Student Loan Default and Collections: FAQs

Defaulting on a federal student loan can lead to serious legal and financial consequences. Make sure you understand how default works and what your options are if you default on your student loan(s).

In this article, we cover the following common questions about default and collections:

- What’s the difference between having loans in default vs. in collections?

- How do I know if my loans are in default?

- How do I get out of default and stop involuntary collections?

- What is loan rehabilitation?

- What is MyEdDebt.ed.gov?

- How is my credit score impacted by defaulted loans?

- What official communications can I expect if my loans are in default?

- What happens if I ignore my defaulted loans?

- What are my rights as a borrower in default?

- Where can I find more resources about default and collections?

1

What’s the difference between having loans in default vs. in collections?

If you don’t make your scheduled loan payments for at least 270 days, your federal student loan goes into default. If you’re not in default but can’t afford your monthly payments, reach out to your loan servicer ASAP to discuss your options (e.g., lowering your monthly payment amount or requesting temporary relief).

After your loan goes into default, it will be transferred to the U.S. Department of Education’s (ED’s) Default Resolution Group (DRG), and you’ll receive a letter outlining steps to help you get back on track. If you’re a borrower with a defaulted Federal Family Education Loan (FFEL) Program loan, your loan will be transferred to a guaranty agency (not DRG).

If you haven’t made a payment on your loan for more than 360 days and don’t take action to resolve the default status, the government can withhold money to collect on the debt you owe. Involuntary collections methods, such as wage garnishment (where the government automatically collects up to 15% of your paycheck to repay your loans) and Treasury offset (through which the government can withhold your tax refund or other federal benefits), may begin.

Note: Before Treasury offset begins, you’ll receive a written notice. For details about what communications you can expect, check out number 7 below.

2

How do I know if my loans are in default?

If you haven’t made a full payment in at least a year (and you aren’t in a forbearance or deferment), your loans are likely in default.

