How To Evaluate Your Aid Offers

After you submit your Free Application for Federal Student Aid (FAFSA®) form, the schools you’ve been accepted to will use the information you provided to create your aid offer (aka what determines your out-of-pocket costs to attend a school). All financial aid offers (sometimes called award letters) are different, so how can you tell which school is the best fit? Follow these steps to create an action plan for comparing aid offers:

- Add Up Your Total Expected and Unexpected Costs

- Add Up Your Federal Student Aid

- Add Up Your State Aid

- Add Up Your Institutional (School) Aid

- Consider Additional Steps To Fill Any Gaps

- Consider Other Factors That Matter to You

- Rank Your Options and Find Your Best Fit

Understand What an Aid Offer Is and Isn’t

There’s no standardized format or delivery method for financial aid offers. They can be sent by postal mail, but most often they’re sent electronically. Some schools may provide a timeline within your acceptance letter for when you can expect to receive your aid offer.

Your aid offer is your best source of truth for your school costs because it includes the exact amounts and types of student aid you’re being offered.

Your aid offer isn’t going to give you the full picture of the total costs associated with attending each school, but that’s where step 1 comes in!

1

Add Up Your Total Expected and Unexpected Costs

To better compare your aid offers, you need to first understand the amount of debt you could be taking on at the schools you’re considering, before you receive any aid. This includes the money you need for all things school related but also unexpected costs that a school may not include when calculating its cost of attendance.

For example, if one school has a longer commute, you’ll want to account for additional weekly gas or public transportation expenses to get a clearer picture of the total costs associated with that school.

To determine your estimated total costs (and the potential debt) for each school, make sure you estimate the amount before student aid is applied and don’t factor in any income sources, such as a part-time job.

2

Add Up Your Federal Student Aid

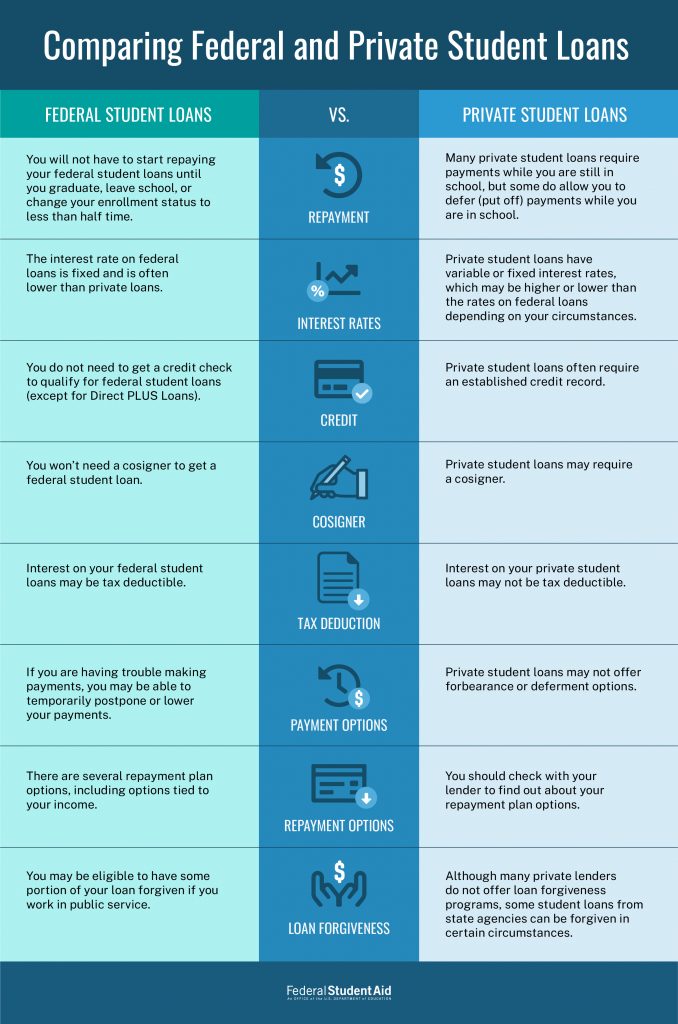

Now that you understand your costs, you can start to factor in your incoming funds (aka student aid). Some types of aid have more favorable terms than others, so you’ll want to understand specifics to plan and compare correctly. This includes whether the aid is money that doesn’t need to be repaid, earned money, or borrowed money. In the case of student loans, this also includes interest rates and loan limits.

