Financial Aid Dictionary: Top Terms Related to Grants, Work-Study, and Student Loans

Use our financial aid dictionary to get simple definitions for the terms that students and borrowers search for the most.

What is an award year?

An award year is generally a 12-month period that runs from July 1 to June 30 of the following year—it’s different from a calendar year that runs from January to December. When you submit a Free Application for Federal Student Aid (FAFSA®) form, you’ll select the award year that you’re planning on attending school.

What is student loan consolidation?

Loan consolidation occurs when a borrower combines one or more federal student loans into a single Direct Consolidation Loan with a fixed interest rate and one monthly payment. Consolidating your student loans may lower your monthly payment and give you access to federal forgiveness programs. However, your repayment period may become longer, and you may pay more interest than if you hadn’t consolidated.

What is a contributor on the FAFSA® form?

A contributor refers to anyone (you, your spouse, your biological or adoptive parent, or your parent’s spouse) who’s required to provide information on your Free Application for Federal Student Aid (FAFSA®) form, provide consent and approval to have their federal tax information transferred directly from the IRS into your FAFSA form, and sign your FAFSA form. Learn about reporting parent information on your FAFSA form.

What is cost of attendance (COA)?

Cost of attendance refers to the total cost for a student to attend a specific school. It includes expenses such as tuition, fees, books, school supplies, food, and housing. Most two-year and four-year colleges calculate their cost of attendance to show the total cost for the school year (for instance, for the fall and spring semesters). Schools with programs that last a different period of time (for instance, an 18-month certificate program) might show a cost of attendance that covers a time period other than a standard academic year.

Keep in mind that your cost of attendance isn’t the price you’ll pay to attend a school—that’s known as the net price (your out-of-pocket costs). The best source of truth to understand your school’s cost is your financial aid offer.

What is default?

If a borrower fails to repay their student loan according to the terms they agreed to in the promissory note, the loan may go into default. This typically occurs when a required payment isn’t made for more than 270 days. Defaulting on a student loan can have legal consequences and can limit the borrower’s eligibility to receive student aid in the future. If you’re having trouble making payments on your student loan, contact your loan servicer.

What is deferment?

A deferment temporarily postpones monthly payments on a federal student loan for borrowers who meet certain eligibility requirements. Interest will continue to accrue (grow) on unsubsidized loans during most deferment periods, but not on subsidized loans. You can either pay the interest as it accrues or allow the interest to accrue and be capitalized (added to your loan principal balance) at the end of the deferment period. If you need to request a deferment, contact your loan servicer.

What is dependency status?

Dependency status refers to whether you’re considered a dependent, independent, or provisionally independent student when you fill out the Free Application for Federal Student Aid (FAFSA®) form. An independent or provisionally independent student reports only their own information (and their spouse’s information if they’re married). A dependent student reports their own and their parents’ information.

Who is a dependent student?

A student is considered to be dependent on the Free Application for Federal Student Aid (FAFSA®) form if they don’t meet any of the criteria for an independent student.

If you’re a dependent student, you’ll report your information and your parents’ information on the FAFSA form. In most cases, a parent will be identified as a required contributor on your FAFSA form. Learn about dependency status.

What is a Direct Loan?

Direct Loans are federal student loans offered directly by the U.S. Department of Education to eligible students and parents. The loan types include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans.

What is entrance counseling?

Before you can receive funds from a Direct Loan, you’ll need to complete entrance counseling if you’re a first-time student borrower. During entrance counseling, you’ll learn about your rights and responsibilities, and you’ll review the terms and conditions of your loan. You can complete entrance counseling on StudentAid.gov, but first ask your school’s financial aid office about its specific requirements.

What is exit counseling?

If you have federal student loans and leave school or drop below half-time enrollment, you’ll need to complete exit counseling. During exit counseling, you’ll learn important information that will help you prepare to start making payments on your loans, including the terms and conditions of your loans and repayment plan options. You can complete exit counseling on StudentAid.gov, but first ask your school’s financial aid office about its specific requirements.

What is the Extended Repayment Plan?

The Extended Repayment Plan is a type of repayment plan that gives you more time to pay off your student loans. To be eligible for the Extended Repayment Plan, you must have more than $30,000 in outstanding Direct Loans or $30,000 or more in outstanding Federal Family Education Loan (FFEL) Program loans. If you meet the eligibility requirements for the Extended Repayment Plan, you can make payments for up to 25 years. To compare all federal student loan repayment plans, use Loan Simulator.