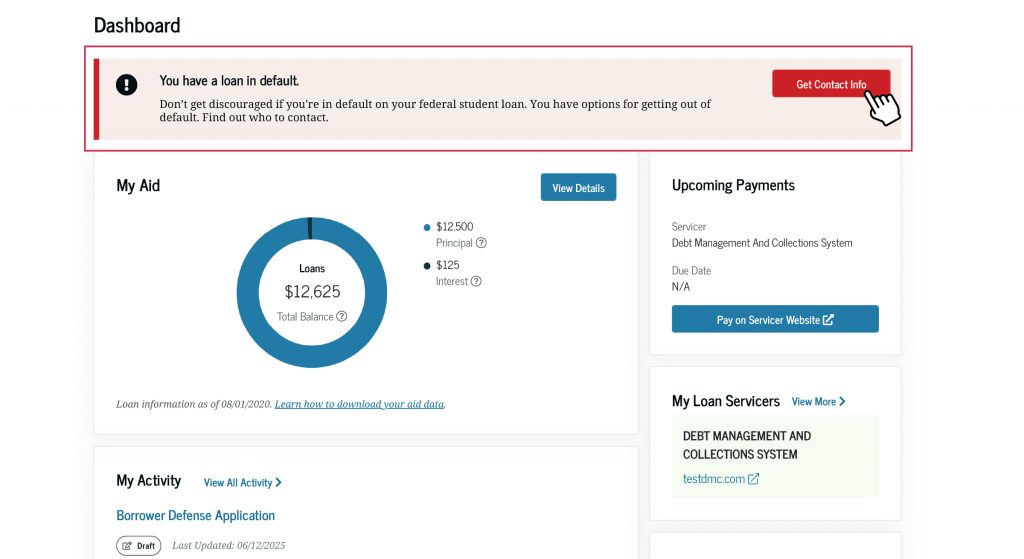

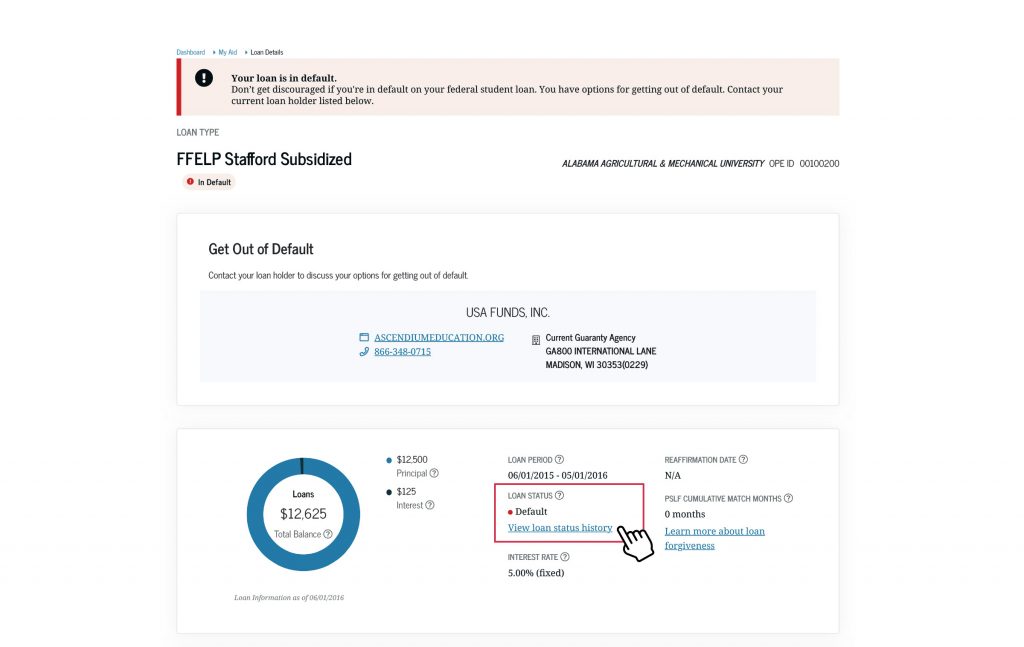

If you are in default, a warning message will appear in a red box when you log in to your StudentAid.gov account Dashboard.

Under the “My Aid” section, you can view your loan details to confirm your loan status.

Another way to confirm your default status is checking to see if you received a letter in the mail from DRG.

Note: It’s possible that your mailing address on file isn’t current, so we highly recommend that you log in to StudentAid.gov to confirm your information. To make changes, you’ll need to update your account information.

For information about official communications related to your defaulted loan, check out number 7 below.

3

How do I get out of default and stop involuntary collections?

Review the table below to evaluate which action is best for your situation.

| Borrower Action | Eligibility Timeline | Pros | Cons | Who Should I Contact? |

|---|---|---|---|---|

| Take action before your loan goes to collections | Less than 271 days past due (not in default) | ✅ Avoids transfer to the U.S. Department of Education’s Default Resolution Group (DRG) or guaranty agency ✅Avoids a record of default being added to your credit report |

None | Your loan servicer Find your loan servicer by logging in to StudentAid.gov and reviewing your “My Aid” page Talk to your servicer to request a forbearance or deferment, make payments, and more |

| Consolidate your defaulted loan | More than 270 days past due | ✅Completing the online application is a faster option compared to loan rehabilitation | ❌ Interest capitalization and expensive collection costs are added to overall debt ❌ Record of the defaulted loan remains on your credit history |

Federal Student Aid Apply for a Direct Consolidation Loan |

| Complete a nine-payment rehabilitation agreement | More than 360 days past due | ✅ Removes the record of the defaulted loan from your credit history ✅ Avoids collection fees |

❌ Takes several months to complete ❌Must fax or mail in application ❌ May require access to a printer |

Contact DRG If you have Federal Family Education Loan (FFEL) Program loans, contact the guaranty agency you were assigned |

| Complete a repayment agreement | More than 360 days past due | ✅ Avoids Treasury offset if first payment is made within 65 days (from the date the notice was sent) ✅ Avoids wage garnishment if first payment is made within 30 days (from the date the notice was sent) ✅ Avoids collection fees |

❌ Takes several months to complete ❌ May require access to a printer ❌May need to fax or mail in application ❌ Record of default remains on your credit history |

|

| Pay in full | Over 270 days past due | ✅ Instant resolution | ❌Often an unrealistic option | DRG or guaranty agency |

Most options above will

- ✓ prevent 15% of your earned wages from being garnished (withheld);

- ✓ prevent Treasury offset of your federal tax refund;

- ✓ allow you to regain the ability to enroll in income-driven repayment plans; and

- ✓ allow you to regain federal student loan benefits, such as requesting a deferment or forbearance.

4

What is loan rehabilitation?

Loan rehabilitation is a method of getting your federal student loan(s) out of default. You make a certain number of consecutive, on-time payments to ED or the guaranty agency (FFEL borrowers only) under a rehabilitation agreement. You must also sign a Rehabilitation Agreement Letter.

To learn more about completing loan rehabilitation, check out our article, “Student Loan Rehabilitation for Borrowers in Default: FAQs.”

5

What is MyEdDebt.ed.gov?

MyEdDebt.ed.gov is the official ED website for borrowers who have defaulted federal student loans. You can visit this website to view your loan status, make payments, and view your voluntary or involuntary payment history.

