7 Options if You Didn’t Receive Enough Financial Aid

If you didn’t receive enough financial aid to cover your school expenses, you still have options to help you fill in the gap between the aid you’ve been offered and your school’s cost:

- Apply for scholarships.

- Request an aid adjustment.

- Explore additional needs-based programs.

- Find part-time work.

- Ask about tuition payment plans.

- Request additional federal student loans.

- Research private or alternative loans.

How Aid Is Calculated

The financial aid office at your college, career school, or trade school determines how much aid you’re eligible to receive based on the information provided on your Free Application for Federal Student Aid (FAFSA®) form. To understand how schools use your information to create your aid offer, learn how financial aid is calculated.

Even after submitting your FAFSA form and receiving your aid offer, your school’s financial aid office is an excellent resource to help you understand and explore ways you can fill the gap.

Read on for seven options to consider if you didn’t receive enough financial aid.

1

Apply for scholarships.

Scholarships are usually based on a student’s grades, skills, or abilities, and they don’t have to be repaid. The key to applying for scholarships is being prepared because most scholarships have deadlines and may require time to write essays. So get organized and regularly search and apply for scholarships.

The following resources can help you find scholarships:

- your school’s financial aid office

- community and religious organizations, local businesses, and community foundations

- your employer or your parent’s employer(s)

- the U.S. Department of Labor’s free scholarship search tool

- your high school counselor’s office

- your state’s higher education agency

- organizations related to your interests (give it a quick online search)

Read our article on scholarship tips.

Local scholarships with fewer applicants may increase your chances of getting scholarship funds.

Remember to be cautious of student aid scams. If you’re concerned about the legitimacy of a scholarship opportunity, contact your school’s financial aid office. Check out these tips to avoid scholarship and financial aid scams.

2

Request an aid adjustment.

Sometimes, a family’s finances are not accurately reflected on the FAFSA form because of special financial circumstances.

Your school will review your request for an aid adjustment based on their specific policy, which is also called a professional judgment.

Any decision by the school is final and can’t be appealed to the U.S. Department of Education.

To request an aid adjustment, contact your school’s financial aid office. Your school may ask you to provide documentation about your circumstances so that they can consider making an adjustment to your FAFSA information and aid offer.

Examples of documentation could include the following:

- a documented interview between you and a financial aid administrator

- statements from you, your parent, spouse, or a third party

- statements from school staff

- court or legal documents

- other supplementary information about your or your family’s financial status or personal circumstances

Note: Special financial circumstances are different than unusual circumstances, which refer to a situation where a dependent student is unable to contact a parent or where contact with a parent would pose a risk to the student.

3

Explore additional needs-based programs.

You may be able to reduce some of your food and healthcare expenses by checking to see if you’re eligible to receive assistance from government or school programs.

The USDA’s Supplemental Nutrition Assistance Program (SNAP) is the largest federal nutrition assistance program. SNAP provides benefits to supplement the food budget of individuals and families in need so they can purchase healthy food. Learn more about SNAP, including eligibility and how to apply.

You can also explore your school’s meal plan options, which typically include special food pricing and may offer student discounts or deals at local restaurants, cafes, and stores. If you need additional assistance, many schools have food pantries that offer fresh produce, ready-to-eat items, and hygiene products for students at no cost. Look for information about food pantries on your school’s website or use the U.S. Department of Housing and Urban Development search tool.

Better health insurance coverage could reduce the amount you pay for copays or prescription medicine. Check with your school to see if you are eligible to sign up for your school’s health plan.

You can also apply for health insurance through the Health Insurance Marketplace, which provides eligible individuals and families with affordable coverage.

4

Find part-time work.

If your aid offer confirmed that you’re eligible for Federal Work-Study (FWS), be sure to lock in a position to help cover costs. Check out our latest article on FWS to learn more.

However, even if you weren’t awarded work-study, most schools have other part-time, on-campus (and sometimes off-campus) positions that can help you pay for school expenses. Working part time can be beneficial to your education experience, as long as you can find a healthy balance between school and work. Reach out to your school’s career services office for information on how to apply for part-time positions.

5

Ask about tuition payment plans.