What is the FAFSA Submission Summary?

The FAFSA Submission Summary is an electronic or paper document that summarizes the information you reported on your Free Application for Federal Student Aid (FAFSA®) form. It may also include your estimated eligibility for a Federal Pell Grant and federal student loans, your Student Aid Index (SAI), and whether you’ve been selected for verification. Once your FAFSA form is submitted and processed, you’ll receive an email with instructions on how you can access an online copy of your FAFSA Submission Summary.

Remember: Your FAFSA Submission Summary is NOT your financial aid offer. Your aid offer will come directly from any school you’ve listed on your FAFSA form after you’re accepted for admission.

What does family size mean on the FAFSA® form?

The Free Application for Federal Student Aid (FAFSA®) form has requirements for how your family size is determined. If you’re a dependent student, your family size will include you and may include your parent, your parent’s spouse, and your parent’s children and other dependents. If you’re an independent student, your family size will include you and may include your spouse (if you’re married), your dependent children, and other dependents.

What is a financial aid offer?

A financial aid offer (sometimes called an award letter) tells you what aid you can receive at a particular college, career school, or trade school. It will include the types and amounts of federal, state, private, and school aid you’re being offered, including grants, scholarships, Federal Work-Study funds, and loans. This combination of aid is your financial aid package.

Your aid offers will come from the schools you listed on your Free Application for Federal Student Aid (FAFSA®) form after you’re accepted for admission. Schools usually send aid offers via email. Learn how to evaluate and compare your aid offers.

What is forbearance?

A forbearance, allows you to temporarily stop making monthly payments or make smaller monthly payments on your student loans. Your loan interest will continue to grow during this time. Learn about the different types of forbearance, and how and when they’re applied to your loans. If you have questions about your circumstances or need to request a forbearance, contact your loan servicer.

What is a grace period?

A grace period is the amount of time after a borrower graduates, leaves school, or drops below half-time enrollment before they are required to begin repaying their student loans. For Direct Subsidized Loans and Direct Unsubsidized Loans, this is a six-month period.

Graduate or professional students with PLUS loans receive an automatic deferment while they’re enrolled in school at least half time, and for an additional six months after they graduate, leave school, or drop below half-time enrollment.

Parent borrowers with PLUS loans don’t have a grace period, but they can request a deferment while their child is enrolled at least half time and for an additional six months after their child graduates, leaves school, or drops below half-time enrollment.

What is the Graduated Repayment Plan?

The Graduated Repayment Plan is a type of repayment plan in which your monthly student loan payments start low and increase every two years. This repayment plan is available for all Direct Loans and Federal Family Education Loan (FFEL) Program loans. To compare all federal student loan repayment plans, use Loan Simulator.

What is a grant?

A grant is a form of financial aid that provides funds to help pay for college, career school, or trade school. Grants are usually awarded to students based on their financial need. Unlike student loans, grants generally don’t need to be repaid. Grants can be offered by the federal government, your state government, your school, or a private or nonprofit organization. To be considered for grants, do your research to find out their eligibility and application requirements, and make sure you submit a Free Application for Federal Student Aid (FAFSA®) form every year that you’re in school.

What is an income-driven repayment (IDR) plan?

An IDR plan is a type of student loan repayment plan that uses your income and family size to determine your monthly payment amount. There are several IDR plans available with different eligibility requirements and terms: the Income-Based Repayment (IBR) Plan, Income-Contingent Repayment (ICR) Plan, Pay As You Earn (PAYE) Repayment Plan, and Saving on a Valuable Education (SAVE) Plan. To compare all federal student loan repayment plans, use Loan Simulator.

You can check what repayment plan you are on by logging in to your dashboard on StudentAid.gov under your “Loan Breakdown” section.

Who is an independent student?

On the Free Application for Federal Student Aid (FAFSA®) form, you’ll be considered an independent student if you meet one of the following criteria:

- at least 24 years old or older by Jan. 1 of the school year for which you are applying for financial aid

- married (and not separated)

- a graduate or professional student

- a veteran

- a member of the U.S. armed forces

- an orphan

- a ward of the court

- a current or former foster youth

- in a legal guardianship (now or in the past)

- someone with legal dependents other than a spouse

- an emancipated minor

- unaccompanied and homeless or at risk of becoming homeless (with a determination from an individual at an eligible agency)

If you’re an independent student, you’ll report only your own information (and your spouse’s information if you’re married) on the FAFSA form. Read more about dependency status.