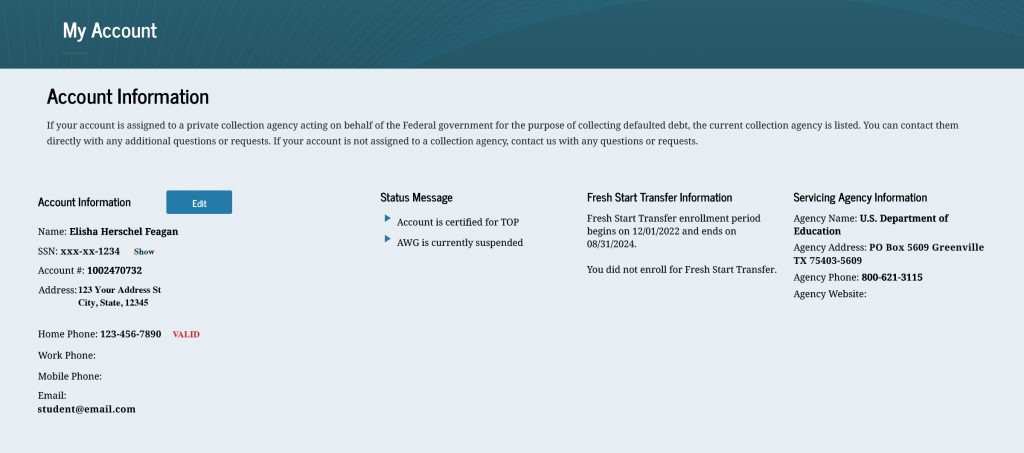

If your loan has been transferred to the U.S. Department of Education’s (ED’s) Default Resolution Group (DRG), you’ll need to create a MyEdDebt.ed.gov account using your Social Security number. Your existing StudentAid.gov account username and password will not work on MyEdDebt.ed.gov. If you have issues creating your MyEdDebt.ed.gov account, read these FAQs or send an email to DRG.

Once you log in to MyEdDebt.ed.gov, the “My Account” page will display your contact information and if you enrolled in the Fresh Start program (which ended on Oct. 2, 2024).

Under “Status Message,” you may see the following statuses:

- “Certified for TOP” – The Treasury Offset Program (TOP) is a debt collection tool that allows the federal government to collect income tax refunds and certain government benefits (for example, Social Security benefits) from individuals who owe debts to the federal government.

- “Account is in AWG” – Administrative Wage Garnishment (AWG) is a process through which ED can order your employer to withhold up to 15% of your disposable pay to collect your defaulted debt without taking you to court.

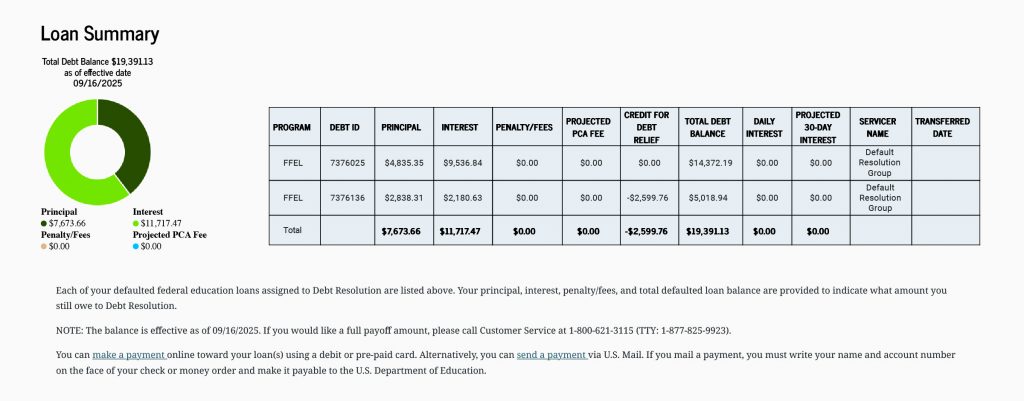

Here’s what might appear under the “Loan Summary” section:

- “Debt ID” – This is a unique identifier that ED creates for your loan. Your Debt ID is what’s used to report the loan to credit reporting agencies.

- “Servicer Name” – Most borrowers will see “Default Resolution Group” listed as their servicer, which also confirms the loan is in default status. If your loan was transferred because you successfully completed rehabilitation, your new servicer info will appear here.

- “Transferred Date” – This refers to the date your loan was removed from default status and transferred to the new servicer.