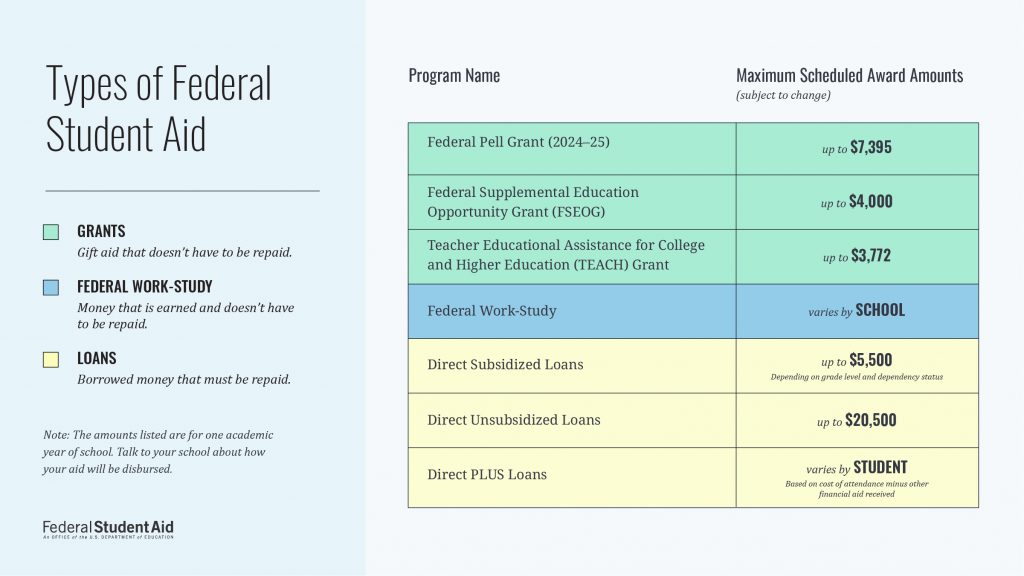

Filling out the FAFSA form is the first step in qualifying for federal student aid. Your financial need impacts your eligibility for Federal Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), Teacher Education Assistance for College and Higher Education (TEACH) Grants, Federal Work-Study, and Direct Subsidized Loans. Unlike a loan, a Federal Pell Grant doesn’t need to be repaid, except under certain rare circumstances.

Another form of federal student aid is Federal Work-Study, which you must qualify for. Federal Work-Study income isn’t guaranteed—you need to find and apply for a job and will work to receive these funds, and the work-study amount may vary each year.

If you see “L” or “LN” abbreviations in your financial aid offer, they often stand for “loans.” “Sub” and “Unsub” stand for “subsidized” and “unsubsidized” loans. The major difference between subsidized and unsubsidized student loans has to do with interest. Here’s a quick way to remember the difference: “Unsubsidized” starts with a “U” because “you” start accruing interest right away on an unsubsidized loan. Learn more about the differences between subsidized and unsubsidized loans.

Finally, parents of dependent undergraduate students and graduate or professional students can apply for Direct PLUS Loans to help pay for education expenses not covered by other financial aid. With parent PLUS loans, the parent, not the student, is fully responsible for paying back the loan. PLUS loans have the highest interest rates for federal student loans.

3

Add Up Your State Aid

State aid is financial aid awarded by your state’s higher education agency to assist with the costs of attending a school. Usually, this type of financial aid is awarded to students attending school within the state they have lived in for a set amount of time.

