Details” tab, you’ll see a qualifying payment bar for each loan.

This includes the expected forgiveness date and various repayment details.

Under the “Payment History” tab, you can learn more about previous payments.

You can filter these payments by a specific loan, time period, and qualifying status.

Learn more about qualifying payments for consolidated loans.

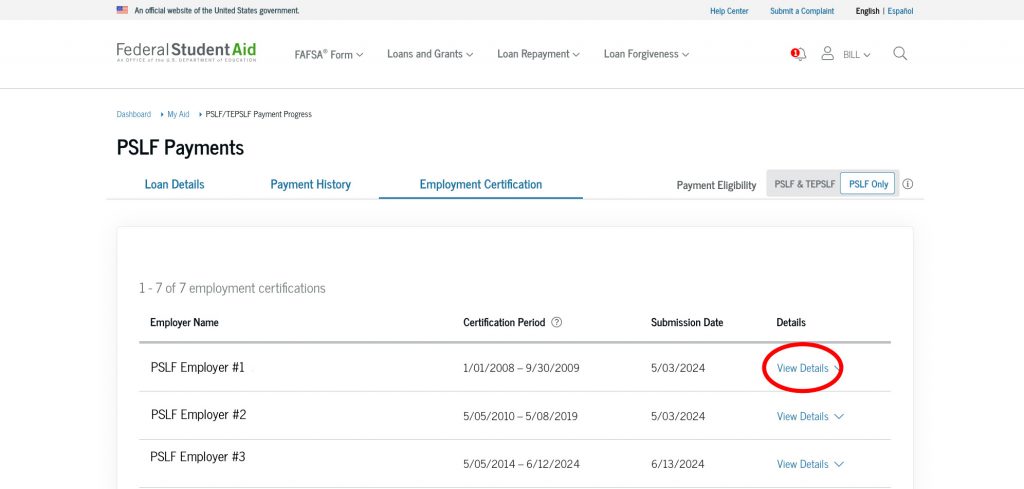

Under the “Employment Certification” tab, you can see details such as employer EIN, hours worked per week, and more.

While the processing of PSLF forms has resumed after the processing pause, it may take some additional time for all of your eligible and qualified payments to show up on StudentAid.gov. When accessing your account, you might see a message informing you that updates are in progress as we continue to update PSLF payment history.

By fall 2024, you’ll see updated PSLF credit for months of eligible deferment or forbearance. We strongly encourage you to wait until accounts are updated through the payment count adjustment before taking additional PSLF actions.

6

Request forgiveness on your remaining loan balance.

After you’ve reached 120 payments and all other PSLF requirements are met, you must request forgiveness of your remaining loan balance using the PSLF form.

After this request is made, a final review of your account will be performed to process forgiveness, which will take about 60 business days.

If you meet the requirements for forgiveness, you’ll first receive a notification from the U.S. Department of Education indicating you have been approved for PSLF. If you’ve opted in for email communication, this notification will come from noreply@studentaid.gov.

Then, you’ll receive a notification from your federal student loan servicer when your loan has been discharged. Once this is complete, your account on StudentAid.gov will be updated to reflect the discharge.

You’re required to continue making payments while your form is being processed unless your account is in a forbearance status. You can contact your servicer to request a PSLF-related forbearance.

If you’ve reached 120 payments before the end of 2024, it might take some time for us to process forgiveness.

If you’ve reached forgiveness and you make an additional payment after the effective date of this forgiveness, overpayments will be first applied to any other outstanding federal student loans you have or be refunded to you. If you don’t have any remaining loans, you will be sent a refund for these payments.