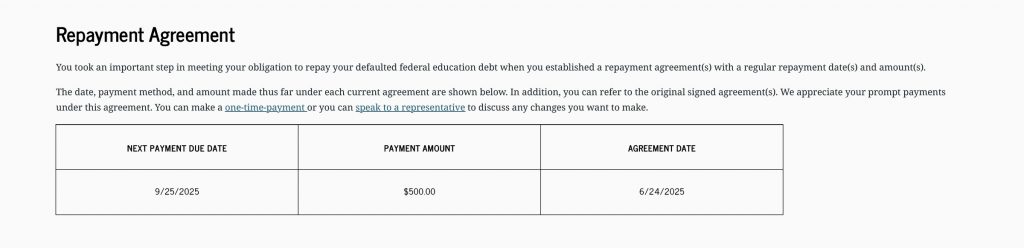

If you enter into a rehabilitation agreement or a repayment agreement, the “Repayment Agreement” section will list the start date, your next payment due date, and the amount due. You won’t be able to view the full agreement on the website. Instead, refer to the documentation you received by postal mail.

6

How is my credit score impacted by defaulted loans?

If action isn’t taken within 65 days of your loan(s) being placed in default, DRG (on behalf of ED) will report your loan(s) as in default to the four major credit reporting agencies: Equifax, Experian, Innovis, and TransUnion. Accounts reported by DRG are in addition to any reporting that was made by your previous loan servicer. That means your loan(s) may appear on your credit report more than once.

If you consolidate a defaulted loan, the record of the default (as well as late payments reported before the loan went into default) may remain on your credit history for up to 10 years.

If you enter into a rehabilitation agreement, ED will send a request to credit reporting agencies to remove the record of default from your account after your ninth rehabilitation payment. This may increase your credit score. However, your credit history will continue to show late payments that were reported by your previous loan servicer after your payment was more than 90 days past due and before the loan went into default.

7

What official communications can I expect if my loans are in default?

The Default Resolution Group (DRG) is the official loan servicer for borrowers in default (for loans held by the U.S. Department of Education). DRG doesn’t charge for its services—the only payments that DRG will ask you to make will be related to your repayment agreement or rehabilitation agreement. These are voluntary payments that you elect to make.

If you’re contacted by a company asking you to pay “enrollment,” “subscription,” or “maintenance” fees to help you get out of default, you should be wary of a potential scam. You can tell a letter is legitimate by confirming it has the official U.S. Department of Education logo. Read our article about common student loan scams and how you can avoid them.

In some cases, if your loans haven’t been transferred to DRG, your loan servicer may contact you by phone or email to help you get your account back on track. View official loan servicer phone numbers and websites.

If you have a commercially held FFEL Program loan, you will be assigned to a guaranty agency. Note: This applies to only a small population of borrowers in default.

If the government withholds your refunds and federal benefit payments to help repay your defaulted loan(s), you will receive a written notification by mail from the U.S. Department of the Treasury. This Treasury offset notice will be sent to your last-known mailing address to inform you that the offset and negative credit reporting are scheduled to begin in 65 days.

8

What happens if I ignore my defaulted loans?

If you stay in default, you may experience involuntary collections like wage garnishment and Treasury offset until your debt is paid in full or the default is resolved. If you don’t act, you’ll also be subject to collection costs, which will increase your overall debt drastically.

Early action to get out of default will reduce the total amount of money you have to pay each month and overall, so don’t delay. Once your loans are out of default, you’ll regain eligibility for benefits, such as requesting a deferment or forbearance or choosing a different repayment plan.

9

What are my rights as a borrower in default?

As a borrower, you have the right to request all documents related to your debt. You also have rights related to wage garnishment.

We recommend that you take the steps outlined in number 3 to get out of default, but you should be aware of the options below if you believe your loan status is incorrect.

| Borrower Action | Eligibility Timeline | Pros | Cons | Who Should I Contact? |

|---|---|---|---|---|

| Request a hearing to avoid wage garnishment | Postmarked no later than 30 days from the date the administrative wage garnishment notice was sent | ✅ Temporary pause on wage garnishment until after hearing | ❌ Will not resolve default ❌ Requires printer and mail/fax actions ❌ May require travel ❌ Record of default remains on your credit history |

The U.S. Department of the Treasury Download the Administrative Wage Garnishment Request for Hearing or Eligibility Determination form |

| Request a hearing to dispute the debt | Postmarked within 65 days of receiving a Treasury offset notification | ✅ Temporarily pause collections until after hearing | Mail required documents to the Default Resolution Group (DRG) Get information about requesting a hearing |

|

| Request a discharge (if eligible) | No set deadline | ✅ Receive relief if eligible | ❌ May take several months for a case decision | Borrower Defense Total and Permanent Disability Discharge |

10

Where can I find more resources about default and collections?

For more information about default, check out the following resources: