Top 4 Questions: Direct Subsidized Loans vs. Direct Unsubsidized Loans

Both Direct Subsidized Loans and Direct Unsubsidized Loans are low-interest federal student loans that can help you pay for the costs of college or career school. But before you accept either one, it’s important that you understand how they’re different so you can make the best choices for your situation.

We’ll dive into the ins and outs of subsidized vs. unsubsidized student loans, but remember that loans are just one type of financial aid that you may be offered.

After you submit the Free Application for Federal Student Aid (FAFSA®) form, you’ll receive a financial aid offer from the colleges or career schools that you listed on your form and were accepted to. Your aid offer will show all the different types and amounts of federal student aid available to you, including grants, scholarships, work-study funds, or student loans.

If you think that you may need to borrow money, then consider these four questions about Direct Subsidized Loans and Direct Unsubsidized Loans.

1

How are they similar?

Both Direct Subsidized Loans and Direct Unsubsidized Loans

- are federal student loans offered by the U.S. Department of Education (ED),

- require you to be enrolled in school at least half-time to be eligible, and

- offer a six-month grace period before you’re required to start repayment.

Your school will determine which loan types you qualify for and the amount you can borrow based on your financial need, your cost of attendance, and any other financial aid you may have received.

2

How are they different?

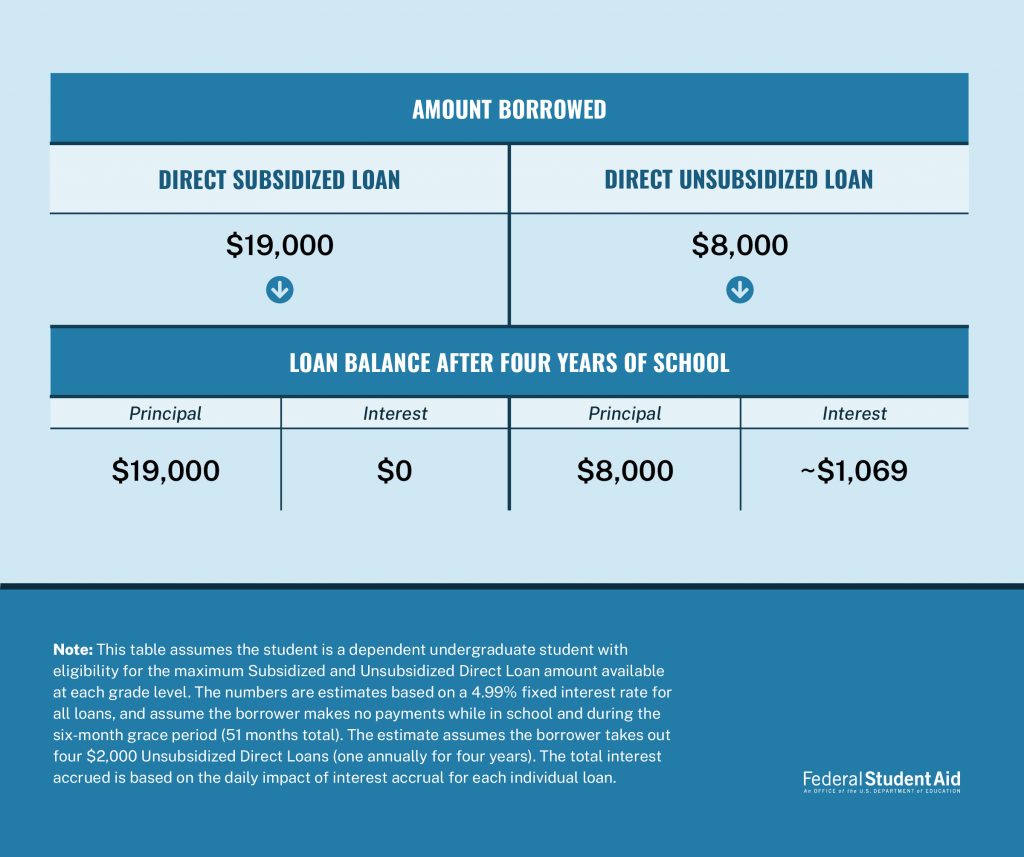

The major difference between subsidized and unsubsidized student loans has to do with interest.

- Direct Subsidized Loans: You won’t be charged interest while you’re enrolled in school or during your six-month grace period.