Some states offer more than $10,000 to students in the form of need-based grants. State aid can really make a difference in your total costs! Check with your state’s higher education agency to learn about state grants you may be eligible for and to see if you need to complete an additional application.

4

Add Up Your Institutional (School) Aid

Institutional aid includes scholarships and grant awards offered by your school. Some schools will offer institutional aid based on merit (aka high academic achievement or good grades), specialized field or major, athletics, and more. Tip: Institutional aid may be named after a successful graduate. Some schools may also offer grants or scholarships based on financial need.

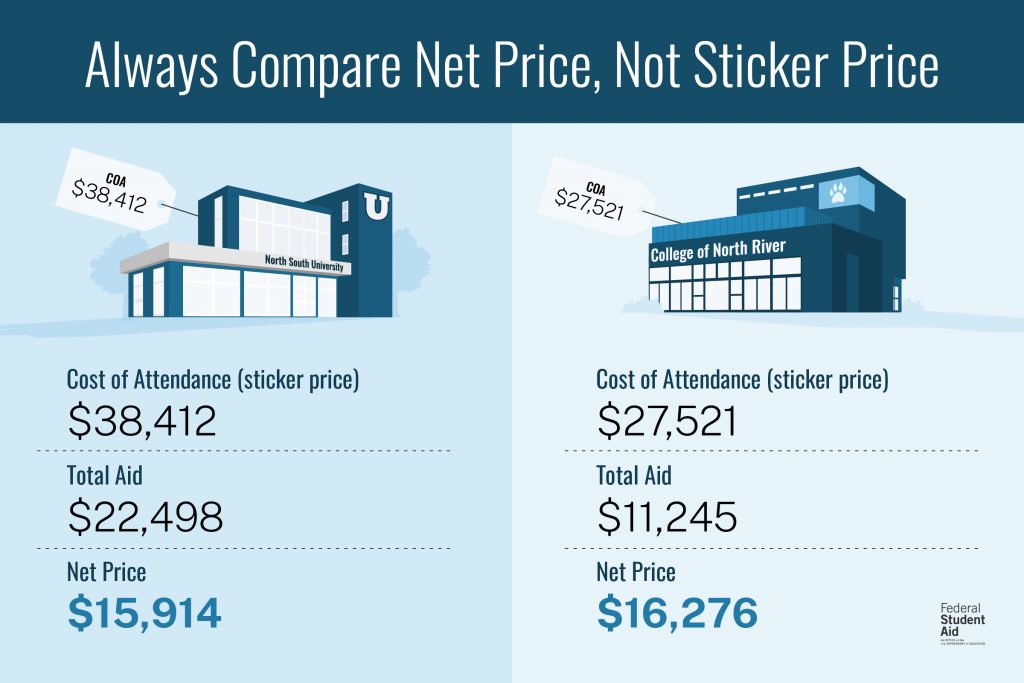

Depending on a school’s resources, it may be able to offer institutional aid that drastically lowers your out-of-pocket costs. This is why you should always compare net price, not sticker price.

Net price is the amount you’ll need to pay out of pocket. You can calculate your net price for a school by using this formula:

Total Cost (the school’s cost of attendance and any anticipated additional costs) – Grants and Scholarships (aid you’re offered that doesn’t need to be repaid) = Your Net Price

5

Consider Additional Steps To Fill Any Gaps

If you plan on working a part-time job or taking out private student loans, be sure to factor that into your aid offer comparison. Many students don’t receive enough aid to cover all their school expenses, and they use other sources to fill the gap. Explore options if you don’t receive enough student aid.

6

Consider Other Factors That Matter to You

Other factors you value may impact your school preferences. For example, maybe you excel in small classes or have always dreamed of going to school in a big city.

With College Scorecard, you can learn more about the student body and facilities, and about the average earnings for someone who graduates from a specific program. You can even compare the average annual cost with what you see in your aid offer.

College Scorecard also provides helpful information about the surrounding environment of the school, campus diversity, specialized mission (like a Historically Black College and University), religious affiliation, and more.