What is interest capitalization?

Interest capitalization occurs when unpaid interest is added to a loan’s principal balance. This can increase the loan’s overall cost and your monthly payments, because interest will grow on the new, larger principal balance.

What are interest rates for student loans?

Interest refers to the additional money that you must pay to borrow loan funds. The interest rate is set as a percentage of the unpaid principal amount that you borrowed. Federal student loans have a fixed interest rate, meaning the rate will not change for the life of the loan. Interest rates vary depending on the loan type and the date the loan was paid out. View the current interest rates.

What is a loan discharge?

In certain situations, you may be eligible to have your federal student loans discharged, forgiven, or canceled. The terms “discharge,” “forgiveness,” and “cancellation” mean essentially the same thing—you won’t have to pay back some or all of your loan(s). Learn about the ways people have their student loans forgiven.

What are loan limits?

Federal student loans have limits on how much you can borrow. These limits depend on whether you’re an undergraduate student, a graduate or professional student, or a parent; what grade level you are in school; and your dependency status.

See how much you can borrow for each loan type in the tables below.

Subsidized and Unsubsidized Loan Limits for Dependent Undergraduate Students*

Subsidized and Unsubsidized Loan Limits for Independent Undergraduate Students*

Subsidized and Unsubsidized Loan Limits for Graduate and Professional Students

Read more about loan limits for students and loan limits for parents.

What is a loan servicer?

A federal student loan servicer is a company that works on behalf of the U.S. Department of Education to handle the servicing of your federal student loans. This includes billing, responding to your questions, and helping you understand or change your repayment plan.

What is a Master Promissory Note (MPN)?

The MPN is a legal document that you must sign before you can receive funds from a Direct Loan. An MPN can cover multiple loans for up to 10 years—it serves as a promise from the borrower to repay all loans, interest, and fees. The MPN also explains the time frame you have to take certain actions, such as canceling all or part of a loan.

What is net price?

Net price (sometimes called net cost) is an estimate of the out-of-pocket costs that you’ll need to pay each year to attend a particular college, career school, or trade school. To find your net price for a school, subtract the grant and scholarship amounts on your aid offer from your cost of attendance.

What is an origination fee for student loans?

An origination fee is a percentage of your total loan amount that’s charged for processing your loan. This fee is subtracted directly from your Direct Loan before the loan is distributed to you. For example, if you borrow a Direct Subsidized Loan of $5,000, the current loan fee is 1.057%. That means a loan fee of $52.85 would be deducted from your loan before it’s distributed to you. Although you would receive $4,947.15, you are still responsible for paying the entire $5,000 that you borrowed. Learn about fees for federal student loans.

Who is considered a parent on my FAFSA® form?

For Free Application for Federal Student Aid (FAFSA®) purposes, a legal parent includes a biological parent, an adoptive parent, or a person that the state has determined to be your parent (for example, when a state allows another person’s name to be listed as a parent on a birth certificate). Grandparents, foster parents, legal guardians, older brothers or sisters, widowed stepparents, and aunts and uncles aren’t considered parents unless they’ve legally adopted you.

What is a Federal Pell Grant?

A Federal Pell Grant provides grant funds to undergraduate students from low-income households. Unlike student loans, Pell Grants usually don’t need to be repaid. To see if you may be eligible for a Pell Grant, check your FAFSA Submission Summary if you’ve already submitted your Free Application for Federal Student Aid (FAFSA®) form. If you haven’t submitted a FAFSA form, you can get an estimate of how much Pell Grant funds you may be eligible for by using the Federal Student Aid Estimator. You can receive Pell Grant funding for the equivalent of 12 semesters, or roughly six years. To keep track of the Pell Grant funds you’ve received, log in to your Dashboard at StudentAid.gov.

What is Federal Pell Grant lifetime eligibility?

The maximum amount of Federal Pell Grant funds you can receive over your lifetime is limited by federal law to be the equivalent of about 12 school terms (roughly six years). Since the amount of a scheduled Pell Grant award you can receive each award year is typically equal to 100%, the six-year equivalent is 600%. The U.S. Department of Education tracks your Lifetime Eligibility Used (LEU) by adding together the percentages of your Pell Grant scheduled awards that you received for each award year. You’ll receive a notice if you’re getting close to your limit. You can also check your LEU by logging in to StudentAid.gov and navigating to “My Aid.”