- Direct Unsubsidized Loans: Interest starts accumulating from the date of your first loan disbursement (when you receive the funds from your school).

Here’s a quick way to remember the difference: “Unsubsidized” starts with a “U” because “you” start accruing interest right away on an unsubsidized loan.

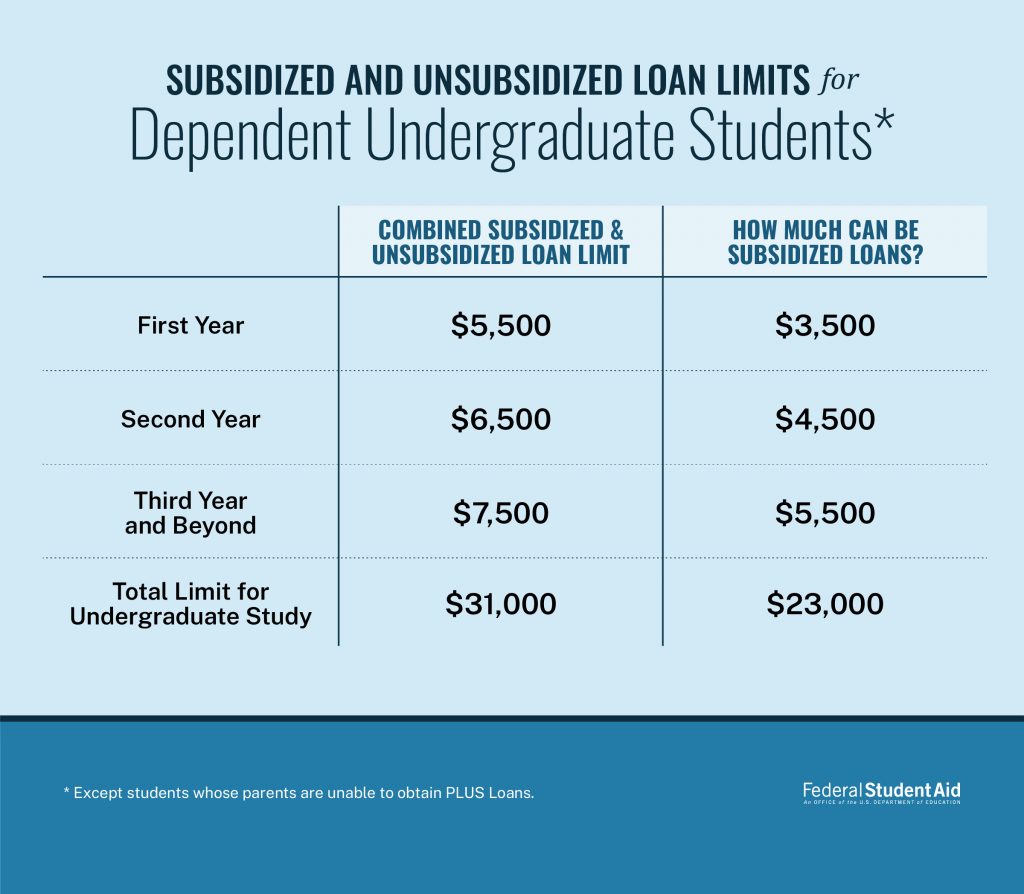

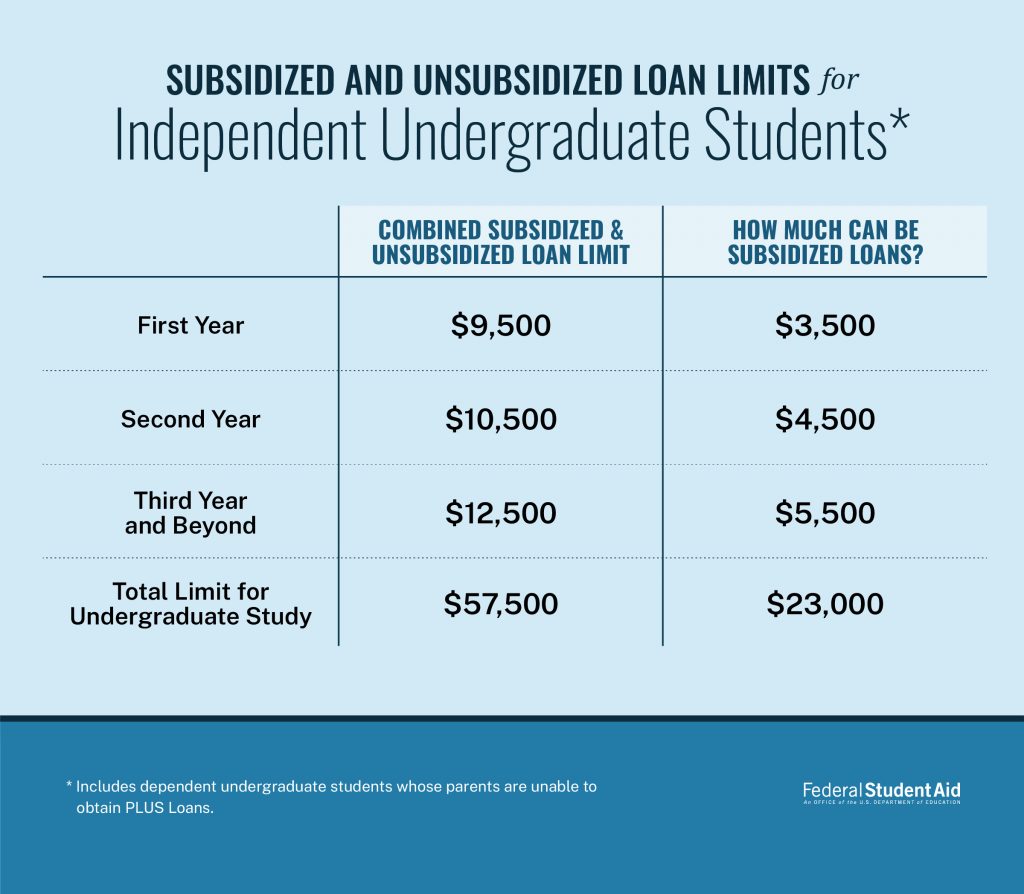

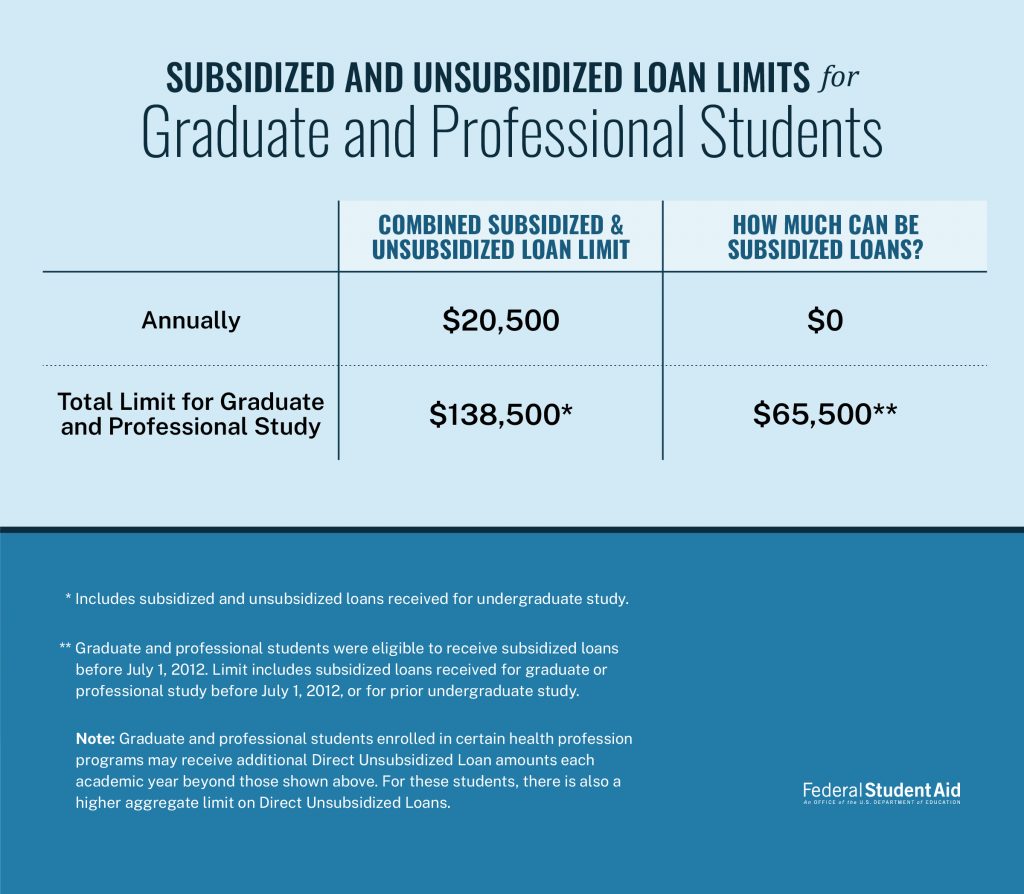

Although the way interest accumulates is the biggest difference between these two types of loans, it’s not the only one. The other difference between these two loan types is the amount of total money you’re allowed to borrow. The limit on how much you can borrow for each loan type depends on what year you are in school and whether you’re a dependent or independent student. Learn more about how much you can borrow.

Take a closer look at how much you can borrow for each loan type in the tables below.

3

What do I need to know about interest?