While College Scorecard provides valuable data and insights, be sure to weigh a variety of factors when determining what school is a good fit for you.

7

Rank Your Options and Find Your Best Fit

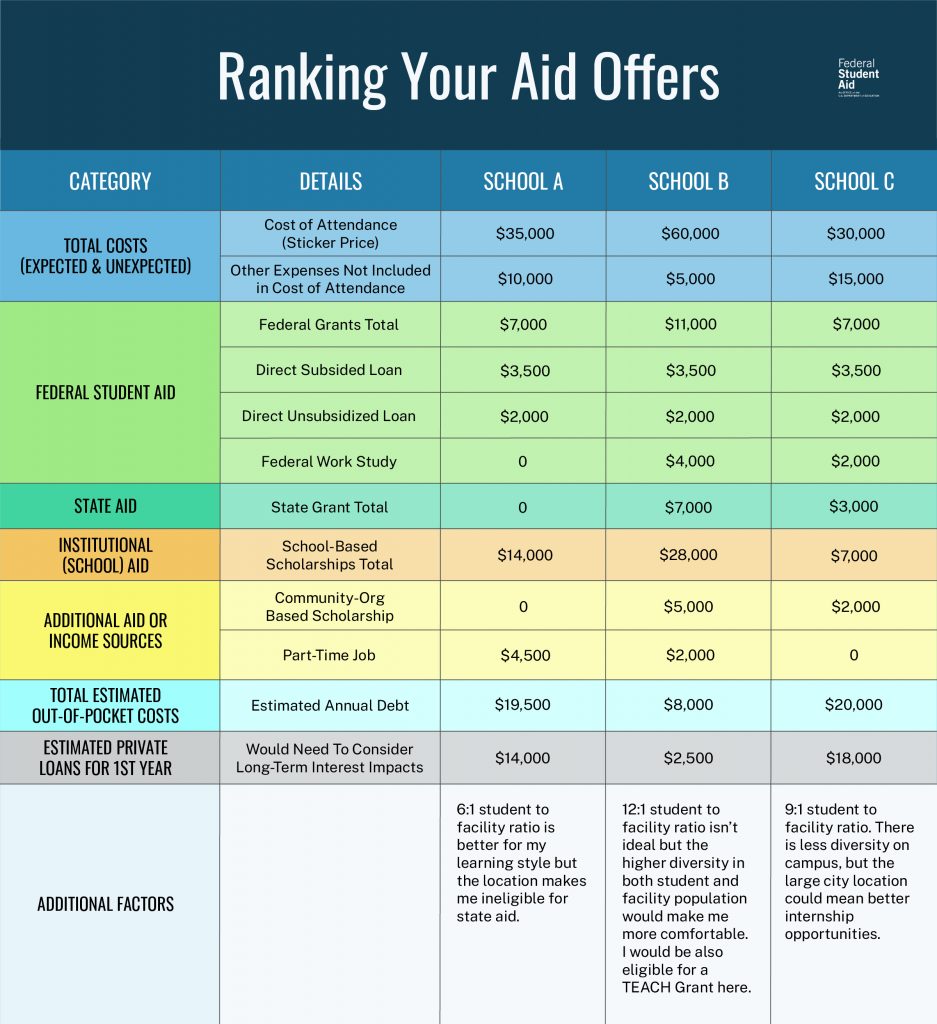

You now have the knowledge and criteria to make a good comparison, so it’s time to rank your choices. To find your out-of-pocket costs, you’ll need to organize the numbers you found in steps 1–6. You’ll want to consider student aid based on the order you should accept it: grants and scholarships first, then work-study funds, and then student loans.

See an example of how your comparison may look in the image below.

If low debt is important to you, School B would be your best choice. However, taking on more debt with School A might be worth it for you if smaller class sizes are a priority. Once you have weighed your options, make sure you pay attention to your school’s deadline and follow the directions listed to accept your aid offer on time for your final choice.