What is a PLUS loan?

A PLUS loan, also known as a Direct PLUS Loan, is a type of federal student loan that’s available for eligible graduate or professional students and for parents of dependent undergraduate students. PLUS loans can help pay for education-related expenses that aren’t covered by other financial aid.

Who is a provisionally independent student?

In some situations, you may be granted a dependency status of “provisionally independent” on the Free Application for Federal Student Aid (FAFSA®) form.

If you indicate that you have unusual circumstances on your FAFSA form, you’ll be considered a provisionally independent student and can submit the FAFSA form without parent information. Unusual circumstances refer to a situation where a student is unable to contact a parent or where contact with a parent would pose a risk.

What is a private student loan?

A private student loan is a loan offered by a private lender, such as a bank, credit union, state agency, or school. These loans aren’t funded by the federal government, and the loan terms and conditions are set by the lender. Learn about federal vs. private student loans.

What is refinancing for student loans?

Refinancing is a general financial term that refers to changing the terms of an existing loan. Federal student loans can’t be refinanced within the federal student aid system. However, these loans can be consolidated into a Direct Consolidation Loan with a fixed interest rate and single monthly payment, which is similar to refinancing in many ways. You may be able to refinance your federal student loans with a private lender, but this would take your student loans out of the federal student aid system and would result in a loss of benefits.

What is satisfactory academic progress (SAP)?

Satisfactory academic progress is a process that schools use to determine if a student is meeting their requirements while working toward a degree or certificate. Every school has its own satisfactory academic progress policy, which students must follow to stay eligible to receive federal student aid. For example, a school might expect you to maintain a certain grade-point average or complete a certain number of credits each year. Check your school’s website or contact your school’s financial aid office to learn about its satisfactory academic progress policy.

What is a scholarship?

A scholarship is a monetary gift that can help you pay for college, career school, or trade school. Unlike student loans, you don’t need to pay back a scholarship. Scholarships can be merit based, specific to particular groups of people, or based on financial need. They can be offered by schools, individuals, employers, private companies, nonprofits, professional and social organizations, and community and religious groups. When you’re looking for scholarships, pay close attention to deadlines and keep in mind that you may be eligible for some scholarships just by filling out the Free Application for Federal Student Aid (FAFSA®) form. To look for scholarships online, try the U.S. Department of Labor’s free scholarship search tool.

What are special financial circumstances?

Special financial circumstances refer to situations in which you or your family have experienced significant changes to your finances, such as a pay cut or loss of employment, tuition expenses at an elementary or secondary school, or high amounts of medical or dental expenses not covered by insurance. In these cases, you should submit your completed Free Application for Federal Student Aid (FAFSA®) form and then request an aid adjustment (professional judgment) from the financial aid office at your school. Your school may ask you to submit documentation of your special financial circumstances so it can consider making an adjustment to your FAFSA information.

What is the Standard Repayment Plan?

The Standard Repayment Plan is a student loan repayment plan with fixed payment amounts that will pay off your loans within 10 years (or up to 30 years for consolidation loans). This plan is the default plan if you don’t choose another plan. All Direct Loan and Federal Family Education Loan (FFEL) borrowers are eligible for the Standard Repayment Plan. To compare all federal student loan repayment plans, use Loan Simulator.