With all this talk about interest, it’s clear that interest matters a lot—here’s why.

Interest is additional money that you’ll have to pay on top of your principal balance (the amount of your original loan). Direct Loans are “daily interest” loans, which means a daily interest formula determines how much interest adds up every day.

The daily interest formula looks like this:

Interest Amount = (Outstanding Principal Balance × Interest Rate Factor) × Number of Days Since Last Payment

You can find your interest rate factor by dividing your loan’s interest rate by the number of days in the year.

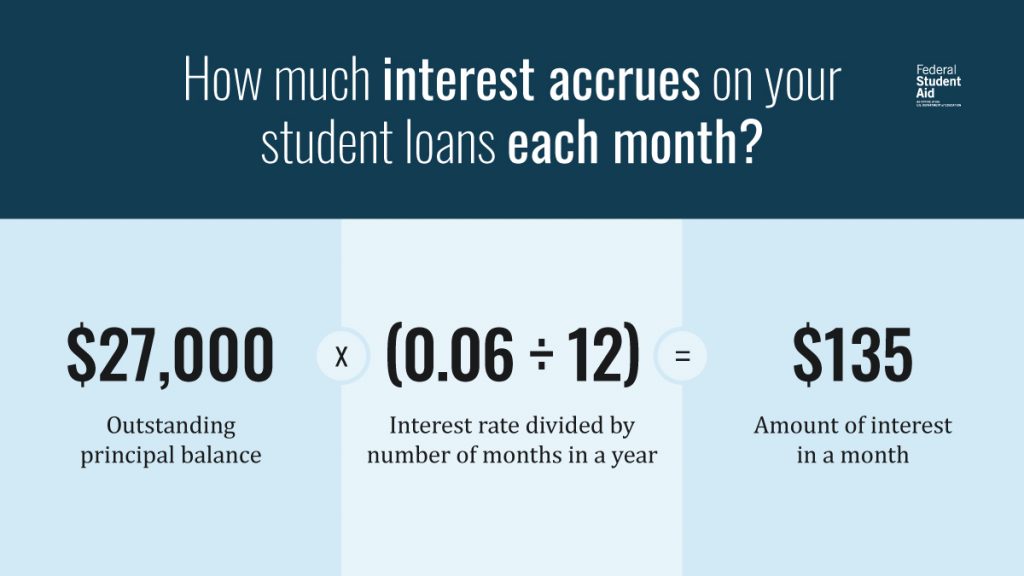

Want to figure out how much interest you’d accrue each month? Since each month has a different number of days, your loan(s) will accrue a different amount each month. But you can get a close estimate using this version of the formula:

(Outstanding Principal Balance × Interest Rate) ÷ Number of Months in a Year = Amount of Monthly Interest

Check out this example of a $27,000 student loan, borrowed with a 6% interest rate.

Learn more about student loan interest and how it would affect any loans you may choose to accept. You can also view the current interest rates for Direct Subsidized Loans and Direct Unsubsidized Loans, which are fixed rates for the life of the loan.

4

Which loan should I accept?

Given the option, you should accept a Direct Subsidized Loan first. Then, if you still need additional financial aid to pay for college or career school, accept the Direct Unsubsidized Loan. You’re responsible for paying all the interest that accumulates on an unsubsidized loan during all periods, so it’s important to borrow only what you need.

You don’t need to accept all the student loans that are offered to you, and you can request a lower loan amount than what you are eligible for. If you end up needing more funds in the future, you can talk to your school’s financial aid office.