Your school’s billing office (sometimes referred to as the bursar’s office, cashier’s office, or student accounts office) may have payment plans available to help you spread any remaining costs over several payments throughout a semester. A payment plan can help you budget your payments rather than paying in one lump sum. It may also help you avoid costly late fees.

6

Request additional federal student loans.

If you’ve exhausted other options, you can consider borrowing additional federal student loans.

If you’re a dependent student, your parent can apply for a Direct PLUS Loan for parents. Most schools use our online application, but others may have their own application.

If your parent’s application is denied because of an adverse credit history, they still have options to become eligible.

If a parent borrower isn’t able to secure a PLUS loan, you may be eligible for additional unsubsidized student loans of up to $5,000, depending on your grade level.

Graduate or professional students enrolled at least half time at an eligible school may be eligible for a Direct PLUS Loan for graduate or professional students. The process is similar to parent PLUS loans.

7

Research private or alternative loans.

Some private financial institutions, such as a bank or credit union, may offer education loans that don’t require the FAFSA form.

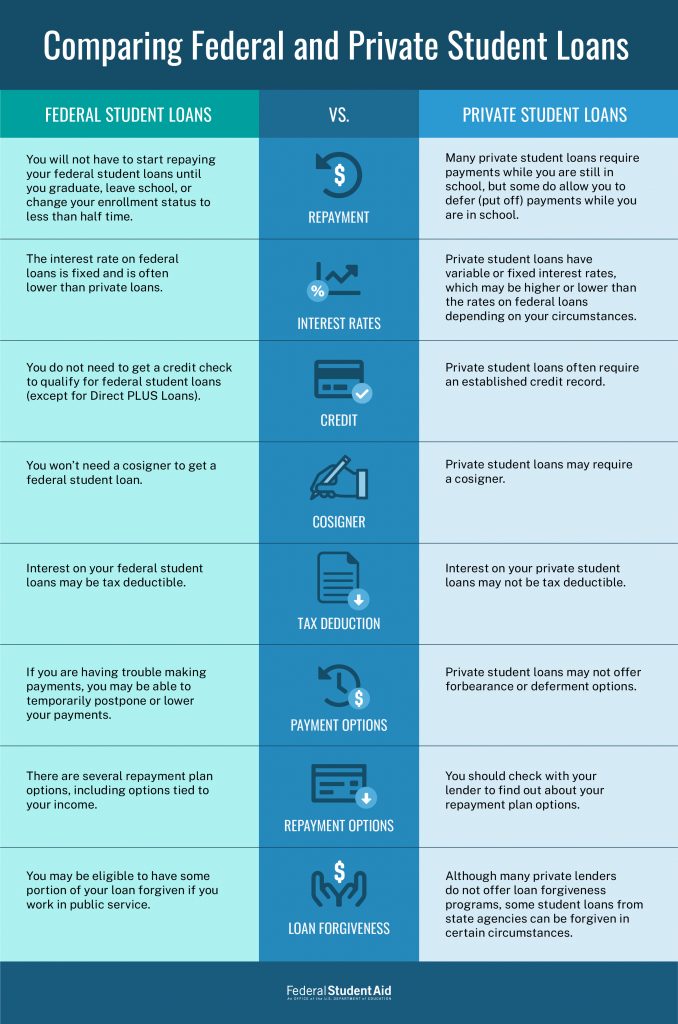

Federal student loans provide many benefits that aren’t typically available with private student loans. Private loans will almost always require a cosigner and may have higher fees or interest rates depending on your credit. Before borrowing money from a private lender, make sure you understand the differences between federal and private student loans.

While we recommend federal student aid first, we realize it doesn’t always cover the total cost of attending school. Before accepting a private loan, compare offers from different companies. A loan contract should explain penalties, interest rates, fees, repayment terms, creditworthiness requirements, and satisfactory academic progress requirements.

Final Thoughts

Before you make any final decisions on how to fill the gap, we recommend that you meet with a representative from your school’s financial aid office to determine what resources and options may be available. There may still be time to change some of your choices before the semester begins. Consider the following:

- Can you change the type of meal plan you chose?

- Are other types of housing available?

- Can you adjust the number of classes you’re enrolled in?

Check with your school to see if you have time to select different, more affordable options.