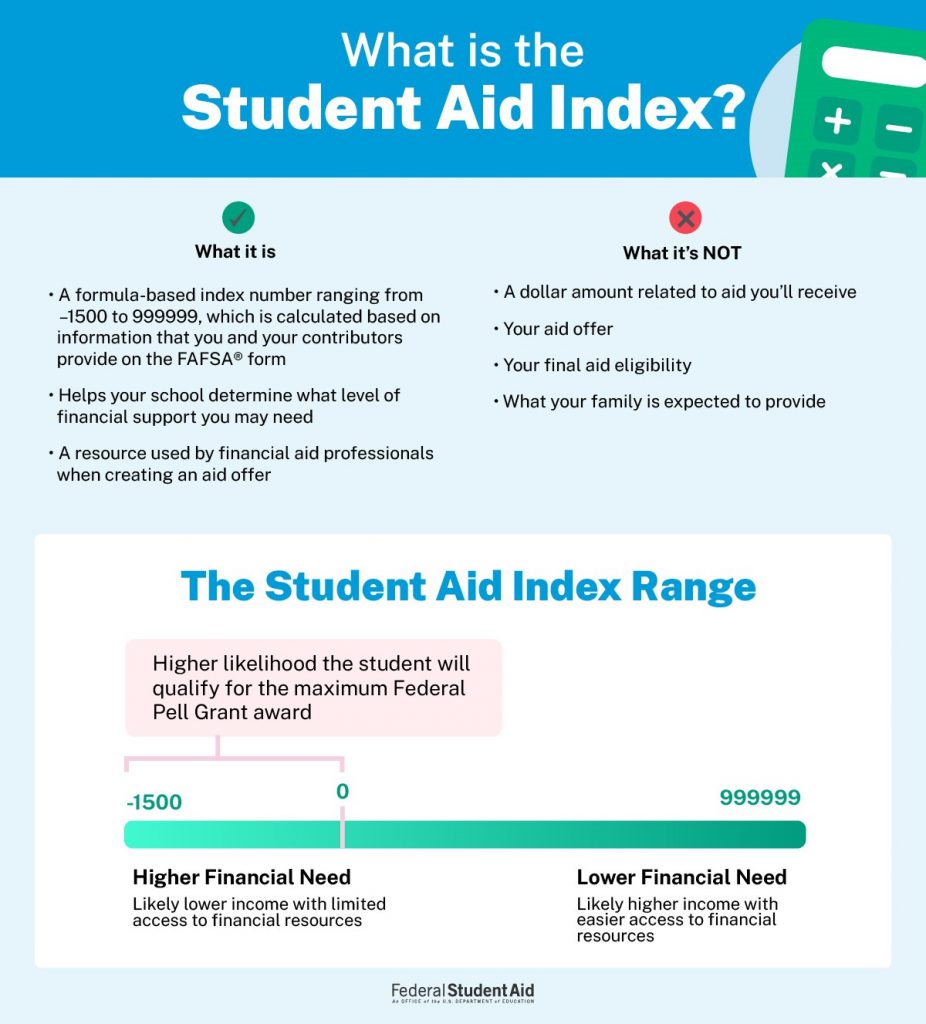

What is the Student Aid Index (SAI)?

The SAI is an index number that’s calculated using the information provided on your Free Application for Federal Student Aid (FAFSA®) form. It’s not the amount of money that you or your family will have to pay for school. Your school will determine your financial need by subtracting your SAI from your cost of attendance. In most cases, you can find your SAI on the FAFSA Submission Summary after your FAFSA form is processed. If your SAI is a negative number, it indicates to your school that you have higher financial need.

What is a subsidized loan?

A Direct Subsidized Loan is a type of federal student loan that’s available to undergraduate students with financial need. If you accept a Direct Subsidized Loan, the U.S. Department of Education will pay the interest on your loan while you’re in school at least half time, during your six-month grace period after you leave school, and during a period of deferment.

What is an unsubsidized loan?

A Direct Unsubsidized Loan is a type of federal student loan that’s available to undergraduate, graduate, and professional students. Unlike a Direct Subsidized Loan, it’s not based on financial need. Interest accrues (adds up) on Direct Unsubsidized Loans during all periods—even when you’re in school. For example, let’s say you accepted $15,000 in Direct Unsubsidized Loans with a fixed interest rate of 8.08% to help you pay for a two-year graduate program. By the time you finish your two-year program, you’ll owe an additional $2,424 in interest unless you make voluntary payments while you’re in school.

What are unusual circumstances?

Unusual circumstances refer to situations that may prevent a dependent student from obtaining parent information on their Free Application for Federal Student Aid (FAFSA®) form because they either can’t contact their parent or because contacting the parent poses a risk to the student. Learn how to complete your FAFSA form if you have unusual circumstances.

What is work-study?

Federal Work-Study provides part-time jobs to students with financial need. Students can gain valuable work experience while earning money to help pay for college, career school, or trade school expenses. To find out if your school participates in the Federal Work-Study Program, check with the financial aid office. If they do, submit your Free Application for Federal Student Aid (FAFSA®) form as early as possible to see if you’re eligible. If you accept a work-study job, you’ll be paid at least once a month.

What is “year-round Pell”?

If you attend an additional school term in an award year, you may be able to receive up to 150% of your yearly Federal Pell Grant award amount. For example, if you were awarded a $3,000 Pell Grant, you’d likely receive $1,500 in both your fall and spring semesters. But you may qualify for another Pell Grant of up to $1,500 if you enroll at least half time during the summer semester.